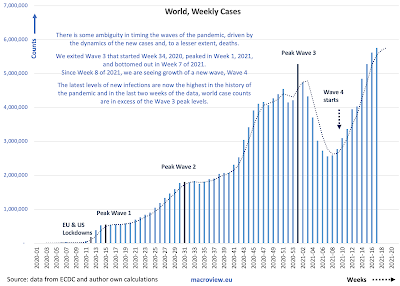

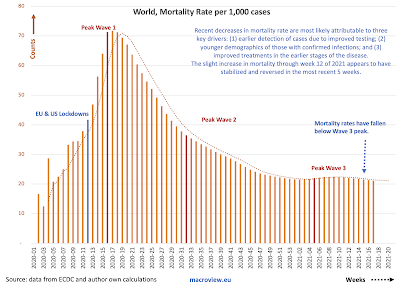

Updating worldwide data for the Covid19 pandemic through week 17 of 2021 (current week):

We exited Wave 3 that started Week 34, 2020, peaked in Week 1, 2021, and bottomed out in Week 7 of 2021.

Since Week 8 of 2021, we are seeing growth of a new wave, Wave 4

The latest levels of new infections are now the highest in the history of the pandemic and in the last two weeks of the data, world case counts are in excess of the Wave 3 peak levels.

Starting with Week 8 of 2021 we are witnessing a new, Wave 4, of the pandemic emerging. The latest weekly death counts as of Weeks 14, 16 and 17, 2021, rank as 7th, 6th and 5th highest in the history of the pandemic.

Good news: Recent decreases in mortality rate are most likely attributable to three key drivers: (1) earlier detection of cases due to improved testing; (2) younger demographics of those with confirmed infections; and (3) improved treatments in the earlier stages of the disease.

The slight increase in mortality through week 12 of 2021 appears to have stabilized and reversed in the most recent 5 weeks.

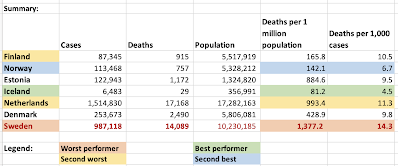

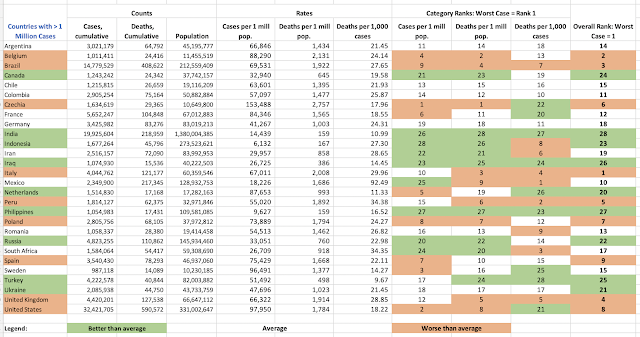

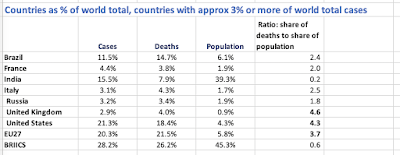

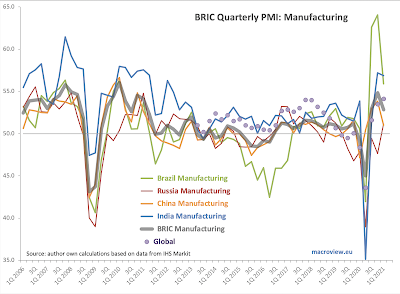

Summary table above shows significant improvement in the pandemic dynamics in the U.S. and more modest, but still sizable improvements in the EU27. BRIICS and Asia are showing worsening pandemic dynamics, and worldwide data broadly reflects this development.

While U.S. and EU27 numbers are encouraging, overall picture of the pandemic remains extremely worrying: worldwide, contagion is still raging unabated and those countries showing strong improvements in vaccinations and reducing contagion spread remain vulnerable to spillovers of new variants and new infections from the rest of the world.