This is an unedited version of my

Sunday Times article from March 23, 2014

Russian-Ukrainian writer, Nikolai Gogol, once quipped that "The longer and more carefully we look at a funny story, the sadder it becomes." Unfortunately, the converse does not hold. As the current Euro area and Irish economic misfortunes aptly illustrate, five and a half years of facing the crisis does little to improve one’s spirits or the prospects for change for the better.

At a recent international conference, framed by the Swiss Alps, the discussion about Europe's immediate future has been focused not on geopolitical risks or deep reforms of common governance and institutions, but on structural growth collapse in the euro area. Practically everyone - from Swedes to Italians, from Americans to Albanians - are concerned with a prospect of the common currency area heading into a deflationary spiral. The core fear is of a Japanese-styled monetary policy trap: zero interest rates, zero credit creation, and zero growth in consumption and investment. Even Germans are feeling the pressure and some senior advisers are now privately admitting the need for the ECB to develop unorthodox measures to increase private consumption and domestic investment. The ECB, predictably, remains defensively inactive, for the moment.

The Irish Government spent the last twelve months proclaiming to the world that our economy is outperforming the euro area in growth and other economic recovery indicators. To the chagrin of our political leaders, Ireland is also caught in this growth crisis. And it is threatening both, sustainability of our public finances and feasibility of many reforms still to be undertaken across the domestic economy.

Last week, the CSO published the quarterly national accounts for 2013. Last year, based on the preliminary figures, Irish economy posted a contraction of 0.34 percent, slightly better than a half-percent drop in euro area output. But for Ireland, getting worse more slowly is hardly a marker of achievement. When you strip out State spending, taxes and subsidies, Irish private sector activity was down by more than 0.48 percent - broadly in line with the euro area’s abysmal performance.

Beyond these headline numbers lay even more worrying trends.

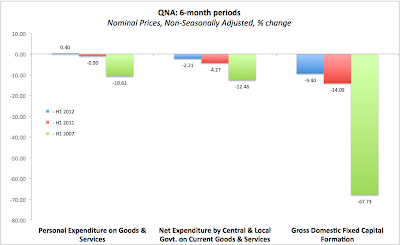

Of all expenditure components of the national accounts, gross fixed capital formation yielded the only positive contribution to our GDP in 2013, rising by EUR 710 million compared to 2012. However, this increase came from an exceptionally low base, with investment flows over 2013 still down 28 percent on those recorded in 2009. Crucially, most, if not all, of the increase in investment over the last year was down to the recovery in Dublin residential and commercial property markets. In 2013, house sales in Dublin rose by more than EUR1.2 billion to around EUR3.6 billion. Commercial property investment activity rose more than three-fold in 2013 compared to previous year, adding some EUR1.24 billion to the investment accounts.

Meanwhile, Q4 2013 balance of payments statistics revealed weakness in more traditional sources of investment in Ireland as non-IFSC FDI fell by roughly one third on 2012 levels, down almost EUR6.3 billion. As the result, total balance on financial account collapsed from a surplus EUR987 million in 2012 to a deficit of EUR10 billion in 2013.

Put simply, stripping out commercial and residential property prices acceleration in Dublin, there is little real investment activity anywhere in the economy. Certainly not enough to get employment and domestic demand off their knees. And this dynamic is very similar to what we are witnessing across the euro area. In 2013, euro area gross fixed capital formation fell, year on year, in three quarters out of four, with Q4 2013 figures barely above Q4 2012 levels, up just 0.1 percent.

At the same time, demand continued to contract in Ireland. In real terms, personal consumption of goods and services was down EUR941 million in 2013 compared to previous year, while net expenditure by central and local government on current goods and services declined EUR135 million. These changes more than offset increases in investment, resulting in the final domestic demand falling EUR366 million year-on-year, almost exactly in line with the changes in GDP.

The retail sales are falling in value and growing in volume - a classic scenario that is consistent with deflation. In 2013, value of retail sales dropped 0.1 percent on 2012, while volume of retail sales rose 0.8 percent. Which suggests that price declines are still working through the tills - a picture not of a recovery but of stagnation at best. Year-on-year, harmonised index of consumer prices rose just 0.5 percent in Ireland in 2013 and in January-February annual inflation was averaging even less, down to 0.2 percent.

The effects of stagnant retail prices are being somewhat mitigated by the strong euro, which pushes down cost of imports. But the said blessing is a shock to the indigenous exporters. With euro at 1.39 to the dollar, 0.84 to pound sterling and 141 to Japanese yen, we are looking at constant pressures from the exchange rates to our overall exports competitiveness.

