Sales of the U.S. Mint gold coins have moderated off their pandemic highs, but remain elevated by historical standards, especially controlling for higher gold prices:

Saturday, October 31, 2020

31/10/20: Gold Coins Market is Still Hedging Residual Covid Risk

Tuesday, October 27, 2020

27/10/20: COVID19 Update: U.S. vs EU27

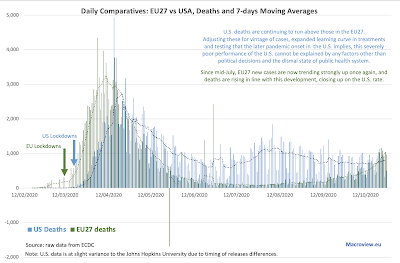

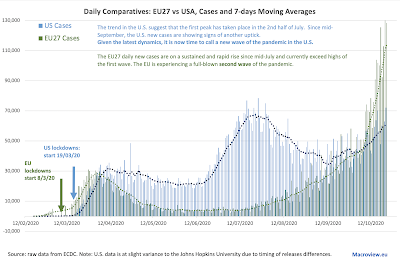

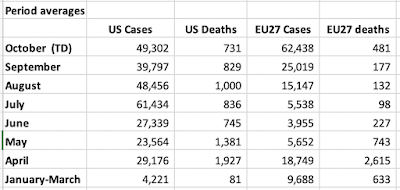

Quick update to the U.S. vs EU27 charts for COVID19 pandemic:

- The U.S. has a vastly higher death rate per 1 million population than the EU27 rate:

- Current death rate per 1 million of population in the U.S. is 690.0

- Current death rate per 1 million of population in the EU27 is 370.3

- Put differently, current U.S. death rate per capita is 86 percent above that for the EU27, though this gap is now slowly closing (it was 90% a week ago).

- Overall counts of deaths in the U.S. are now above the EU27, since July 12. Current excess gap is at +67,604. Adjusted for population and pandemic timing differences, the gap is 114,869.

- The EU27 are now experiencing a second wave of infections. As the result, over October to-date, EU27 new case numbers have surpassed the U.S. in all but 2 days and deaths on 11 occasions

27/10/20: Identity & Risk: My Keynote Talk

My recent keynote address to the pTools Virtual Conference 2020: Identity & Risk: Financial Services in a Time of Transformation & Uncertainty (22nd October 2020) is now available at: https://vimeopro.com/user12978768/ptools-virtual-conference-2020.

27/10/20: COVID19 Update: Russia

Russia is now in a full-blown second wave of the pandemic with rapidly accelerating daily deaths counts:

Overall, Russia currently ranks 33rd worst in the league of 47 countries with more than 100,000 cases, with better than average (95% confidence interval) scores in the number of cases per 1 million population, deaths per 1 million of population and deaths per 1,000 of cases. Despite the commonly cited controversy over Russian reporting methodologies for COVID19 linked deaths (incidentally, Russia does not use a unique methodology for such reporting, although Russian methods for assigning causes of deaths are different from those used in the EU27), Russian rates of deaths per cases detected and rates of deaths per 1 million of population are comparable (in rankings) to Russia's case numbers.

Nonetheless, the second wave of the pandemic is both deadlier and larger than the first wave and it remains to be seen if Russian healthcare system can cope with this.

Monday, October 26, 2020

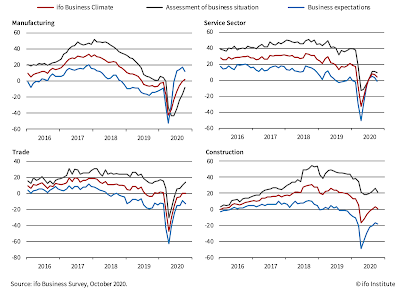

26/10/20: ifo Institute: German Economic Conditions Deteriorated in October

ifo Institute's latest Business Climate survey data for Germany is pointing to continued weakness in the recovery momentum:

Notably, all four sectors covered remain under water:

Current conditions are deteriorating month-on-month in two sectors, expectations have deteriorated in all four sectors.

