Sorry to break the bad news, folks, but the latest Residential Property Price Index (RPPI) for October is showing accelerating property prices declines on foot of already substantial rates of contraction registered during 2011 as a whole. the bust is getting bustier.

All properties index fell to 71.2 in october from 72.8 in September, posting a monthly decline of 2.20%. This is the sharpest rate of monthly contraction in prices since March 2009 and the third fastest rate of decline in the history of the series! 3moMA for RPPI is now at 72.63. Year on year prices are now down 15.14% - the highest yoy decline since February 2010. Relative to peak prices are down 45.44%. 12 mo MA is at -1.36% for mom rate of decline and year-to-date rate of prices declines average -1.49%.

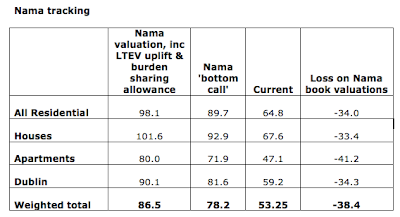

When it comes to Nama, relative to its cut-off date of November 30, 2009, property prices are now down 24.17%. When fully set up, Nama called bottoming out of the markets for Q1 2010. Since then, prices are down 20.62%, so those highly paid geniuses employed by Nama to 'value' properties and 'assess' markets are really shining stars. Recall that Nama paid an uplift of LTEV on assets purchased of an average 10%, plus carries a burden-sharing discount / cushion. Factoring these two into the equation, Nama-assessed properties are now held at a loss of 27.79% on their Nama valuations, even with burden sharing cushion 'savings' factored in. Taken across Nama book value, these (for now paper) losses can be assessed at ca €8.3bn.

Let's drill deeper. House prices sub-index is now at 74.3 against 76.0 in September, a decline mom of -2.24% the largest monthly drop since June 2011. 3moMA now stands at 75.77 and year on year change in the sub-index is 14.89% - the steepest annual decline rate since February 2010. relative to peak house prices sub-index is now -43.71% off.

Apartments prices sub-index fell from 53.2 in September to 52.2 in October, a mom drop of 1.88% shallower than September mom decline of 3.10%. 3moMA is now at 53.43 and year on year sub-index is down 19.81% - the steepest annual decline since April 2010. Relative to peak, apartments prices are now off 57.87%.

Recalling that Nama holds loads of assets written against apartments, Nama cut-off-date valuations, LTEVs and burden sharing cushion included, Nama valuations for apartments-related properties are now off 35.10%.

Chart above shows the price dynamics for Dublin properties. Dublin sub-index stands at 63.1 against September reading of 65.1, a mom decline of 3.07% - steepest since the catastrophic drop of 3.76% in August this year. 3mo MA is now at 64.9 and year on year prices in Dublin are down 17.52% - largest yearly decline since March 2010. Relative to peak, Dublin residential prices are down 53.09%.

Given the above, we can update projections for the core index and sub-indices for 2011 as a whole. These are shown below.

Depressing is the word that comes to mind. The picture is made even less palatable when we recall incessant blabber from our Government reps and stuff-brokers, as well as property 'experts' that inundated the earlier parts of the year with 'property prices will bottom out in H2 2011' noise.