Financial markets are headless chickens rampaging across the risks landscape, says IMF. This being hardly surprising, the IMF goes on to astonish us all by admitting that the beheadings were the job of the Central Bankers and international policy advisers... aka, the IMF...

IMF's Global Financial Stability Report published today offers some very uneasy reading on the topic of the global financial system risks, both in terms of the evolution of these risks over time and the sources of the risks.

Per IMF: "Easy money continues to increase global financial stability risks. Accommodative policies aimed at supporting the recovery and promoting economic risk taking have facilitated greater financial risk taking."

In other words, instead of reducing the overall level of risks accumulated in the financial system, monetary and regulatory policies deployed since the onset of the Global Financial Crisis (GFC) have resulted in an increase in these risks. Why? Because the entire response since the start of the GFC was focused on priming the debt pump. This manifested itself in record low rates charged by Central Banks on funding they supply into the banking system; in massive waves of liquidity injected by the Central Banks into the sovereign and private debt markets; in incessant pressure to accumulate credit placed on the economies from the policymakers irrespective of the debt levels already present; in wilful reduction of the debt repayment capacity of the households via increased taxation by the insolvent states and so on. All of this has meant that while economic fundamentals (the Great Recession and debt overhang) should have led to a reduction in credit supplied into the global financial system, the opposite took place.

Asset bases of the banks grew, on the aggregate, Central Banks balance sheets swell and asset markets boomed. As IMF notes: "This has resulted in asset price appreciation, spread compression, and record low volatility, in many areas reaching levels that indicate divergence from fundamentals." In other words: as companies managed no significant gains in their productive capacity, their capital valuation exploded. Solely because the hurdle rate on investment (the cost of investment) collapsed. Never mind there is no new demand for companies' output. When money is cheap, it pays to borrow. So asset prices appreciated. Meanwhile, the risk spreads between various quality borrowers have become much tighter. During the crisis, we saw massive widening of risk premia that lower quality (higher risk) borrowers (sovereign, corporate and household) had to pay to secure credit. Now, with money being given away at negative real prices, no one gives a damn is one borrower is less likely to repay than the other: risks are misplaced once again. You don't have to look any further for the evidence of this than the Euro area sovereign yields. When Italy borrows in the markets at negative rates, you know the jig is up. Surprisingly, all of this: irrationally easy credit and outright bubbly assets valuations, coincided with a decline in markets volatility. In other words, markets are now acting as if their participants are 100% (or close) certain the trend is only up for asset prices. And worse, this applies to all asset classes: from housing to bonds to VCs to Private Equity.

IMF notes that "What is unusual about these developments is their synchronicity: they have occurred simultaneously across broad asset classes and across countries in a way that is unprecedented." The word *unprecedented* should ring the alarm bells. We are deep into the monetary policy corner (zero rates, massive liquidity pumping programmes) and fiscal policy corner (debt levels carried by the sovereigns are now breaking all-time records). Should the *unprecedented* start unwinding, what stands between here and a full blow disaster?

Nothing. Worse than nothing.

Most certainly not the fabled 'reformed' banking systems with all the layers of new supervisors and rules mounted on top of their crumbling strategies is no solution, despite all the European chatter about Banking Union and joint supervision and macro prudential risks oversights and so on… All of this is pure blabber. For as the IMF states: "Capital markets have become more significant providers of credit since the crisis, shifting the locus of risks to the shadow banking system. The share of credit instruments held in mutual fund portfolios has been growing, doubling since 2007, and now amounts to 27 percent of global high-yield debt." So risks have: (1) risen, and (2) migrated into the less manageable, more poorly monitored and understood sub-system.

"At the same time, the fund management industry has become more concentrated. The top 10 global asset management firms now account for more than $19 trillion in assets under management." So risks have: (3) concentrated behind fewer black boxes of management strategies.

With (1)-(3) above you have: "The combination of asset concentration, extended portfolio positions and valuations, flight-prone investors, and vulnerable liquidity structures have increased the sensitivity of key credit markets, increasing market and liquidity risks."

