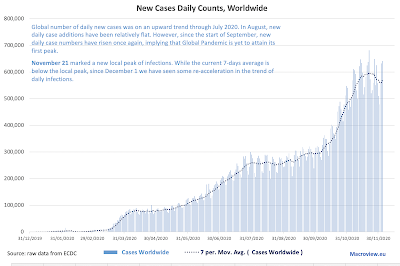

In previous posts, I covered worldwide trends for Covid19 pandemic evolution (https://trueeconomics.blogspot.com/2021/01/2121-covid19-update-worldwide-numbers.html) and pandemic developments in Europe and the EU27 (https://trueeconomics.blogspot.com/2021/01/2121-covid19-update-europe.html). Here, let's take a look at the set of countries with more than 250,000 confirmed cases.

As of week 52 of 2020, there were 40 countries in this group, accounting for 90 percent of the world total number of cases, 92 percent of the global deaths and 64 percent of the world's population.

Tables below provide summary statistics for these countries:

Some noteworthy observations from the above:

- The U.S. is the worst performing major advanced economy when it comes to the pandemic trends: it ranks 2nd worst in the world in terms of its numbers of Covid19 cases per 1 million of population, 7th worst in the world in terms of its death rate per capita, but a reasonably-benign 25th in the world in mortality rate (deaths per positive test case). Using the three metrics mentioned, the U.S. ranks 6th worst performing country in the league of all countries with > 250,000 cases.

- The UK ranks even worse than the U.S. The country ranks 15th worst in the world in the rate of infections (Covid19 positive tests per capita), and 5th worst in deaths per capita and deaths per positive case. Across all three metrics, the UK ranks third worst in the world.

- Belgium ranks the worst major country in overall pandemic impact terms (cases per capita, deaths per capita and deaths per case), followed by Italy in the second place. The UK, as mentioned above ranks the third, Spain forth, Peru fifth, the US and Argentina tied in the sixth place, Hungary comes in 8th, Czechia 9th and France 10th. Thus, six out of the 10 worst hit countries in the world are EU27 members.

- In mortality terms (deaths per 1,000 cases), Mexico is the worst-performing country with 88.42 deaths per 1,000 positive cases; followed by Iran (45.56), Peru (37.19), Italy (35.12) and the UK (30.52). Overall, only 6 countries have mortality rates > 30 per 1,000 positive tests.

- There were 7 countries with more than 1,000 deaths per 1 million of population, and only 4 countries with infection rate of > 50,000 cases per 1 million of population.