We covered in detail strong recovery in BRIC Manufacturing PMIs (https://trueeconomics.blogspot.com/2020/10/141020-bric-manufacturing-pmis-q3.html) and fragile recovery in Services PMIs (https://trueeconomics.blogspot.com/2020/10/141020-bric-services-pmis-q3-results.html). Here is a summary chart:

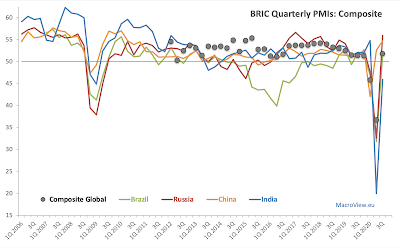

Now, let's take a look at BRIC Composite PMIs for 3Q 2020:

Brazil Composite PMI ended Q3 2020 on a reading of 51.6 - an improvement on 31.8 in 2Q 2020. Brazil's Composite PMIs have run sub-50 recessionary reading in 1Q and 2Q 2020, returning to growth in 3Q 2020, albeit at the levels not consistent with a V-shaped recovery.

Russia Composite PMI stood at a strong 55.9 reading in 3Q 2020, up on 32.6 in 2Q 2020 and signaling an end to 2 consecutive quarters of sub-50 readings. This marks the fastest pace of growth since 1Q 2017, but is also consistent with the levels of current activity being still below pre-COVID19 pandemic period.

India Composite PMI remained in recessionary territory in 3Q 2020 at 45.9, an improvement on 19.9 in 2Q 2020. Overall, Indian economy has suffered the sharpest hit from the pandemic, compared to all other BRICs. It is continuing to exhibit recessionary dynamics to-date.

China Composite PMI ended 3Q 2020 at 54.7, marking the second consecutive quarter of recover (2Q 2020 reading was 52.6). 3Q 2020 reading is the highest since 1Q 2020, and suggests that the Chinese economy is getting close to recovery in its activity levels to pre-pandemic position.

Overall, BRIC block activity indices imply lagging momentum in the recovery in services, and faster than global pace of recovery in manufacturing. Statistically, BRIC growth momentum in 3Q 2020 is within historical average, however, growth dynamics in 1Q and 2Q 2020 were significantly below historical averages, which implies that 3Q 2020 PMIs indicate incomplete or only partial recovery in the BRIC economies post-pandemic so far.

No comments:

Post a Comment