Updating data for BRIICS for Covid19 pandemic through Week 17 of 2021 (current week):

Sunday, May 9, 2021

9/5/21: COVID19: BRIICS

9/5/21: COVID19: Europe and EU27

Updating graphs for Europe and EU27 pandemic data through week 17 of 2021:

- New cases are off their Wave 3 highs, solidly so

- Current case counts are still above Wave 2 trough and well ahead of where they were at the end of Summer 2020.

While the progress on vaccinations across Europe has been less impressive than desired, it now appears that two factors are driving the end of the Wave 3 of this pandemic:

- Vaccinations roll-outs, and

- Cumulated effects of recent (and in some countries still ongoing) restrictions.

Saturday, May 8, 2021

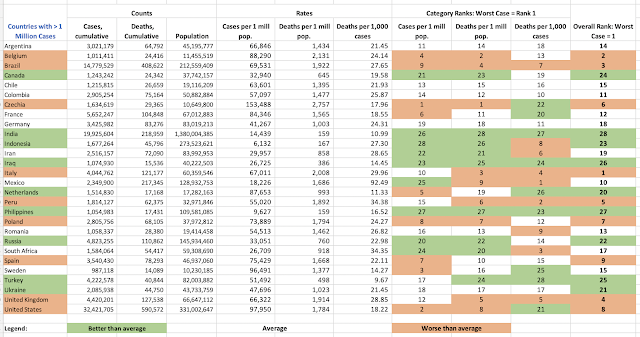

8/5/21: COVID19: Most impacted countries

Covering data through this week (week 17) of 2021 for world's most impacted countries.

First: most impacted countries by the rate of infections and by mortality:

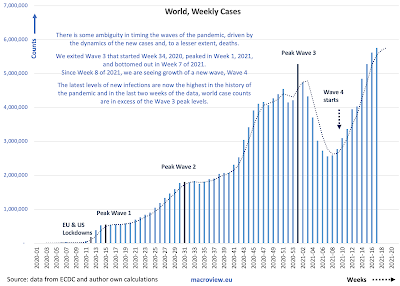

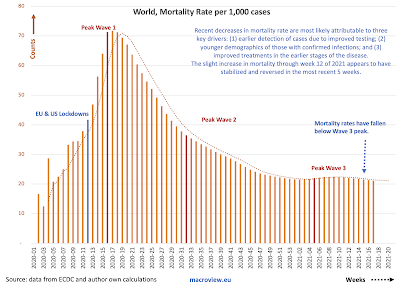

8/5/21: COVID19: Worldwide Data

Updating worldwide data for the Covid19 pandemic through week 17 of 2021 (current week):

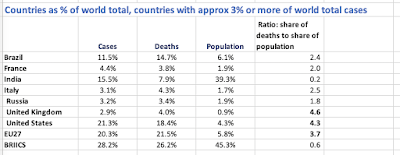

Summary table above shows significant improvement in the pandemic dynamics in the U.S. and more modest, but still sizable improvements in the EU27. BRIICS and Asia are showing worsening pandemic dynamics, and worldwide data broadly reflects this development.

While U.S. and EU27 numbers are encouraging, overall picture of the pandemic remains extremely worrying: worldwide, contagion is still raging unabated and those countries showing strong improvements in vaccinations and reducing contagion spread remain vulnerable to spillovers of new variants and new infections from the rest of the world.

Friday, May 7, 2021

6/5/21: 75 Top Economics Influencers to Follow 2020-2021

With some delay of a few months (tells you the range of my attention span, right?) - delighted to spot this list of 75 Top Economics Influencers to Follow via Focus Economics: https://www.focus-economics.com/blog/top-economics-influencers-to-follow for 2020-2021.

Thanks, Focus Economics team!

Monday, May 3, 2021

3/5/21: Margin Debt: Things are FOMOing up...

Debt, debt and more FOMO...