25/10/20: COVID19: U.S. Excess Deaths are 130,000 at a lower end of estimates

I have been running EU vs U.S. comparatives for COVID19 pandemic dynamics for some time now, and as those reading this blog would know, some months ago I added an estimate - based on mortality figures - of the excess U.S. deaths compared to the EU27. These currently - by my estimate - stand at 114,621 (see latest estimate here: https://trueeconomics.blogspot.com/2020/10/231020-covid19-update-us-vs-eu27.html).

My estimate is crude. It is based on timings, population size and mortality rate adjustments.

A more accurate recent estimate has been provided by the Columbia University study (https://resiliencesystem.org/columbia-university-says-trump-could-have-avoided-over-130000-covid-19-deaths-more-robust-pandemic) that puts the number at 130,000-210,000 'avoidable deaths'. That is some range, of course. Per study: "If "the U.S. had followed Canadian policies and protocols, there might have only been 85,192 U.S. deaths – making more than 132,500 American deaths 'avoidable,'" the authors wrote. "If the U.S. response had mirrored that of Germany, the U.S. may have only had 38,457 deaths – leaving 179,260 avoidable deaths."

One way or the other, there are at least 100,000+ Americans dead because of the completely shambolic public health system and policy responses by the current Federal and State leaderships in the U.S.

Columbia study seems to nail some of these factors: "The country's disproportionate death toll stems from delayed federal action, an insufficient testing regimen, a lack of consistent mask-wearing guidance, and the failure of top officials, notably Trump, to model best practices". Alas, predictably (mythology of the American culture), it misses the elephant in the room: the U.S. healthcare system itself. American approach to distributing access to healthcare based on private insurance (plus Medicare and Medicaid) is leaving tens of millions of Americans outside the basic safety net. Those without insurance as well as countless more with the atrociously large deductibles and co-pays are too afraid to present themselves to the hospitals designed to bankrupt people of modest means to seek early support and help. It matters little how much the U.S. authorities test the public (and, yes, tests are highly rationed, still, despite all the bluster from the White House), if people do not seek help in fear of being destroyed financially.

In 2020, the average annual deductible for single, individual coverage is $4,364 and $8,439 for family coverage. Co-pay normally ranges 10-40% of the bill, though it is more complicated, since there are various caps and step-downs in co-payments. (https://www.ehealthinsurance.com/resources/individual-and-family/how-much-does-individual-health-insurance-cost#:~:text=Deductibles%20and%20cost%2Dsharing%20expenses,and%20%248%2C439%20for%20family%20coverage.)

The typical American household has an average of $8,863 in a bank or credit union account. There are serious variations by age and type of household, with couples 34 and younger, couples without children have an average of $4,727 in savings, while single people without children have an average of $2,729 in savings. Couples with children between the age of 35 and 44 have an average of $10,399, couples aged 45-54 with children average $15,589. (https://www.cnbc.com/2019/03/11/how-much-money-americans-have-in-their-savings-accounts-at-every-age.html)

Meanwhile, the median charge for COVID-19 inpatient care was $45,683 for people aged 51 to 60 and $34,662 for those in the 23 to 30 age bracket, according to a recent study. This was the median billed to people without insurance or those who were forced to be treated out of network. The highest average allowed amount paid to the provider under an insurance plan was $24,012 for people aged 51 to 60 and, at its lowest, $17,094 for people above age 70. (https://www.thehealthcareloop.com/hospitalized-care-for-covid-19-averages-34662-to-45683-varying-by-age/)

So a person visit for COVID19 treatment, counting lost wages, would wipe out between 1/2 and all of the savings held by average household. Contagion within the family would be a near insolvency event.

Anyone surprised American system is killing the U.S. citizens and residents?

Saturday, October 24, 2020

24/10/20: America's Scariest Charts: Duration of Unemployment & Employment Index

Two previous posts covered some core labor markets data for the U.S.:

- Non-farm payrolls through September 2020: https://trueeconomics.blogspot.com/2020/10/241020-americas-scariest-charts-non.html and

- Labor Force Participation rate and Employment-to-Population ratio: https://trueeconomics.blogspot.com/2020/10/241020-us-labor-force-participation.html

Current reading stands at 3,194,750 which is above the 2008-2011 crisis peak of 3,169,786 and only slightly below all-time pre-COVID19 high of 3,313,000 attained in January 1975.