That's IMF-speak for 'sh*t about to hit the fan'. In more academic terms, Nassim Taleb - in 2011 article in Foreign Affairs said: "Complex systems that have artificially suppressed volatility tend to become extremely fragile, while at the same time exhibiting no visible risks. Such environments eventually experience massive blowups, catching everyone off-guard and undoing years of stability or, in some cases, ending up far worse than they were in their initial volatile state. Indeed, the longer it takes for the blowup to occur, the worse the resulting harm in both economic and political systems."

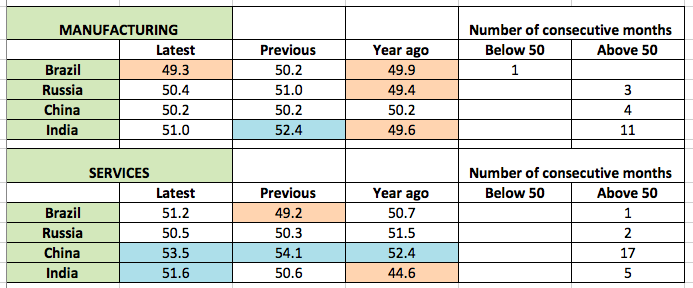

In 2008-2011 GFC, global economy had a buffer: the Emerging Markets. These fared better than advanced economies precisely because regionalisation has enabled them to offset the risk transmission channels that globalisation has created. But what about now? This time around, the buffer is no longer there. Quoting IMF: "Emerging markets are more vulnerable to shocks from advanced economies, as they now absorb a much larger share of the outward portfolio investment from

advanced economies. A consequence of these stronger links is the increased synchronization of asset price movements and volatilities." Translation: if sh*t does hit the fan, there won't be an umbrella big enough to cover everyone… nay, anyone…

But IMF does another useful thing in its GFSR report. It evaluates the impact of the credit risks present. "To illustrate these potential risks to credit markets, this report examines the impact of a rapid market adjustment that causes term premiums in bond markets to revert to historic norms (increasing by 100

basis points) and credit risk premiums to normalize (a repricing of credit risks by 100 basis points)." Now, note - they are not suggesting any risk-run on the markets, nor change in sentiment of any variety. They are just measuring what will happen if *historical norms* were to prevail (for comparison, however, that norm in the euro area implies credit risks and term premia repricing by more like 200 basis points).

"Such a shock could reduce the market value of global bond portfolios by more than 8 percent, or in excess of $3.8 trillion. If losses on this scale were to materialize over a short time horizon, the ensuing portfolio adjustments and market turmoil could trigger significant disruption in global markets." You don't say… sure they will. Remember that the ECB is hoping to deliver roughly USD1 trillion addition to its balance sheet through extraordinary measures, such as TLTROs and ABS purchases. And the shock is almost 4 times that of the ECB extraordinary efforts. What happens, then, with the euro area banks that are so stuffed with Government bonds and corporate debt they are making even thick-necked ECB squirm? Oh, right, they will need to either absorb these losses (which can be of the size of the GFC-induced write downs) or pretend that their bonds holdings are not subject to risks, just as the entire world will see them as being subject to huge risks. Take your pick - either we have an insolvent banking system or we have a dishonest banking system… or may be both… or may be we already have instead of *will have*…

The IMF is always keen on suggesting what needs to be done. But, alas, the Fund has now been devoid of any new ideas on all policy fronts for some time. Ditto on the topic of global financial stability. IMF says: "Managing risks from an ongoing overhaul in bank business models to better support economic risk taking. The policy challenge is to remove impediments to economic risk taking and strengthen the transmission of credit to the real economy." Wait, what? Superficial risk taking stimulation that the IMF said above is the cause of the imbalances is now also the solution to the built up imbalances? Yep, you've heard it right: hair of the dog to the power of 10. "Cure the hangover from 10 pints by downing 10 bottles of vodka…", says Doc. IMF.

But more on the banks in the next post…