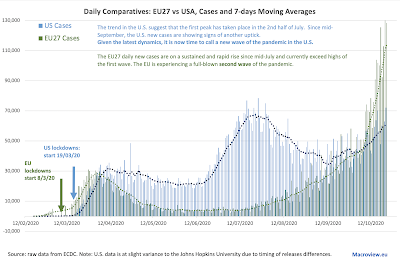

The global pandemic is accelerating, not abating:

New cases numbers have set all-time records in the last two days, and daily counts ranked in top 10 in the last 10 days on eight occasions, with the balance two occasions coming in ranked 13th and 15th, respectively. Despite the rising public complacency and fatigue to the pandemic numbers, globally, we are yet to attain the first peak of the pandemic, suggesting that when this does happen, we are likely to be set for an even worse second wave of infections.

Overall, 7-days average for new infections is at a jaw-dropping 390,097, more than 3 times the historical median and up on the 30-days average of 333,024 cases per day.

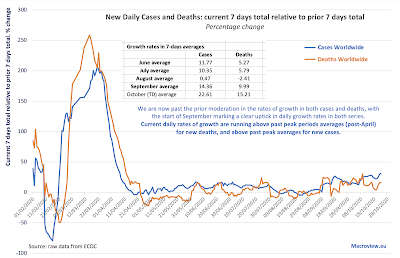

In deaths counts, things are not looking great either.

Globally, new daily deaths counts peaked back in April 2020. This peak was generated by severe lags in reporting past deaths and changes in methodologies for reporting deaths, primarily in Europe, as the world developed statistical tools for tracking deaths and accounting for them. Since then, the more accurate peak took place around the first half of August.

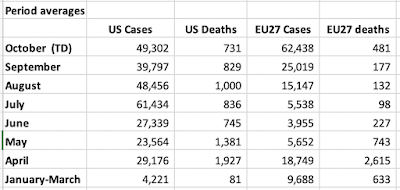

In the months since August local peak, we have seen virtually no meaningful moderation in deaths counts. Current 7 days average of new daily deaths is 5,616 per day, slightly up on the 30 days average of 5,573 - a rather discouraging sign, given rapid improvements in treatments availability and a marked shift of the infections toward younger cohorts of population. Mortality rates per confirmed case are more subdued today, of course, but this is hardly a reflection on any changes in the underlying severity of the diseases, and more likely reflects improved and earlier detections and improved quality of interventions. Interestingly, the new evidence from the second wave sweeping across Europe suggests longer lags between new cases detections and increase in hospitalisations. Despite this lag, however, it now appears that hospitalisations are once again on a rise in the EU27.

Growth rates in new cases and deaths are alarming:

Both, growth rates in new cases and in daily reported deaths are now significantly in excess of anything observed since the flattening out of the growth curve starting with mid-May. October rates of deaths and cases are substantially ahead of September rates, indicating that the pandemic is accelerating, not abating.