In absolute level numbers, preliminary first-time claims for the week of October 17, 2020 stand at 756,617 which is still 3 times the rate of first-time claims filings in the last week before COVID19 pandemic onset (March 14, 2020). The good news is, preliminary estimate for the new claims for the week of October 17 suggest a decline in new claims filings of 73,125 on week prior - the fastest rate of reductions in 10 weeks. However, overall average weekly decline in first-time claims over the last 10 weeks has been rather unimpressive at 8,212. At this rate of improvement, it will take almost 62 weeks to draw current first-time claims down to the levels seen in the last pre-COVID19 week.

24/10/20: America's Scariest Charts: Non-farm Payrolls

In the previous post, I covered data for the U.S. Labor Force Participation and Employment to Population Ratios (see https://trueeconomics.blogspot.com/2020/10/241020-us-labor-force-participation.html). Now, let's update the data for Total Nonfarm Payrolls through September:

Here is a genuinely scary table, highlighting the fact that in the COVID19 pandemic, the U.S. sustained jobs losses of the combined magnitude equivalent to those suffered in all recessions from 1980 through the Great Recession:

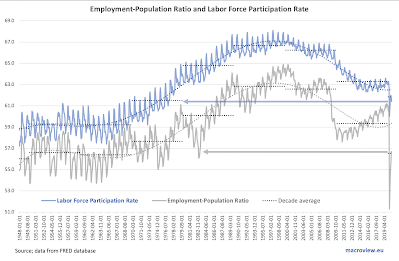

24/10/20: U.S. Labor Force Participation Rate is Falling, Again

One of thee major casualties of the COVID19 pandemic has been the U.S. labor market. However, with an allegedly robust recovery under way, we are seeing significant improvements across some metrics of labor markets health. In some, but not all.

Take labor force participation rate:

23/10/20: COVID19 Update: Nordics

My last update on Nordics vs Sweden comparatives was a month ago, although I did post some more recent data trends on Twitter since then. Here are the latest numbers:

New deaths counts are relatively benign, both in Sweden and (at a higher rate) in the rest of the Nordics. However, new daily counts in thee Nordics ex-Sweden are literally out of control as a new, and much larger wave of the pandemic sweeps EU27.

Sweden entered the second wave of the pandemic with a delay, compared to other European states, so its numbers are still lagging those in other Nordic states.

I commented on the often-heard argument in favour of Sweden's 'herd immunity' strategy earlier today and you can read it here, if you missed it (bottom of the post): https://trueeconomics.blogspot.com/2020/10/231020-covid19-update-countries-with.html.

It appears, based on Sweden's (amongst others') experiences, that we really have very limited options in terms of public policy response to the pandemic. My five cents, based on multiple observations of experts' advice: we need

- Fully enforceable and strongly policed public distancing measures,

- Mandatory masks in all public places,

- Restricted (though, probably, not banned) access to public commons and public places,

- Effective and wide-spread free testing on demand,

- Aggressive tracing and strictly enforced quarantines,

- Improved separation of COVID19 patients from all general health facilities (in order to ensure that normal health services provision is not impacted by the pandemic), and

- Significant increase in spending on public health and education so both key sectors of the society can be opened safely and sustainably.

Anything short of these will result in stop-and-go swings of the pandemic and knee-jerk policy reactions with rolling shutdowns of the entire economies.

23/10/20: COVID19 Update: Russia

Two weeks ago I pointed out the fact that Russian COVID19 numbers are going exponential as the pandemic clearly entered a new wave dynamic. This trend is still there and death counts are rapidly accelerating as well.

If the chart isn't clear enough, here are the numbers:

This isn't a fluke, nor a product of increased testing, though the latter factor contributes to higher detection numbers, it should be pushing down deaths (earlier interventions should be consistent with better treatment options and outcomes).

Around two weeks ago, Russia new cases went exponential. Now, there are signs of a similar dynamic in the already rising daily death counts.

