Ok, folks... the latest batch of news from CSO and the official 'Green Jerseys' reaction to same would have made a fine candiate for a Nobel literature prize, were they published in a single tome with a heading Literature of Absurd on it...

We have our routine 'Housing market has bottomed out' shrills from the property pushers in the media - despite the fact that property prices continue to fall. We also have the metronome-like 'Unemployment has stabilized' tale, a chapter of gargantuan efforts to avoid mentioning the fact that fewer and fewer people actually work in Ireland, earning living and paying taxes.

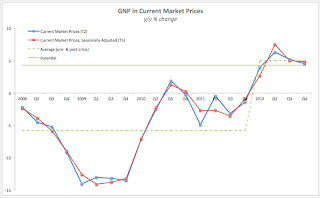

Today we have a new pearl: 'Irish economy is growing once again, albeit slowly'.

Complete porkies, if you ask me. Here's the plain and simple reality of what's going on:

In constant market prices terms, Irish GDP based on constant factor cost (in other words, the real activity in the economy carried out by MNCs and domestic enterprises, net of taxes, gross of subsidies) grew 2.3% (+€819 mln) q/q in Q2 2012. Alas, as usual, q/q growth is... err... mostly meaningless. Instead, y/y comparative shows this metric

shrinking €300mln (-0.8%).

What's the dynamic here? Oh, not good, either. In Q2 2011, y/y real GDP (constant factor basis) grew 3.21% y/y. In this quarter it

shrunk 0.8% y/y... a

negative growth swing of 4 percentage points!

Now, adding taxes (net of subsidies) to the above figure produces official real GDP (GDP expressed in constant prices terms). This stood at €40.327 billion in Q2 2012 up €744 mln on Q1 2012 (+1.9% q/q) but

down 1.1% (-€442mln) y/y. Now, wait, folks... so official GDP is

down y/y. Not up.

What's the dynamics of this change? Oh, well, in Q2 2011 official real GDP was

up 2.86% on same period in 2010, so Irish economic growth has overall

deteriorated in Q2 2012 compared to same period a year ago by a whooping 3.9 percentage points.

Next step is for us to subtract from our real GDP outflows of payments abroad (net of inflows of income from abroad) - the so-called Net Factor Income From the Rest of the World adjustment. Bear with me here. It is important.

In Q2 2012 we, as economy, have managed to send out €7.219 billion in factor payments abroad,

net of what we received from abroad. Sounds a lot? Not really - this is down on €8.397bn in Q1 2012 (which

added €1,178mln to our GNP) and it is

down €1,385 mln on Q2 2011 (which adds same amount to our GNP compared to Q2 2011 levels).

What the above means? Here's the punchline to reality: as the result of €744mln increase in our GDP and a €1,178mln decrease in our payments abroad, our GNP officially expanded by €1.922bn in Q2 2012 q/q. Meanwhile, due to a

contraction in real GDP of €442mln offset by reduction in outflows of income abroad of €1,385mln, our GNP rose €943mln (+2.9%) y/y in Q2 2012.

Thus, real economic activity in Ireland fell, y/y in Q2 2012, but because the MNCs have decided to expatriate less income out of Ireland in Q2 2012, our GNP actually rose.

Why would MNCs decide not to expatriate much of profits? For a number of reasons:

- Lack of capital investment around the world means corporates have no incentive to move profits out of Ireland outside the immediate objective of boosting reported profits at home;

- Booming equity markets in the US mean that there is no immediate pressure for US MNCs operating here to ship retained profits out of Ireland's tax heaven;

- Fall-off in pharma exports from Ireland also took a bite out of the retained profits here.

Any of these have any tangible effect on our real economy? Not really. Actually - none whatsoever.

In real economic terms, Irish economy shrunk in Q2 2012 by 1.1% (real GDP terms) y/y and that is it, folks.

One more note. In seasonally adjusted, constant prices terms:

- Personal Consumption of Goods & Services has hit absolute record low in Q2 2012 of €19,598mln for any quarter since Q1 2007.

- Net Expenditure by Central and Local Government on Current Goods and Services has hit an absolute low of €5,934mln in Q2 2012 for the entire period since Q1 2007.

- Gross Domestic Fixed Capital Formation has hit a record low of €3,427mln

- Exports of Goods and Services have posted a contraction on Q1 2012 but are up €1 billion on Q2 2011

- Imports of Goods and Services have posted a q/q contraction of €1.7bn and are now at a historical low for any Q2 period of 2007-present period

- Total domestic demand is now at the absolute lowest point for any quarter since Q1 2007 and is down €1.6bn on Q1 2012 and €1.9 billion on Q2 2011.

This is not flat growth, folks. This is shrinking real economy.

Note: I will post updated charts later tonight. Stay tuned.