Continued unemployment claims (based on seasonally-adjusted data) are continuing to decline, as the latest data through mid-December 2020 shows, yet, even with these news, the latest data print puts continued claims for unemployment at the levels comparable with late 2009.

So here is the chart showing overall levels of continued unemployment claims in the U.S.:

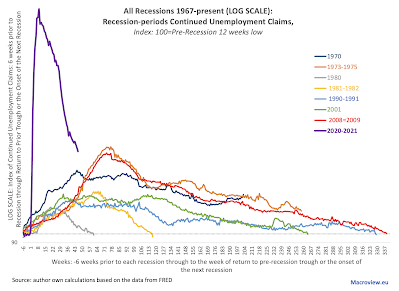

And here is one of my "Scariest Charts", showing index of continued unemployment claims across all modern recessions:

Given current rates of continued unemployment claims declines,

- Over the last 4 weeks, average weekly decrease in continued unemployment claims stood at 77,000

- Current levels are 3,570,000 higher than pre-Covid low.

- Which means that it would take roughly 46 weeks at the current 4-weeks average rate of decrease to eliminate surplus unemployment generated by the Covid19 pandemic. Which is pretty much the same distance to point of regaining pre-Covid19 levels of unemployment claims as well.

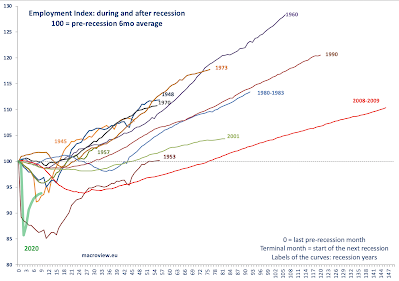

Meanwhile, some bad news from the most recent data on new unemployment claims:

In December 2020, new unemployment claims rose, not fallen, on 4 months cumulative basis due to a large increase in non-seasonally adjusted new claims in the first week of the month. How bad are things? Most recent data point ranks 33rd highest new unemployment claims weekly count in the entire history of the series (since July 1967). However, excluding other weeks of Covid19 pandemic, or, put differently, contextualizing current levels to pre-Covid19 history, the latest levels of new unemployment claims would have ranked as 5th highest in history.