23/10/20: COVID19 Update: Countries with > 100,000 cases

Some interesting updates to the league tables for countries with > 100,000. Since the last update, five more countries joined the rather sad club, including Sweden (more on this later), and there are now 47 countries around the world with more than 100,000 cases of the disease recorded.

The tables below are organized as a heat map, with green cells reporting statistics that put a country in the 'better than average' category, while orange cells marking countries statistically worse than average:

- The EU27 - ranked relative to the countries, though excluded from the national level statistics inputs - is ranked 17th worst in the table.

- The U.S. is now jointly ranked 7th worst with the UK - a one point deterioration in performance for thee U.S. since the earlier update.

- Sweden ranks 15th worst - poorer performance than the EU27, but not by much.

- Globally, the worst impacted country is Peru, followed by Belgium and Bolivia (tied for the 2nd rank), Brazil (4th) and Chile (5th).

- The U.S. accounts for 4.34% of the world population, but holds a steady 20% share of global cases and deaths.

- The EU27 accounts for 5.92% of the world population, and holds 11% of world's cases and 14% of world's deaths.

- BRIICS+ Turkey account for 46.5% of world's population, 39% of world's cases and 30% of world's deaths.

- Sweden's infection rate is 25th highest in the world, which is basically identical to the EU's ranks of 26th. In actual numbers, Sweden's rate is only 1.68% higher than that of the EU27.

- However, Sweden ranks 15th in the mortality rate per capita of population (575.95 per 1 million of population), where as thee EU27 ranks 19th (361.33 per 1 million of population). Actual rate in Sweden is 59.4% higher than in the EU27.

- Sweden also ranks much worse than the EU27 in the COVID19 deaths per infection rate: Sweden is ranked 8th worst in the world, against the EU27 rank of 12th worst. Sweden has COVID19 mortality rate of 54.5 per 1,000 cases, the EU27 rate is 34.7.

- Sweden did not shut down its economy. But it is not doing better than all other economies that did. There are a total of 39 advanced economies in the world, including Sweden. In 2020-2021 growth outlook (cumulated forecast over 2 years), Sweden ranks 16th highest growth. Not exactly terribly, but not great either.

- In 2020-2021, based on IMF's October 2020 forecasts, Sweden's real GDP is expected to end 2021 at 98.59, relative to 100 for the end of 2019. Worse than Norway at 100.62, and Finland at 99.45 and Estonia at 99.07 and Denmark at 98.84, but better than the Netherlands at 98.43.

- Hardly an impressive performance for a 'herd immunity' country that is in more recent weeks enjoying post-peak troughs.

23/10/20: COVID19 Update: U.S. vs EU27

Things are running out of control in the EU27 and remain out of control in the U.S. of A. Here are the latest daily numbers:

Overall:

- The U.S. has a vastly higher death rate per 1 million population than the EU27 rate:

- Current death rate per 1 million of population in the U.S. is 681.7

- Current death rate per 1 million of population in the EU27 is 361

- Put differently, current U.S. death rate per capita is 89 percent above that for the EU27, although this gap is now slowly closing, down from 91% in the prior update

- Overall counts of deaths in the U.S. are now above the EU27, since July 12

- Current excess gap is at +67,397. Adjusted for population and pandemic timing differences, the gap is 114,621

- The EU27 are now experiencing a second wave of infections. As the result, over October to-date, EU27 new case numbers have surpassed the U.S. in all but 2 days and deaths on 7 occasions

- In the U.S. pandemic continues to rage and re-accelerating from August-September slowdown. Deaths are lagging, but still running at elevated levels and are more recently rising once again.

- In the EU27, the pandemic is back with more than a vengeance: daily new cases counts are vastly above anything we have seen in the first wave. Death counts are lagging behind the prior peak, but a re massively above June-September numbers and climbing up.

