Updating residential property price indices for Ireland for 1Q 2015:

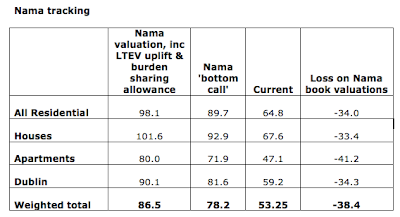

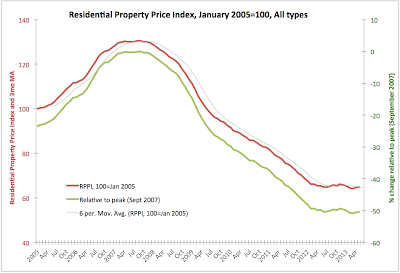

- National property prices index ended 1Q 2015 at 80.7, up 16.79% y/y - the highest rate of growth in series history (since January 2005), but down on 4Q 2014 reading of 81.4. Latest reading we have puts prices at the level of October 2014. Compared to peak, prices were down 38.2% at the end of 1Q 2015. National property prices were up 25.9% on crisis trough in 1Q 2015.

- National house prices ended 1Q 2015 at index reading of 83.8, which is down on 84.6 reading at the end of 4Q 2014, but up 16.55% y/y - the highest rate of growth in the series since September 2006. Relative to peak, national house prices were still down 36.5%.At the end of 1Q 2015, house prices nationally were up 25.5% on crisis period trough.

- National apartments prices index finished 1Q 2015 at 66.4, up on 4Q 2014 reading of 64.2 and 25.5% higher than a year ago. Apartment prices are down 46.4% on their peak and up 45.3% on crisis period trough. Y/y growth rates in apartments prices is now running at the highest level in history of the CSO series (from January 2005).

- Ex-Dublin, national residential property price index ended 1Q 2015 at 75.3, marking a marginal decline on 4Q 2014 reading of 75.5, but up 10.74% y/y - the highest rate of growth since May 2007. Compared to peak, prices are down 41.5% and they are up 13.9% on crisis period trough.

- Ex-Dublin house prices finished 1Q 2015 at the index reading of 77.1, which is virtually unchanged on 77.2 reading at the end of 4Q 2014. Year-on-year prices are up 10.78% which is the fastest rate of expansion since May 2007. Compared to peak prices are still 40.6% lower, although they are 14.2% ahead of the crisis period trough.

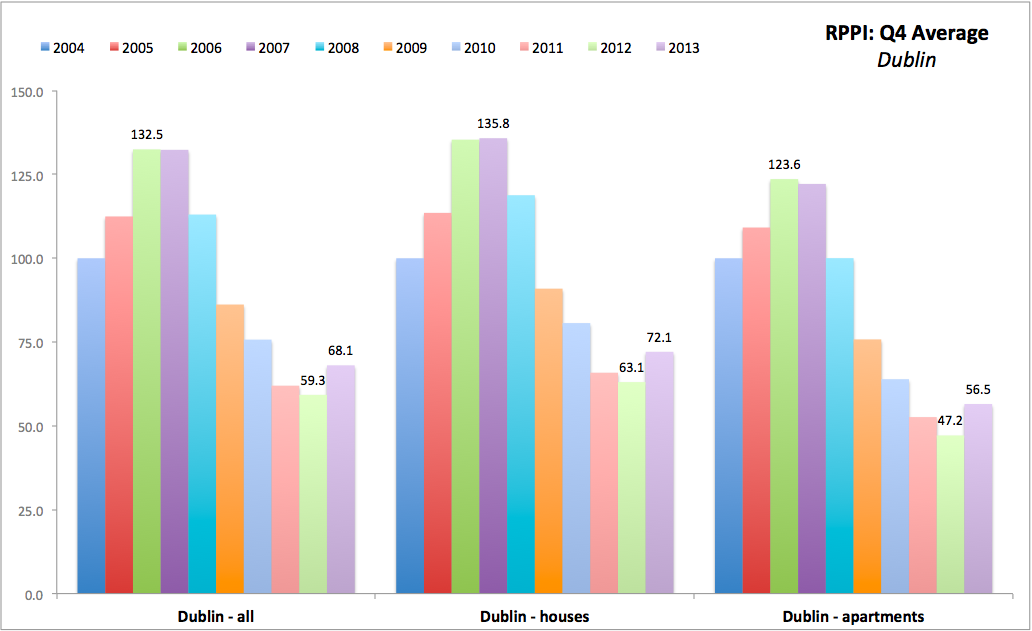

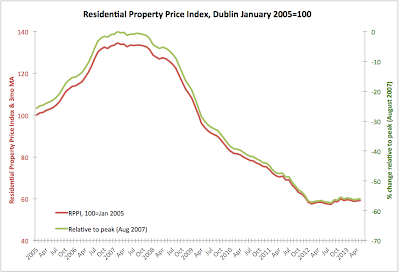

- Dublin residential property prices were at 82.5 at the end of 1Q 2015, down on 83.8 index reading at the end of 4Q 2014. Annual rate of growth at the end of 1Q 2015 was 22.77%, the highest since October 2014. Dublin residential property prices are down 38.7% compared to peak and up 44% on crisis period trough. Over the last 24 months, Dublin residential property prices grew cumulatively 40.3%.

- Dublin house prices index ended 1Q 2015 at a reading of 86.9, which is below 88.8 index reading at the end of 4Q 2014, but up 22.05% y/y, the highest rate of growth in 3 months from December 2014. Dublin house prices are down 36.9% on pre-crisis peak and are up 42.93% on crisis period trough. Over the last 24 months, cumulative growth in Dublin house prices stands at 39.5%.

- Dublin apartments price index ended 1Q 2015 at a reading of 73.7, up on 70.2 reading attained at the end of 4Q 2014, and up 29.75% y/y - the fastest rate of growth recorded since September 2014. Compared to peak, prices are still down 42.2% and they are up 59.2% on crisis period trough. Over the last 24 month, Dublin apartments prices rose cumulatively by 51.3%.

Longer dated series available below:

And to update the chart on property valuations relative to inflation trend (bubble marker):

As chart above clearly shows, we are getting closer to the point beyond which property prices will no longer be supported by the underlying fundamentals. However, we are not there, yet. Acceleration in inflation and/or deceleration in property prices growth will delay this point significantly. One way or the other, there is still a sizeable gap between where the prices are today and where they should be in the long run that remains to be closed.