CSO published Residential Property Price Index today for May 2014. Lots of various headlines reporting double digit gains in property prices and lauding general recovery in the market, as usual.

Let make some sense of the data as we have it:

Point 1:

National house prices: Index was at 70.1 in April 2014 and this rose to 71.7 in May 2014. April reading was just a notch above 70.0 in December 2013. In other words, for all annual gains, we were just about back to the level prices were in December last year. In May, this rose above December 2013 levels, and closer to September-October 2011 average.

I would not call this a 'recovery', yet, especially since we have drawn another 'u' around December 2013-April 2014.

That said, relative to peak prices are down 45.1% and are up 11.9% on crisis period low. Cumulated gain over last 24 months is only 9.47% which equates to annual average growth in the 'recovery' period of just 4.63%. Again, given the depth of decline from the peak, this is not a 'bubble'-type recovery.

3mo moving average was down through April 2014 at -0.23% compared to 3mo period through January 2014, but in May this moved into positive territory of +0.86% compared to 3mo average through February 2014.

Current national prices are 26.9% below Nama valuations (inclusive of LTEV and risk cushion) so for Nama to return profit on average acquired loan it will need ca 27.4% rise from here on. At current running 24 months growth rate, that will require roughly 6 years.

Point 2:

National property prices ex-Dublin: the index reading is at 68.2 barely up on 68 in March 2014. Compared to crisis trough, the index is now only 3.2% up. Cumulated rate of growth over 24 moths through April 2014 is negative at -1.02%. 3mo MA through May 2014 is 1.02% below 3mo MA through February 2014. In other words, nationally (excluding Dublin) things are not getting better.

Point 3:

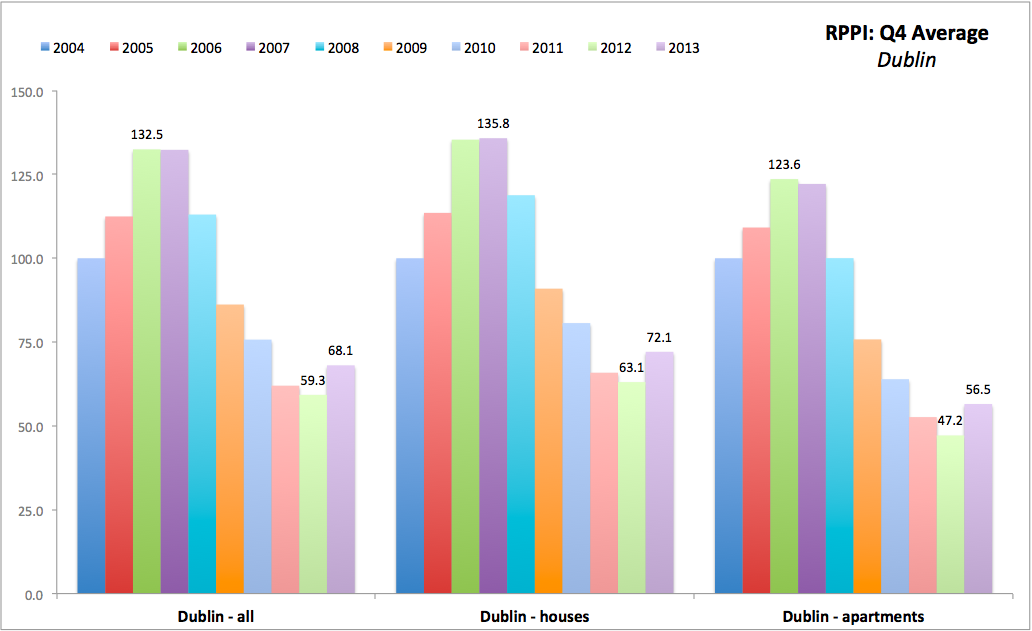

Dublin properties, despite all the talk about 'new bubble' and 'boom' are only now in line with those nationally (chart above shows this much). In other words, Dublin 'boom' is a correction for much steeper decline in Dublin properties relative to the rest of the country.

Point 4:

Dublin all properties index is now at 72.2 in May, which is up on 69.3 in April 2014, and is the highest reading since February 2011.

Relative to peak, Dublin properties are still down 46.3% although they are now 26% above the crisis trough. Cumulated gain in Dublin over 24 months through May 2014 is 23.6% which equates to roughly 11.2% annual rise - robust and clearly signalling recovery, in contrast to ex-Dublin markets.

But, 3mo MA through April 2014 was % below 3mo MA through January 2014, while 3mo AM through May 2014 is 2.66% up on 3mo MA through February 2014, which shows some volatility in the index and can be a sign of the rally regaining some momentum or seasonal effects combining with some improved economic news or simply volatility taking hold of the recent data. Simple answer - we have no idea what is going on.

Crucially, as chart above shows, apartments segment of Dublin market is showing weaker growth over the last 6 months than houses segment. This is surprising, given rapid rises in rents and reported shortages of accommodation.

So here you have it: for all the hoopla about 'mini-bubble' etc,

things are still very much shaky:

- Growth in Dublin is strong, but so far consistent with the market catch up with more conservative price declines to trough in the rest of the country.

- Meanwhile, outside Dublin, things are solidly dead.