Below is the unedited version of my article for Sunday Times from 25/03/2012.

Last week, as Ireland and the world celebrated

the St Patrick’s Day, close to fifteen hundred Irish residents, including close

to a thousand of Irish nationals, have left this country. In all the celebratory

public relations kitsch, no Irish official has bothered to remember those who

are currently being driven out of their native and adopted homeland by the

realities of our dire economic situation.

According to the latest CSO report – covering

the period from 1987 through 2011, emigration from Ireland has hit a record

high. In a year to April 2011 some 76,400 Irish residents have chosen to leave

the country, against the previous high of 70,600 recorded in 1989. For the

first time since 1990, emigration has surpassed the number of births.

Given the CSO methodology, it is highly

probable that the above figures tell only a part of the story. Our official

emigration statistics are based on the Quarterly National Household Survey, unlikely

to cover with reasonable accuracy highly mobile and less likely to engage in official

surveys younger households, especially those that moved to Ireland from East

Central Europe.

For example, emigration numbers for Irish

nationals rose 200% between 2008 and 2011, with steady increases recorded every

year since the onset of the crisis. Over the same period of time, growth in

emigration outflows of EU15 (ex-UK) nationals from Ireland peaked in 2008-2009

and halved since then. Prior to 2010, Irish nationals contributed between 0%

and 10% of the total net migration numbers. By 2010 and 2011 this rose to

42% and 68% respectively. Meanwhile, the largest driver of net migration inflows

prior to the crisis - EU12 states nationals - were the source of the largest

emigration outflows in 2009, but their share of net outflows has fallen to 39%

and 13% in 2010 and 2011 respectively. There were no corresponding shifts in

Irish and non-Irish nationals’ shares on the Live Register. In other words,

unemployment data for non-Nationals does not appear to collaborate the official

emigration statistics, most likely reflecting some significant under-reporting

of actual emigration rates for EU12 and other non-EU nationals.

There are more worrisome facts that point to a dramatic change

in the migration flows in recent years. Back in 2004-2007 there were a number

of boisterous reports issued by banks and stockbrokerages that claimed that

Irish population and migration dynamics were driving significant and long-term

sustainable growth into the Irish economy. The so-called demographic dividend,

we were told, was the vote of confidence in the future of this economy, the

driver of demand for property and investment, savings and consumption.

In 2006, one illustrious stockbrokerage research outfit produced

the following conclusions: “The population [of Ireland] is forecast to reach 5

million in 2015… The labour force is projected to grow at an annual average

2.2% over the whole period 2005 to 2015. Combined with sustained 3% annual

growth in productivity, this suggests the underlying potential real rate of

growth in Irish GDP in the five years to 2010 could be close to 5.75%. Between

2011 and 2015, the potential GDP growth rate could cool down to around 5%.”

Since the onset of the crisis, however, the ‘dividend’ has

turned into a loss, as I predicted back in 2006 in response to the

aforementioned report publication. People tend to follow opportunities, not

stick around in a hope of old-age pay-outs on having kids. In 2009, only 33% of

new holders of PPS numbers were employed. Back in 2004 that number was 68%.

Amazingly, only one third of those who moved to Ireland in 2004-2007 were still

in employment in 2009. Almost half of those who came here in 2008 had no

employment activity in the last 2 years on record (2008 and 2009) and for those

who came here in 2009 the figure was two thirds.

In more simple terms, prior to the crisis, majority (up to 68%)

of those who came here did so to work. Now (at least in 2009 – the last year we

have official record for) only one third did the same. It is not only the gross

emigration of the Nationals and Non-Nationals that is working against Ireland

today. Instead, the changes in employability of Non-Nationals who continue to

move into Ireland are compounding the overall cost of emigration.

In order to assess these costs, let us first consider the

evidence on net emigration in excess of immigration. In every year – pre-crisis

and since 2008, there were both simultaneous inflows and outflows of people to

and from Ireland. In 2006, the number of people immigrating into Ireland was

above the number of people emigrating from Ireland by 71,800. Last year, there

was net emigration of 34,100. Between 2009 and 2011, some 76,400 more people

left Ireland than moved here.

