In the previous post I covered overall dynamics of Irish consumer prices in October. Now, let's take a quick look at comparatives across the euro area. These are reported by the CSO with one month lag, so all we have is September 2012 year on year changes in prices. For comparative reasons, I also put y/y changes in prices for January 2012. The chart below shows the difference between Irish inflation and euro area overall inflation, with positive numbers signifying by how much Irish CPI changes in specific category exceeds euro area overall CPI changes for that category. Negative numbers show by how much euro area CPI changes exceeds Irish CPI changes.

Of notable trends/patterns:

- Irish overall consumer price inflation HICP (2.4% annual in September 2012) was below that for the EA17 (2.6%) and below EU27 (2.7%).

- Ireland also posted lower inflation in September in Food and-alcoholic beverages, clothing and footware, Furnishings, household equipment and maintenance, Health, Recreation and culture, and Restaurants and hotels.

- Ireland posted identical (to EA17) inflation in Alcoholic beverages & tobacco.

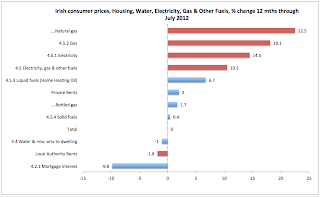

- Ireland's inflation was in excess of that for the EA17 in Housing, water, electricty, gas & other fuels, Transport, Communications, education (by a massive 9.3 percentage points) and Miscellaneous goods & services.

- Higher inflation rates in Ireland have accelerated in September, compared to January in only two categories: Housing, water, electricity, gas and other fuels, and Education.

In annual terms, Ireland is now in inflation territory since August 2010, with the peak rate of 3.11% in April 2011 and the current rate running at 1.20% - a modest inflationary environment, which means that our nominal GNP, were it to post 0% real growth is expanding at the rate closer to 1% nominally - a massive under-shooting of the rate of nominal growth required to deflate our debt pile.