Continued unemployment claims are running below the 2008 GFC peak for the third week in a row, but adjusting to pre-Covid19 cycle unemployment roughs, we are still ways to go:

- Latest weekly change in continued unemployment figures is an increase of 230,000 - the first rise in 13 weeks.

- Pre-Covid19 trough was at 1,702,000 continued claims. We are currently at 5,757,000.

- Compared to pre-recession 12 weeks low, current unemployment claims are 334% higher or more than 3.3 times higher.

- New claims are also rising: the latest confirmed data is a weekly increase of 23,977 - the largest in 5 weeks.

- The latest preliminary data shows new claims up +228,982 in the week of December 5th, based in States' data.

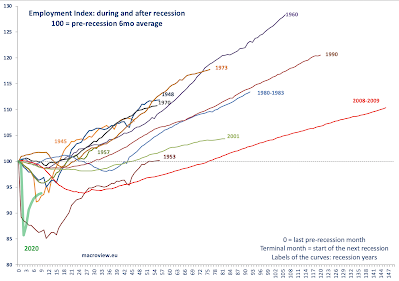

Meanwhile, labor force participation rate is weak: down from 61.7 in October to 61.5 in November. Which is below 2020 average of 61.8, which itself is not impressive. And employment to population ratio is down from 57.4 to 57.3 in November too. Woeful:

No comments:

Post a Comment