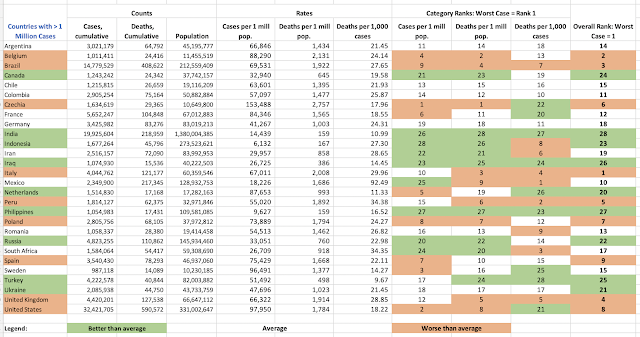

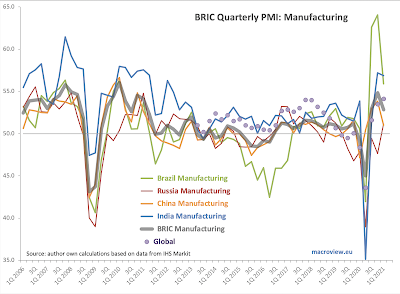

BRIC PMIs for May 2021 show uneven pace of recovery within the group of the largest Merging and Middle Income economies and a uniform evidence of pressure on inflation side.

- Brazil: Manufacturing PMI is currently running at 53.0 for 2Q 2021 for two months into the quarter, down from 1Q 2021 reading of 55.9. This marks second consecutive quarter of decreases in Manufacturing sector activity in Brazil. Brazil Services PMI is currently running at a deeper recessionary reading of 45.6, compared to 1Q 2021 at 46.1. As the result, Brazil's Composite PMI fell from the already recessionary reading of 47.9 in 1Q 2021 to 46.9 in 2Q 2021 to-date. Prices, meanwhile continued to show severe inflation pressures. Per Markit: "The rate of input cost inflation across the private sector softened further from March's record high, but remained one of the strongest since composite data became available in early-2007. ... In contrast to the trend for input costs, there was a quicker increase in aggregate selling prices. In fact, the rate of charge inflation was the strongest seen in the series history. Manufacturers again saw the sharper rise, despite inflation here softening during May."

- Russia: Manufacturing PMI remains at the same level through the first two months of 2Q 2021 (51.2) as in 1Q 2021, implying steady, but relatively weak growth. That said, monthly numbers have been more volatile in 2Q 2021 so far (range of 50.4 to 51.9) compared to 1Q 2021 (range of 50.9 to 51.5). Russia Services PMI rose to a robust reading of 57.5 in May, pushing the quarterly average to 56.4 2Q 2021 so far, up on 1Q 2021 average of 53.6. All in, Russian PMIs for both sectors are now in the second consecutive > 50.0 readings territory - a good signal. Composite PMI rose to 55.1 in 2Q 2021 to-date, compared to 53.2 in 1Q 2021. This marks the highest composite PMI for any BRIC economy for 2Q 2021 to-date. Just as with global and rest-of-BRICs cases, Russian inflationary pressures were running high in May. per Markit: "Price pressures remained high in May, with rates of private sector cost and charge inflation quickening notably. Sharper supplier price hikes and greater fuel costs reportedly spurred increases in cost burdens."

- India: Manufacturing PMI slipped from 56.9 in 1Q 2021 to 53.2 in 2Q 2021 to-date, marking the second consecutive quarter of declining PMIs. May 2021 reading was at 50.8, signaling, statistically, zero growth conditions in the sector. Services PMI fell below 50.0 mark in May reaching 46.4, with 2Q 2021 reading so far standing at 50.2, down from 54.2 in 1Q 2021. Statistically, the 2Q 2021 reading to-date implies zero growth in the Services sector. As the result, India's Composite PMI fell to 51.8 in 2Q 2021 to-date, down from 56.4 recorded in 4Q 2020 and 1Q 2021. With domestic demand slipping, inflationary pressures remained high, but did not accelerate. per Markit: "The rate of input cost inflation at the composite level eased to a four-month low in May, with slower increases noted at manufacturing firms and their services counterparts. Aggregate selling prices rose moderately and at a rate that was similar to April's. The quicker rate of charge inflation was seen in the manufacturing industry."

- China: China Manufacturing PMI remains relatively robust in 2Q 2021 so far (52.0) compared to 1Q 2021 (51.0), with levels of activity somewhat higher than historical average (50.7). Meanwhile, activity in the Services sector has accelerated, with Services PMI rising from 52.6 in 1Q 2021 to 55.7 in 2Q 2021. The latest Composite PMI reading remains robust at 54.3 for the first two months of 2Q 2021, compared to 52.3 in 1Q 2021, and above, statistically, historical average of 52.6. On inflation, Markit note states: "Both the gauges for input costs and output prices rose higher into expansionary range, indicating tremendous inflationary pressure. ... "Policymakers mentioned rising commodity prices at the State Council executive meetings on May 12 and May 19. They issued instructions about stabilizing commodity supplies and prices. ... Inflationary pressure would limit the room for monetary policy maneuvering, which could hinder the economic recovery. Some enterprises began to hoard goods in response to rising raw material prices, while others suffered raw material shortages. Supply chains were also significantly affected.""

Per Markit, globally: "Higher employment also reflected companies' efforts to combat rising capacity pressures. Backlogs of work expanded at the fastest rate in 17 years, with stronger increases at both manufacturers and service providers. Demand outstripping supply also led to increased price inflation. Input costs rose to the greatest extent since August 2008 and output charges at the quickest rate on record (since at least October 2009)."

Two charts to illustrate the above trends: