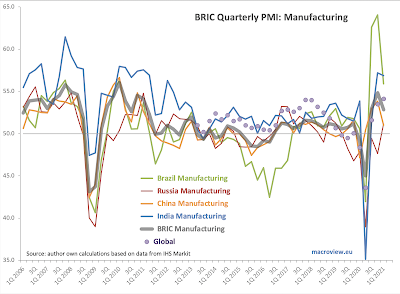

Given a lot of noise about economic re-opening and abatement of the late 2020 wave of the pandemic, we expected BRIC countries PMIs to improve significantly in 1Q 2021 compared to 4Q 2020. Alas, the opposite took place:

- Brazil Manufacturing PMI fell from 64.1 in 4Q 2020 to 55.9 in 1Q 2021. All three months of 1Q 2021 came in sub-60 (all three months of 4Q 2020 were above 60) and March 2021 was the lowest monthly reading since June 2020.

- Russia Manufacturing PMI slipped from 51.5 in February to 51.1 in March. On quarterly basis, Russia Manufacturing PMI actually managed to rise from a recessionary reading of 47.6 in 4Q 2020 to a weak recovery reading of 51.2 in 1Q 2021. This is the highest reading since 1Q 2019 and the first above-50 reading since the end of 2Q 2019. Russia was the only BRIC economy posting increasing PMI in Manufacturing sector in 1Q 2021, and at that, the improvement went to anaemic growth from pretty steep contraction.

- China Manufacturing PMI disappointed, falling from 53.8 in 4Q 2020 to 51.0 in 1Q 2021. Given structural importance of Chinese manufacturing globally, this implies a further build up in orders backlogs in the global supply chains, signaling more inflationary pressures down the line. On a monthly basis, March 2021 posted fourth consecutive decline in monthly PMIs, with March reading of just 50.6 - statistically, basically indistinguishable from zero growth conditions in the sector.

- India Manufacturing PMI fell from 57.7 and 57.5 in January and February 2021 to 55.4 in March 2021, marking the slowest monthly rate of growth since August 2020. On a quarterly basis, India Manufacturing PMI fell from a hard-to-believe rate of expansion of 57.2 in 4Q 2020 to still robust growth of 56.9 in 1Q 2021.