Updating the Residential Property Price Index data from CSO released earlier this week, here are the core highlights for September 2013:

For Houses RPPI:

Dublin RPPI:

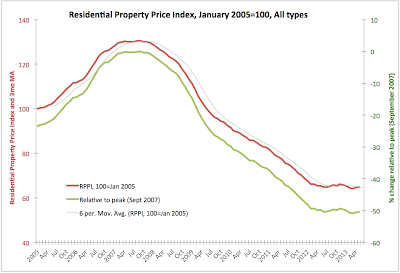

- All country RPPI rose to 68.2 in September from 67 in August, marking sixth consecutive month of rises The index is now up 3.65% y/y (in August it was up 2.76% y/y).

- 3mo cumulated change in RPPI is 3.96% and 6mo cumulated change is 6.4%. 6mo average rise is 0.66%.

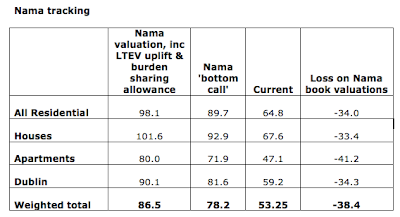

- Nama valuations (with 10% cushion on LTEV uplift and risk sharing) are now 33.97% off the mark.

- Relative to peak, index now stands at -47.74% and relative to absolute minimum it is at +6.4%.

For Houses RPPI:

- Index rose to 71.0 in September from 69.8 in August and posted a 3.35% rise y/y.

- 3mo cumulated gains are at 4.11% and 6mo cumulated gains are at 6.29%. Average over 6 months monthly increase is 0.69%.

- Relative to peak, the index now stands at -46.21% and relative to absolute minimum it is at +6.29%.

- September marked sixth consecutive month of rises in house prices.

For Apartments:

- Index rose to 50.9 in September from 50.0 in August and posted a 8.53% rise y/y.

- 3mo cumulated gains are at 1.6% and 6mo cumulated gains are at 6.26%. Average over 6 months monthly decrease is -0.41%.

- Relative to peak, the index now stands at -58.92% and relative to absolute minimum it is at +11.38%.

- September marked second consecutive month of rises in apartments prices.

Dublin RPPI:

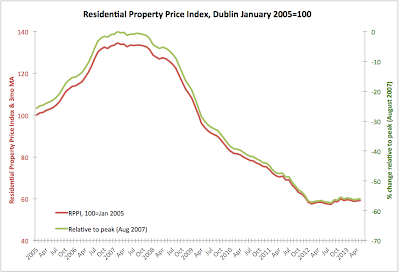

- Index rose to 65.9 in September from 63.4 in August and posted a massive 12.27% rise y/y.

- 3mo cumulated gains are at 9.47% and 6mo cumulated gains are at 12.07%. Average over 6 months monthly increase is 1.13%.

- Relative to peak, the index now stands at -51.0% and relative to absolute minimum it is at +15.01%.

- September marked sixth consecutive month of rises in Dublin property prices.

Conclusions:

- Twin convergence toward long-term equilibrium prices is now evident in Dublin markets (upward price pressures) and National ex-Dublin prices (downward pressures).

- The core question is when will Dublin prices overshoot their long-run trend and moderate again?

- Another core question is what the fundamentals determined price levels are for Dublin and for the rest of the country?

- I have no answers to the above questions and anyone who says they do is most likely talking porkies.

- What I do know is that there are plenty of risks to the downside and headwinds working through the economy. These include: mortgages arrears, income effects of tax and charges changes in Budget 2014, banks rates on existent mortgages; and new mortgages supply and pricing.

- So far, my gut feeling is that we are still on a sustainable upward trend in Dublin and on moderating negative trend in the rest of the country.