We all know that goods exports are heading South. In 2013 these were down 3.9 percent, which is a steeper contraction than the one registered in 2012. On the positive side, January data came in with a rise of 4% on January 2013, but much of this uplift was due to extremely poor performance recorded 12 months ago. Trouble is brewing in exports of services as well. In 2012, in real terms, Irish exports of services grew by 6.9 percent. In 2013 that rate declined to 3.9 percent. On the net, our total trade surplus fell by more than 2.7 percent last year.

Such pressures on the externally trading sectors can only be mitigated over the medium term by either continued deflation in prices or cuts to wages. Take your pick: the economy gets crushed by an income shock or it is hit by a spending shock or, more likely, both.

Irony has it some Irish analysts believe that absent the fall-off in the exports of pharmaceuticals (the so-called patent cliff effect), the rest of the economy is performing well. Reality is begging to differ: our decline in GDP is driven by the continued domestic economy's woes present across state spending and capital formation, to business capital expenditure, and households’ consumption and investment.

All of the above supports the proposition that we remain tied to the sickly fortunes of the growth-starved Eurozone. And all of the above suggests that our economic outlook and debt sustainability hopes are not getting any better in the short run.

From the long term fiscal sustainability point of view, even accounting for low cost of borrowing, Ireland needs growth of some 2.25-2.5 percent per annum in real terms to sustain our Government debt levels. These are reflected in the IMF forecasts from the end of 2010 through December 2013. Reducing unemployment and reversing emigration, repairing depleted households' finances and pensions will require even higher growth rates. But, since the official end of the Great Recession in 2010 our average annual rate of growth has been less than 0.66 percent per annum on GDP side and 1.17 percent per annum on GNP side. Over the same period final domestic demand (sum of current spending and investment in the private economy and by the government) has been shrinking, on average, at a rate of 1.47 percent per annum.

This implies that we are currently not on a growth path required to sustain fiscal and economic recoveries. Simple arithmetic based on the IMF analysis of Irish debt sustainability suggests that if 2010-2013 growth rates in nominal GDP prevail over 2014-2015 period, by the end of next year Irish Government debt levels can rise to above 129 percent of our GDP instead of falling to 121.9 percent projected by the IMF back in December last year. Our deficits can also exceed 2.9 percent of GDP penciled in by the Fund, reaching above 3 percent.

More ominously, we are now also subject to the competitiveness pressures arising from the euro valuations and dysfunctional monetary policy mechanics. Having sustained a major shock from the harmonised monetary policies in 1999-2007, Ireland is once again finding itself in the situation where short-term monetary policies in the EU are not suitable for our domestic economy needs.

All of this means that our policymakers should aim to effectively reduce deflationary pressures in the private sectors that are coming from weak domestic demand and the Euro area monetary policies. The only means to achieve this at our disposal include lowering taxes on income and capital gains linked to real investment, as opposed to property speculation. The Government will also need to continue pressuring savings in order to alleviate the problem of the dysfunctional banking sector and to reduce outflows of funds from productive private sector investment to property and Government bonds. Doing away with all tax incentives for investment in property, taxing more aggressively rents and shifting the burden of fiscal deficits off the shoulders of productive entrepreneurs and highly skilled employees should be the priority. Sadly, so far the consensus has been moving toward more populist tax cuts at the lower end of the earnings spectrum – where such cuts are less likely to stimulate growth in productive investment.

We knew this for years now but knowing is not the same thing as doing. Especially when it comes to the reforms that can prove unpopular with the voters.

Box-out:

This week, Daniel Nouy, chairwoman of the European Central Bank's supervisory board, told the European Parliament that she intends to act quickly to force closure of the "zombie" banks - institutions that are unable to issue new credit due to legacy loans problems weighing on their balance sheets. Charged with leading the EU banks' supervision watchdog, Ms Nouy is currently overseeing the ECB's 1000-strong team of analysts carrying out the examination of the banks assets. As a part of the process of the ECB assuming supervision over the eurozone's banking sector, Frankfurt is expected to demand swift resolution, including closure, of the banks that are acting as a drag on the credit supply system. And Ms Nouy made it clear that she expects significant volume of banks closures in the next few years. While Irish banks are issuing new loans, overall they remain stuck in deleveraging mode. According to the latest data, our Pillar banks witnessed total loans to customers shrinking by more than EUR 21 billion (-10.3 percent) in 12 months through the end of September 2013. In a year through January 2014, loans to households across the entire domestic banking sector fell 4.1 percent, while loans to Irish resident non-financial corporations are down 5.8 percent. One can argue about what exactly will constitute a 'zombie' bank by Ms Nouy's definition, but it is hard to find a better group of candidates than Ireland's Three Pillars of Straw.