Irish Residential Property Price Index (RPPI) is out today with latest figures for June 2013 offering a snapshot on H1 and Q2 activity in the sector, with some encouraging signs.

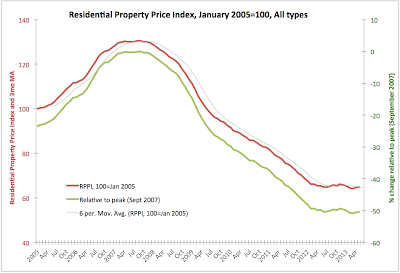

From the top line data: the overall property price index has managed to post the first annual increase in June since January 2008. However, overall trend in overall index remains flat, as established from Q2 2012.

From the top line data: the overall property price index has managed to post the first annual increase in June since January 2008. However, overall trend in overall index remains flat, as established from Q2 2012.

- Year on year, RPPI was up 1.23% in June, having posted -1.07% growth in May 2013.

- 3mo cumulated change through June 2013 was at 2.34% and this contrasts +0.62% rise in 3 months through May 2013.

- 6mo cumulated change remains negative at -.03%, but much shallower than -1.97 6mo cumulated change through May 2013.

- M/m June rise of 1.23% was the largest m/m move up since September 2007.

- However, on 3mo MA basis, the index June reading was 65.0 - still below the levels recorded in February 2013.

- Relative to peak the index is down 49.73%, the best reading since December 2012. However, the RPPI is only 2.34% above the all-time low.

Top-line conclusion: RPPI is struggling to lift up above the flat trend despite the unprecedented level of prices collapse to-date.

Chart to illustrate the above trends:

Apartments drove the overall index up on a m/m basis and largely accounted for much of change y/y. The problem is that apartments index is based on thin data, so it is subject to much volatility.

- Houses RPPI was up 0.89% y/y in June, having posted a y.y contraction of -0.88% in May. M/m index rose 0.89%.

- 3mo cumulated increase in Houses RPPI was 2.10% in June against a rise of 0.9% in May.

- 6mo cumulated move in Houses RPPI remains negative at -0.73% - a moderation on -2.17% contraction in May.

- 3mo MA through June is 67.7, which is the best 3mo MA reading since February 2013 (67.93).

- Relative to peak, Houses RPPI is down 48.3% and current index reading is only 2.1% above the all-time low.

- Apartments RPPI reached 50.1 in June 2013, up 5.25% y/y and this contrast in the index being down 3.09% y/y in May 2013. M/m June move stood at +6.37%.

- 3mo cumulated change through June 2013 stood at +4.59% a strong reversal on -8.54% 3mo cumulated fall in May 2013.

- 6mo cumulated rise in June stood at 6.82% against 6mo cumulated rise of 3.06% in May 2013.

- Current reading of the index is 59.56% below the peak and is 9.53% ahead of the absolute low.

- However, Apartments RPPI STDEV during the crisis period has been at 23.5 against 20.3 for Houses Index. And STDEV for m/m changes was 2.36 for Apartments, against 0.84 for Houses.

- 3mo MA for Apartments index reached 48.53 in June 2013, which is above May 3mo MA, but below April.

Chart below illustrates Apartments and Houses indices trends:

Top line conclusions: Again, the flat trend remains for the houses index and there is a slight upward trend for the apartments. Both series are relatively anaemic, despite the positive moves. High volatility in Apartments index suggests that caution should be used in interpreting overall RPPI data short-term moves.

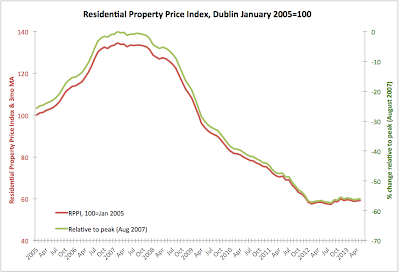

Dublin RPPI:

- Dublin RPPI rose 4.15% y/y in June 2013, having posted a rise of 1.37% y/y in May. June marks sixth consecutive month of increases in Dublin RPPI (y/y terms).

- 3mo cumulated change in June stood at 2.38% reversing the 3mo cumulated decline of -0.17% in May 2013.

- 6mo cumulated increase in June was 1.69%, reversing a -1.33% 6mo cumulated drop in may.

- Relative to peak, Dublin RPPI is now down 55.24% and relative to absolute low the index is up only 5.06%.

- 3mo MA at 59.43 in June 2013 is the best 3mo MA reading since January 2013.

- Against the peak, current reading brings us back to the levels last seen in December 2011-January 2012.

Chart to illustrate:

Top line conclusions: Dublin RPPI is showing most significant and lasting gains of all sub-indices, backed also by medium-range volatility (STDEV for m/m changes is 1.38 for Dublin RPPI).

How significant was the skew in All Properties RPPI due to movements in Apartments? Very significant.

- All RPPI was up 1.2% y/y in June 2013

- National Houses RPPI was up 0.9%

- National Apartments RPPI was up 5.3%

- Ex-Dublin, All RPPI was down -1.0%, Ex-Dublin Houses RPPI was down 0.9% (close to All RPPI ex-Dublin)

- Dublin All RPPI was up 4.2% with Dublin Houses RPPI up 3.6% and Dublin Apartments RPPI up 9.7%.

Hence, overall RPPI was strongly pushed up by Apartments and Apartments index was pushed up by Dublin Apartments.