Assuming that 2004-2007 period was the period of ‘demographic

dividend’, total net outflows of people from the country in the period since 2008

through 2011 compared to the pre-crisis migration trend is 203,400 people. In

other words, were the ‘demographic dividend’ continued at the rates of

2004-2007 unabated through the years of the current crisis, working population

addition to Ireland from net migration would have been around 2/3rds of 203,400

net migrants or roughly 136,000 people. Based on the latest average earnings of

€689.54 per week, recorded in Q4 2011, and an extremely conservative value

added multiplier of 2.5 times earnings, the total cost of the ‘demographic

losses’ arising from emigration can be close to 8% of our GDP. And that is

before we factor in substantial costs of keeping a small army of immigrants on

the Live Register. Some dividend this is.

This is only the tip of an iceberg, when it comes to capturing

the economic costs of emigration as the estimates above ignore some other, for

now unquantifiable losses, that are still working through the system.

In recent years, Ireland experienced a small, but noticeable

baby boom. In 2007-2007, the average annual number of births in Ireland stood

at just below 60,000. During 2009-2011 period that number rose by almost 25%.

2011 marked the record year of births in Ireland since 1987 – at 75,100. In the

environment of high unemployment, elevated birth rates can act to actually

temporarily moderate overall emigration, since maternity benefits are not

generally transferable from Ireland to other countries, especially the

countries outside the EU. Even when these benefits do transfer with families,

new host country benefits replacement may be much lower than the benefits in

Ireland. Which, of course, means that a number of emigrants from Ireland can be

temporarily under-reported until that time when the maternity benefits run

their course and spouses reunite abroad.

Even absent the above lags and reporting errors, net migration is now running close to its historic high. In 2011, there were total net emigration of 34,100 from Ireland against 34,500 in 2010. These represent the second and the first highest rates of net emigration since 1990.

At this stage, it is pretty much irrelevant – from the policy

debate point of view – whether or not emigrants are leaving this country

because they are forced to do so by the jobs losses or are compelled to make

such a choice because of their perceptions of the potential for having a future

in Ireland. And it is wholly academic as to whether or not these people have

any intentions of returning at some point in their lives. What matters is that

Ireland is once again a large-scale exporter of skills, talents and productive

capacity of hundreds of thousands of people. The dividend is now exhausted,

replaced by a massive economic, not to mention personal, social, and political

costs that come along with the Government policies that see massive scale

emigration as a ‘safety valve’ and/or ‘personal choice’.

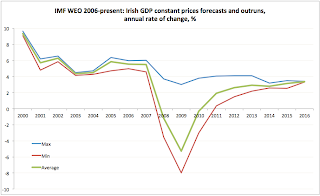

Charts:

Box-out:

On 14th of March, Governor of the

Central Bank of Ireland, Professor Honohan has told Limerick Law Society that

Irish banks should be less inhibited about repossessing properties held against

investment or buy-to-let mortgages. This conjecture cuts across a number of

points, ranging from the capital implications of accelerated foreclosures to economic

risks. However, one little known set of facts casts an even darker shadow over

the banks capacity to what professor Honohan suggests they should. All of the

core banking institutions in the country currently run large scale undertakings

relating to covered bonds and securitizations they issued prior to 2008 crisis.

Since 2008, the combination of falling credit ratings for the banks and

accumulation of arrears in the mortgages accounts has meant that the banks were

forced to increase the collateral held in the asset pools that back the bonds.

In the case of just one Irish bank this over-collateralization increased by 60%

in the last 4 years. This is done in order to

increase security of the Covered Bond pool for the benefit of the Bondholders

and is achieved by transferring additional mortgages into the pool. In just one

year to December 2011, the said bank transferred over 26,000 new mortgages into

one such pool. As the result of this, the bank can face restrictions and/or

additional costs were it to foreclose on the mortgages within the pool. Things

are even worse than that. In many cases, banks now hold mortgages that had

their principal value pledged as a collateral in one vehicle while interest

payments they generate has been collateralized through a separate vehicle. The

mortgage itself can potentially even be double-collateralized into the security

pool as described above. The big questions for the Central Bank in this context

are: 1) Can the banks legally foreclose on such loans? and 2) Do the banks have

sufficient capital and new collateral to cover the shortfalls arising from

foreclosing mortgages without undermining Covered Bonds security?