This is an unedited version of my Sunday Times article from July 14, 2013.

The release of the Irish quarterly national accounts for Q1 2013 two weeks ago should have been a watershed moment for Ireland. Aside from confirming the fact that Irish economy is back in a recession, the new figures reinforce the case for the New Normal – a longer-term slowdown in trend growth and continued volatility of economic performance along this trend. The former revelation warrants a change in the short-term policies direction. The latter requires a more structural policies shift.

Months ago, based on the preliminary data for the last quarter of 2012, it was painfully clear that Irish economy has entered another period of economic recession. This point was made on these very pages back in early March although it was, at the time, vigorously denied by the official Ireland.

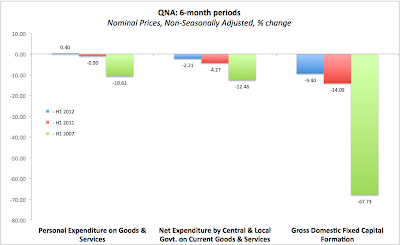

Irish economy is currently in its fourth recession in GDP terms since 2007. Q1 2013 marked the third consecutive quarter in the latest recessionary episode. Since the onset of the crisis, Ireland had 17 quarters of negative growth in private and public domestic investment and expenditure, and counting.

For the Government that spent a good part of the last 2 years telling everyone willing to listen about our returning fortunes, things are looking pretty grim. Since settling into the office by the end of H1 2011, through the first quarter 2013, Coalition-steered economy has contracted by EUR1.52 billion or 3.75%.

The fabled exports-led recovery, first declared in Q1 2010, is not translating into real economic expansion. Neither do scores of strategic policies documents launched with promises of tens of thousands of new jobs.

With the national accounts officially in the red, the bubble of claimed policies successes is bursting. What is emerging from behind this bubble is the New Normal. Whether we like it or not, in years to come we will continue facing high risks to growth and a lower long-term growth trend. Traditional Keynesianism and Parish Pump Gombeenism - the two, largely complementary policy options normally promoted in Ireland - cannot sustain us in the future.

Prior to the crisis, Irish economy experienced three periods of economic growth, all driven by different internal and external forces, none of which are likely to materialize once again any time soon.

The first period of 1991-1997 witnessed rapid convergence in physical and financial capital, as well as in human capital utilization to the standards, observed in other small open economies of the EU.

From 1998 through 2003, Irish economy experienced a combination of rising share of economic activity generated in the domestic economy and rapid expansion of the financial services. This period is characterised by two short-lived, but significant booms and busts: the dot.com expansion and the subsequent dramatic acceleration in public spending.

From the late 1990s, Ireland also experienced accelerating property boom, which culminated in an unsustainable investment bubble. All three periods of economic expansion in recent past were underpinned by favourable external demand for MNCs exports out of Ireland, low or falling cost of capital and accommodative tax environments, in which tax competition was an accepted norm.

These drivers are now history.

Since the onset of the second stage of the domestic economy’s recession in H2 2010, Ireland has entered an entirely new period of development that will shape our long-term growth performance.

Externally, our capacity to extract rents and growth out of tax arbitrage is coming under severe pressures, best highlighted by the recent G8 decisions, the CCCTB proposals tabled in Europe and by accelerated tax policies gains in countries capable of serving big growth regions outside the EU. The financial repression that commonly follows credit busts is also denting our tax-driven growth engine by raising competition for tax revenues, and lowering our real cost competitiveness vis-à-vis Europe and North America.

Internally, since 2002, MNCs-led manufacturing in Ireland has suffered what appears to be an irreversible decline. Goods exports are down from EUR90.4bn in 2002 to EUR78.7bn in 2012 before we take account for inflation. Meanwhile, exports of services are up from EUR32.2bn to EUR93.3bn. Problem is: over the same time, services exports net contribution to the economy has expanded by only EUR18 billion. More worryingly, services exports growth is now falling precipitously.

Data from the Purchasing Managers Indices confirms the long-term nature of our economic slowdown. Average rates of growth in GDP are now closer to 1.5% per annum based on Services sectors contribution and closer to 1.0% for Manufacturing. Prior to the crisis these were 7.0% and 2.6%, respectively. In 1990-2007, all sectors included, Ireland experienced average annual growth of 6.6%. Now, we are looking at ca 1.5-1.7% average growth rates through 2020.

Lower growth rates for Ireland will be further reinforced by the lack of access to credit flows previously abundantly available from the global funding markets. This will impact our banks lending, direct debt issuance by companies, and securitised or asset-backed credit.

The retrenchment of the global financial flows away from the euro area, coupled with regulatory changes in European banking suggest that investment in the New Normal will become inseparably linked to the internal economy and significantly more expensive than the decade preceding the 2008 crisis. Much of this change will be driven by the same financial repression that will act to reduce our tax regime advantages.

