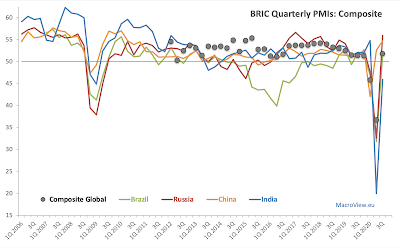

Both inflationary pressures and economic activity indicators are going through the roof in May, signaling a roaring run for 2Q 2021 growth.

- Manufacturing PMI for Ireland is up at 64.1 in May, compared to 60.8 in April. This is a historical high for the series, for the second month in a row.

- Services PMI for Ireland moved up from April's 57.7 to May reading of 62.1. This marks third consecutive month of above 50 readings, with all of these being statistically above 50.0 line.

- Construction Sector PMI (data through mid-May) improved, but remains (at 49.3) still in the contracting activity territory.

- Markit's Composite PMI, based on Manufacturing and Services sectors activity indices, rose from 58.1 in April 2021 to 63.5 in May, setting a new all time high. Again, this is the third consecutive month of above 50.0 readings for the Composite PMI.

In line with robust economic growth, we are witnessing - just as is the case around the world - continued build up of inflationary pressures. Per Markit release: "Input price inflation accelerated for the fifth successive month in May, reaching the highest since July 2008. Manufacturers continued to see much steeper increases in input prices than service providers, although the differential narrowed in the latest period. Companies passed on higher costs to customers, with output prices increasing at a record pace in May (since September 2002)." Emphasis is mine.