Friday, October 23, 2020

23/10/20: COVID19 Update: Worldwide Cases and Deaths

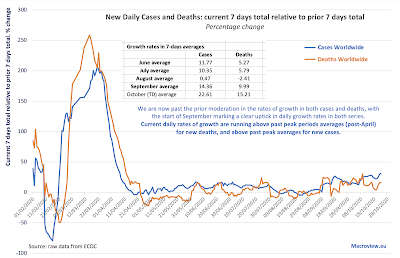

The global pandemic is accelerating, not abating:

New cases numbers have set all-time records in the last two days, and daily counts ranked in top 10 in the last 10 days on eight occasions, with the balance two occasions coming in ranked 13th and 15th, respectively. Despite the rising public complacency and fatigue to the pandemic numbers, globally, we are yet to attain the first peak of the pandemic, suggesting that when this does happen, we are likely to be set for an even worse second wave of infections.

Overall, 7-days average for new infections is at a jaw-dropping 390,097, more than 3 times the historical median and up on the 30-days average of 333,024 cases per day.

In deaths counts, things are not looking great either.

Both, growth rates in new cases and in daily reported deaths are now significantly in excess of anything observed since the flattening out of the growth curve starting with mid-May. October rates of deaths and cases are substantially ahead of September rates, indicating that the pandemic is accelerating, not abating.

Thursday, October 22, 2020

21/10/20: Pollution Shifting and Heterogeneity in Local Regulatory Coverage

States, like California within the U.S., and some individual member states within the European Union tend to adopt own-level regulations on harmful emissions in an effort to 'pave the way' for other peer states. These regulations, of course, only apply to the economic agents 'captive' in the state. They do not apply to more mobile companies that can shift their emissions across borders to minimize the impact of more stringent regulations. Even Federal-level standards on pollution abatement are often subject to local applicability variations, resulting in pollution shifting across states' borders in line with the above.

A recent study by Feli Soliman, titled "Intrafirm Leakage" published by CESifo as a Working Paper No. 8619 (https://ssrn.com/abstract=3712780) provides some empirical evidence of exactly such pollution shifting. The study finds that "...multiplant firms partially regulated under the ozone regulations of the US Clean Air Act offset regulation-induced reductions among regulated plants with spillovers to unregulated plants and by moving plants out of regulated areas." Crucially, however, the offsetting decisions are more than sufficient to render overall pollution output un-impacted by the more stringent local regulations: "Taken together, these leakage effects fully offset emissions reductions at regulated plants."

Another interesting finding in the study is that thee effects of this pollution shifting "are strongest among highly productive firms and those operating in tradable industries." In other words, the companies that hold prospect for future growth (and expansion of their pollution output) and have higher likelihood of survival are the very same firms that gain from pollution arbitrage across borders.

Overall, the author concludes that "By themselves, these results imply that expanded ozone regulation under the [Clean Air Act] has not contributed to the clean-up of US manufacturing"

Saturday, October 17, 2020

17/10/20: COVID19 Update: Russia

Russian pandemic numbers are getting seriously out of control, once again, and this outrun was pretty much predictable based on early eit from serious restrictions.

Russia managed to lower, but not crush, pandemic pressures between the first wave peak of the second week of May 2020 and the start of July. By mid-August, both new cases and daily deaths counts fell to their post-peak lows. However, starting with September, the pandemic evolved into a second wave, with exponential increase in new cases through today, and deaths following the same trend path.

Here is a summary table of the second wave dynamics:

16/10/20: COVID19 Update: U.S. vs EU27

In two previous posts, I have updated data for COVID19 pandemic through October 16 for:

- Global cases and deaths: https://trueeconomics.blogspot.com/2020/10/161020-covid19-update-worldwide-cases.html

- Countries with > 100,000 cases: https://trueeconomics.blogspot.com/2020/10/161020-covid19-update-countries-with.html

- The EU27 are now experiencing a full-blown second wave of infections. As the result, over October 1-16, EU27 new case numbers have surpassed the U.S. on 14 occasions and deaths on 3 occasions.

- The above development is extremely alarming. As the first chart shows, EU27 is setting new records in total numbers of daily cases, records that are running at a rate of 3 times higher daily new cases counts that at the peak of the first wave of the pandemic. This will, inevitably, translate into higher levels of deaths in weeks to come. More ominously, current rates of new cases arrivals in the EU27 are bound to overwhelm the healthcare systems of the member states.