Source: topdowncharts.com and my annotations

Ratio of leveraged longs to shorts is at around 3.5, which is 2014-2019 average of around 2.2. Bad news (common signal of upcoming correction or sell-off). Basically, we are witnessing a FOMO-fueled chase of every-rising hype and risk appetite. Meanwhile, margin debt is up 70% y/y in March 2021, although from low base back in March 2020, now back to levels of growth comparable only to pre-dot.com crash in 1999-2000. Adjusting for market cap - some say this is advisable, though I can't see why moderating one boom-craze indicator with another boom-craze indicator is any better - things are more moderate.

My read-out: we are seeing margin debt acceleration that is now outpacing the S&P500 acceleration, even with all the rosy earnings projections being factored in. This isn't 'fundamentals'. It is behavioral. And as such, it is a dry powder keg sitting right next to a campfire.

Tuesday, April 27, 2021

26/4/21: What Low Corporate Insolvencies Figures Aren't Telling Us

One of the key features of the Covid19 pandemic to-date has been a relatively low level of corporate insolvencies. In fact, if anything, we are witnessing virtually dissipation of the insolvencies proceedings in the advanced economies, and a simultaneous investment boom in the IPOs markets.

The problem, of course, is that official statistics - in this case - lie. And they lie to the tune of at least 50 percent. Consider two charts:

And

The chart from the IMF is pretty scary. 18 percent of companies are expected to experience liquidity-related financial distress and 16 percent are expected to experience insolvency risk. The data covers Europe and Asia-Pacific. Which omits a wide range of economies, including those with more heavily leveraged corporate sectors, and cheaper insolvency procedures e.g. the U.S. The estimates also assume that companies that run into financial distress in 2020 will exit the markets in 2020-2021. In other words, the 16 percentage insolvency risk estimate is not covering firms that run into liquidity problems in 2021. Presumably, they will go to the wall in 2022.

The second chart puts into perspective the IPO investment boom. Vast majority of IPOs in 2020-2021 have been SPACs (aka, vehicles for swapping ownership of prior investments, as opposed to generating new investments). The remainder of IPOs include DPOs (Direct Public Offerings, e.g. Coinbase) which (1) do not raise any new investment capital and (2) swap founders and insiders equity out and retail investors' equity in.

The data above isn't giving me a lot of hope, to be honest of a genuine investment boom.

We are living through the period of fully financialized economy: the U.S. government monetary and fiscal injections in 2020 totaled some $12.3 trillion. That is more than 1/2 of the entire annual GDP. Since then, we've added another $2.2 trillion. Much of these money went either directly (monetary policy) or indirectly (Robinhooders' effect) into the Wall Street and the Crypto Alley. In other words, little of it went to sustain real investment in productive capital. Fewer dollars went to sustain skills upgrading or new development. Less still went to support basic or fundamental research.

In this environment, it is hard to see how global recovery can support higher productivity growth to bring us back to pre-pandemic growth path. What the recovery will support is and accelerated transfer of wealth:

- From lower income households that saved - so far - their stimulus cash, and are now eager to throw it at pandemic-deferred consumption;

- To Wall Street (via corporate earnings and inflation) and the State (via inflation-linked taxes).

Monday, April 26, 2021

25/4/21: Impact of foreign shareholders on the performance of the Chinese banks

A new paper (pre-print version): Gurdgiev, Constantin, and Jiagi, Li, The Journey of a thousand miles: a decade of impact of foreign shareholders on the performance of the Chinese commercial banks (April 25, 2021). Handbook of Banking and Finance in Emerging Markets, eds. D. K. Nguyen, Edward Elgar Publishing, August 2021, forthcoming., Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3834020.

Abstract:

We analyze the impact of foreign shareholdings on the performance of 28 Chinese commercial banks over a period of 2010-2019, capturing the period prior to and following the reforms of 2014. Using panel data GMM with instrumental variables, we consider bank performance from three perspectives: profitability, quality of assets and liquidity. The individual performance indicators are return on equity (ROE), non-performing loan (NPL) ratio, loan-to-deposit ratio, and loan loss coverage ratio. We find that foreign shareholdings have a significant negative impact on ROE. Increase in foreign investment is coincident with growth in the size of Chinese commercial banks in terms of assets that is faster than the increases in the banks’ return on capital. These findings are intuitively justified: if foreign investors increase banks’ appetite for growth, growth in assets under management will tend to outpace growth in returns on assets in the earlier stages of new investments. From the quality perspective, we show that banks’ NPL ratio is negatively correlated with foreign shareholdings and the correlation is significant both statistically and empirically. NPL ratios fall in the banks with more foreign participation. This result stands contrasted by the fact that some foreign investors (activist and hedge funds), seek to invest in Chinese listed banks with higher NPLs. In terms of liquidity performance, foreign share ownership has a significant negative influence on banks’ loan-to-deposit ratio. Loan loss coverage ratio significantly increases, along with the increasing foreign participation in Chinese commercial banks shareholdings. Combined, these effects suggest significant positive twin effect of foreign shareholdings on Chinese commercial banks risk profiles. As the result, Chinese banks with higher foreign shareholdings are better prepared to sustain losses from bad loans and state risks and have lower risk exposures to bad loans. The combined effects of our findings strongly suggest that Chinese banks’ ROE can be expected to pick up in the near future with further financial opening in the sector and the greater involvement of foreign investors that comes along with it.

25/4/21: Impact Finance perspective of the systemic threats to blockchain applications

New paper (pre-print version):

Gurdgiev, Constantin and Fleming, Adam, Informational efficiency and cybersecurity threats: A Social Impact Finance perspective of the systemic threats to blockchain applications (April 25, 2021). Forthcoming, Chapter 12 in Innovations in Social Finance: Transitioning Beyond Economic Value, eds. Thomas Walker, Jane McGaughey, Sherif Goubran, and Nadra Wagdy, Palgrave Macmillan, 2021, Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3834032.

Abstract:

Crypto-assets and blockchain technologies hold the promise of providing more secure systems for managing public and private data, enhancing public trust in data collection, and increasing the efficiency of social impact finance transactions. However, to-date, blockchain technologies have struggled to deliver on these promises. Specifically, cybersecurity threats to blockchain technologies are accelerating and becoming more impactful over time, generating growing risk to the use of the blockchain technologies in social impact finance services provision. Our analysis data on cybersecurity breaches involving cryptocurrencies trading platforms from 2014 through 2019 shows that cryptocurrencies markets have, to-date, failed to develop informational efficiencies necessary to sustain these technologies’ deployment in impact finance. Faced with increasing cybersecurity threats permissionless blockchain systems appear to be more vulnerable to shocks, than they were in the past. Cyber breaches in the cryptocurrency markets create major risk contagion pathways, which are dramatically increasing volatility of both directly attacked currencies and other major cryptocurrencies; as well as present an increased risk of system-wide attacks that threaten not only the accounting and transactional accuracy and efficiency of the crypto-based fintech solutions, but also the data stored using public blockchain protocols. These findings lead us to conclude that, absent dramatic improvements in the regulation of cryptocurrencies and exchanges, public blockchains based on traded crypto-assets are not suitable for large scale deployment in social impact finance applications.

Friday, April 23, 2021

23/4/21: There are no 'social' winners amidst this pandemic

No one is left unscarred by the #covid19 pandemic when it comes to public approval trends for the major social stakeholders in Ireland:

Source: Core Research.Broadly-speaking, the above is expected, although Core Research report contains one glaring omission: it does not survey public attitudes to media/press. Worse, the three improving stakeholder groups are also the three least impacted: own employer, citizens and large companies. Meanwhile, approval of the government is still nosediving.

Covid pandemic is certainly testing Irish (and other countries') key institutional frameworks. The fallout from these tests is going to be long-lasting and deep. We went into the pandemic with huge deficits of trust in key institutions of our societies. And we are becoming more polarized and less enthusiastic in our support for these institutions since then.

Thursday, April 22, 2021

22/4/21: Pew Research on Public Support for Economic Reforms in the US, UK, France and Germany

Here's an interesting insight from Pew Research surveys:

Set aside France results. Look at the U.S. and UK: 50-51 percent of the countries' population feel the existent economic system needs major changes or "complete" reform.

There are other insights from the data accessible here: https://www.pewresearch.org/global/2021/04/22/many-in-western-europe-and-u-s-want-economic-changes-as-pandemic-continues/ .