With Eurostat publishing today preliminary estimates for Euro area GDP for Q3 2012, the Netherlands have moved firmly into the view as the country with substantial pressure on its economy.

Take a look at the core numbers:

- In Q3 2012, the Dutch economy contracted 1.1% q/q - the sharpest quarterly contraction in all fo the EU27

- This contraction follows 0.1% growth in Q2 and Q1 2012 and a contraction of 0.7% in Q4 2011

- In other words, in q/q terms, the Netherlands are now heading for a tripple-dip recession.

- In year on year terms, things are bleaker still: Q4 2011 say annual contraction of 0.4%, which was followed by a 1.0% drop in Q1 2012, 0.4% decline in Q2 2012 and now 1.4% decline in Q3 2012.

The problem the country faces, despite having a AAA-rated government debt and relatively minor issues on the fiscal side, is the debt overhang in the household sector. As charts below show, the Netherlands has the second highest gross debt/GDP ratio in the EU27 and the highest in the euro area. The debt overhang in the household sector is getting worse, not better, during the current crisis.

Gross debt to GDP ratio on households side has the same (directionally, but potentially more severe in magnitude) effect on future growth as the Government debt. Based on the OECD and IMF data:

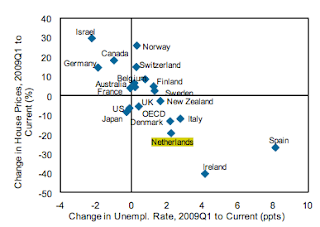

And here are some comparatives from Goldman Sachs Research, highlighting the Netherlands plight:

Note: HP change refers to House Prices change

All of which makes the Netherlands a 'sick man' of Europe and helps explain why the Dutch Government is rightly concerned with the costs of underwriting peripheral economies 'rescue' using its own money...