This means that at the times of adverse shocks - such as, for example, a fall in revenues from exports or an increase in foreign companies extraction of profits from Ireland – our economy will be experiencing more severe credit and income contractions. This will put more pressure on investment and lower the velocity of money in the economy. Longer-term capital financing will become more difficult as domestic investors will face more uncertain returns and higher liquidity risk. A bust and severely restricted in competitiveness banking sector - legacy of the misguided post-2008 reforms - will not be helpful.

Thus, in the future, switch to services exports away from manufacturing and domestic investment, and reduced access to credit will mean higher volatility in growth, and lower predictability of our economic environment.

The New Normal requires more agile, more responsive and better-diversified economic systems, alongside a more conservative risk management in fiscal policies and less centralisation and harmonisation of policies at super-national level. It also calls for more aggressive incentivising of domestic investment and savings.

In terms of the fiscal policy stance, this means adopting a more cautious approach advocated, in part, by the ESRI this week. Irish Government should aim to continue reducing public spending, but do so in a structural way, not in a simplified framework of pursuing slash-and-burn targets. In addition, the Government needs to re-focus on identifying lines of expenditure that can be re-directed toward more productive use. In the short run, this can take the form of switching some of the current expenditure into capital investment programmes.

Reforms of social welfare, public education, health and state pensions systems will have to make these lines of spending more effective in helping people in real need, while slimmer in terms of total spend allocations. This can be achieved by direct means-testing and capping some of the benefits. But majority of these changes will have to wait until after the immediate unemployment and growth crises have passed.

In the longer run, going beyond the ESRI proposals, the Government should permanently reallocate some of the spending (such as, for example, overseas aid or poorly performing enterprise supports) to areas where it can increase value-added in public services (e.g. water supply or public transport) and create new exports platforms (e.g. e-health and higher quality internationally marketable education). Additionally, new revenues should be raised from severely undertaxed sectors and assets, such as agriculture and land, to be used to lower tax burden on both, ordinary and highly skilled workers.

Beyond a short-term stimulus, rather than directing tax- and debt-funded new investment, public sector should help generate new opportunities for more intensive growth. Increasing value added in existent activities, not simply scaling these activities up in terms of quantity of services deployed or employment levels involved should become the priority for future public sector growth.

Adding further to the ESRI analysis, the objective of using fiscal policy to drive enterprise creation requires simultaneously freeing more resources in the private sector to invest in new technologies acquisition and adoption, and development of indigenous R&D. We need to increase, not shrink, disposable incomes of the middle- and upper-middle classes and improve incentives for these segments of the population to invest. IBEC's suggestion this week that the Government should abandon any future tax increases makes sense in this context. The key, however, is that direct and indirect income tax increases of recent years must be reversed.

We need to recognise, support and scale up clustering initiatives in the tech and R&D sectors that deliver partnerships between the existent MNCs and larger domestic enterprises and start ups. To do this, we should create direct links between the existent clusters, such as for example IT@Cork initiative and public procurement systems. To re-orient public procurement toward supporting younger enterprises, larger procurement tenders should explicitly target new opportunities for partnerships between MNCs and SMEs or start-ups.

To address structural decline in debt financing available in the economy, we should exempt from taxation capital gains accruing to any real investment in Irish enterprises, including the IPOs and new rights issues, where such investments are held for at least 5 years. To qualify for this scheme, an enterprise should have at least a quarter of its worldwide employees based in Ireland.

The New Normal of lower trend growth and higher uncertainty about the economic environment is here. Addressing the challenges it presents requires robust policy reforms. The least painful and the most productive way of implementing these would be to start as early as possible.

Box-out:

Recent report from CBRE on office market in Dublin for Q2 2013 provides an interesting insight into the commercial real estate markets dynamics in Ireland. Despite the cheerful headlines and some marginally encouraging news, the market remains in deep slump and so far, hard data shows no signs of a major revival. Good news: vacancy rate in Dublin office space has declined by 4% on Q1 2013, to 17.2% in Q2 2013. The vacancy rate was 19.32% in Q2 2012. Bad news: at this rate, it will take us good part of 10 years to catch up with the EU-average rates. More bad news: office investment spend fell from EUR79.6mln in Q2 2012 to EUR72.6mln in Q2 2013. Adding an insult to the injury, prime yields fell from 7.0% to 6.25% in the year through June 2013. The office market in Dublin is firmly reflective of what is happening in the economy. Only 37% of offices take ups in Q2 2013 were by Irish companies. Massive 65-66% of the city and suburban office space was taken up by the ICT and Financial services providers in a clear sign that outside these sectors, economic activity remains largely stagnant. Overall, on a quarterly basis, offices take up in Dublin has fallen for the second quarter in a row while there was the first annual decline since Q3 2012.