The pitfalls of forecasting Irish GDP and structural deficit in handy charts...

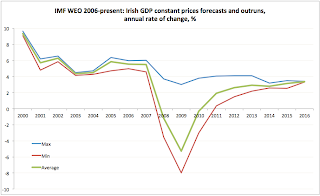

First - the range of forecasts and outruns for annual GDP growth in constant prices:

Structural deficits - the reverse is true. Forecasts are tighter (as potential GDP assumes away cyclical effects) and outrun estimates are all over the place instead:

There is also a strangely strong correlation between conservative estimates of the structural deficits and the average estimates of the structural deficit and the IMF reported and forecast GDP growth rates. In other words, the models used by the IMF appear to produce more consistent lower end deficit estimates.

Which, of course, begs a question. You see, per IMF, Ireland's structural deficits were on average and at the minimum levels strongly outside the fiscal sustainability in 2000-2006 and well outside the Fiscal Compact bound of -0.5%. Over the same period of time, EUCommission reported structural deficits were actually within the parameter bounds for Fiscal Compact. Given that the IMF min and average estimates closely reflect the growth estimates and reported outruns, it appears that the IMF metric is probably a more reasonable reflection of the fiscal realities than that of the EUCommission.

Which is not exactly the great news for the Fiscal Compact as far as the treaty expected ability to achieve any real impact on fiscal discipline goes.

First - the range of forecasts and outruns for annual GDP growth in constant prices:

Not only the range of forecasts is wide (exclude the 2008-2009 period for obvious reasons), but what is worse is that there is virtually no agreement within the WEO database on past rates of growth. For example, take year 2000:

- WEO September 2011 claims 2000 saw growth of 9.298%

- WEO April 2011 and September 2010 state it was 9.665%

- WEO April 2010 and October 2009 claimed it was 9.447%

- WEO April 2009 and October 2008 set it at 9.237%

- WEO April 2008 at 9.15%

- WEOOctober 2007 at 9.1%

- WEOApril 2007 reported it to be 9.4%

- WEOOctober 2006 and April 2006 showed 9.2%

So which is the real growth rate, then? And how long do we need to wait to confirm it? Of course, much of the above is due to referencing to different prices bases - in other words, inflation 'target' changes' but you do get the point - even past rates are changing over time, implying the difficulty of actually comparing past performance.

Meanwhile, the range of forecasts is outright massively all over the place. Take this year forecasts (and we exclude the fact that between WEO database releases twice a year, we have intermediate updated forecasts published in separate documents without actually updating the database. So back in 2009 the IMF predicted 2012 rate of growth to be 2.325% to 2.337% (April-October versions). By April 2010 it was 2.306% and by October 2010 it was 2.446%. InApril 2011 the forecast for 2012 was revised to 1.908% and in September 2011 it was revised to 1.484%. So much for planning: the range over just 1.5 years is 2.446% to 1.484%.

There is also a strangely strong correlation between conservative estimates of the structural deficits and the average estimates of the structural deficit and the IMF reported and forecast GDP growth rates. In other words, the models used by the IMF appear to produce more consistent lower end deficit estimates.

Which, of course, begs a question. You see, per IMF, Ireland's structural deficits were on average and at the minimum levels strongly outside the fiscal sustainability in 2000-2006 and well outside the Fiscal Compact bound of -0.5%. Over the same period of time, EUCommission reported structural deficits were actually within the parameter bounds for Fiscal Compact. Given that the IMF min and average estimates closely reflect the growth estimates and reported outruns, it appears that the IMF metric is probably a more reasonable reflection of the fiscal realities than that of the EUCommission.

Which is not exactly the great news for the Fiscal Compact as far as the treaty expected ability to achieve any real impact on fiscal discipline goes.

No comments:

Post a Comment