- Meanwhile, the U.S. is also seeing increases in new cases, having enjoyed a temporary and short relief from the peak of the second wave around the end of the second week in September. Since then, the U.S. new cases are running at accelerating rates once again.

- In other words, it is time to call the third wave of the pandemic in the U.S.

- Deaths are also on a rising trend, in Europe, while lagging new cases explosion in the U.S.

- EU27 daily deaths counts are running at the rates more than double of September, more than 3.5 times the rates of August. October so far is the fourth deadliest month in this pandemic for the European Union.

- U.S. daily deaths are the pandemic lows, but still significantly above those in the EEU27.

- The U.S. has a vastly higher death rate per 1 million population than the EU27 rate: Current death rate per 1 million of population in the U.S. is 665.4 against the current death rate per 1 million of population in the EU27 is 347.9

- Put differently, current U.S. death rate per capita is 91 percent above that for the EU27.

- Overall counts of deaths in the U.S. are now above the EU27, since July 12. Current excess gap is at +66,037.

- Currently, adjusted for population and pandemic timing differences, the U.S. has 114,621 more deaths than the EU27.

- Meanwhile, owing to the second wave of the pandemic raging in Europe, EU27 member states are starting to go back into lockdown management mode.

16/10/20: COVID19 Update: Countries with > 100,000 cases

Worldwide COVID19 developments through October 16 ECDC data were covered in the post here: https://trueeconomics.blogspot.com/2020/10/161020-covid19-update-worldwide-cases.html. Now, as usual, time to take a look at the group of countries with more than 100,000 cases.

As always, the table is presented in two parts:

16/10/20: COVID19 Update: Worldwide Cases and Deaths

Based on the ECDC data through October 16, 2020, here are the latest COVID19 pandemic numbers worldwide:

Cases:

- As of October 16, there were 38,941,034 cases identified world-wide.

- The rate of new cases arrivals 338,793 per day over the last 7 days, which is above the 30-days average of 311,074.

- Since the start of October, there were 8 days with daily counts ranked within the top 10 highest in the entire history of the pandemic.

- The rate of new cases arrivals rose to a massive 21.2 percent in October to-date, almost 50% higher than the average daily growth rate in September, almost 50 times the rate of new cases growth in August, and more than double the rate of growth in June-July.

- All of the above clearly indicates that, globally, we are still in the acceleration phase of the first wave of COVID19 pandemic.

- The slight reduction in daily counts we've seen between the first week of August and the end of September is now fully exhausted.

- Over the last 7 days, daily death counts averaged 5,135 worldwide, which is slightly below the 30-days average of 5,486, but rising once again.

- October (to-date) average daily growth rate in deaths is 17.62%, which is massive, compared to September's 9.99%, and to falling rate of -2.41% recorded in August. October rate is so far three times higher than June-July rate.

- Note that October to-date rate of growth in new cases is pretty close to the rate of growth in new deaths. This is worrying, because it seems to contradict some claims made in the media about allegedly rapidly declining mortality of COVID19.

Wednesday, October 14, 2020

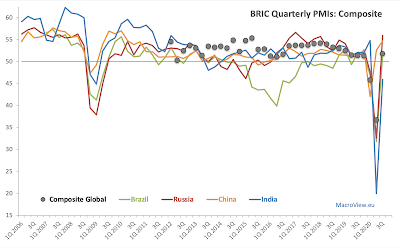

14/10/20: BRIC: Composite economic activity indicators Q3 results

We covered in detail strong recovery in BRIC Manufacturing PMIs (https://trueeconomics.blogspot.com/2020/10/141020-bric-manufacturing-pmis-q3.html) and fragile recovery in Services PMIs (https://trueeconomics.blogspot.com/2020/10/141020-bric-services-pmis-q3-results.html). Here is a summary chart:

Overall, BRIC block activity indices imply lagging momentum in the recovery in services, and faster than global pace of recovery in manufacturing. Statistically, BRIC growth momentum in 3Q 2020 is within historical average, however, growth dynamics in 1Q and 2Q 2020 were significantly below historical averages, which implies that 3Q 2020 PMIs indicate incomplete or only partial recovery in the BRIC economies post-pandemic so far.