Latest consumer price indices are out for Ireland. Headline number for annual comparatives is moderate inflation at 2.0% in HICP metric and 1.6% on CPI metric. M/m we have deflation.

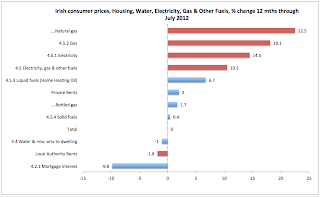

Alas, the headlines do not tell the whole story. Much is revealed in the following three charts which, in summary, show that most of inflation, including double-digit rampant inflation, is concentrated in state-controlled or state-set prices (marked in red).

You can see that even when it comes to energy, state-controlled prices (e.g. electricity and natural gas) are ahead of inflation driven by virtually identical underlying oil and gas prices (other hydrocarbons-linked fuels).

The above, of course is consistent with the State policies that have prioritized extraction of rents from the private economy in order to close fiscal gap. The State is doing this even though Irish Government is aware that we face a deleveraging crisis among our households and companies. In other words, prioritization of the policy is clear - skin consumers to save the Exchequer and to hell with households barely capable of making ends meet.

Don't think that this is not a prescription for an economic disaster. Killing off private economy to sustain public sector's lack of real reforms as well as to sustain exceptionally costly measures to underwrite Irish financial sector meltdown is not a good thing to do. But, hey, 'international investors' seem to approve.

Alas, the headlines do not tell the whole story. Much is revealed in the following three charts which, in summary, show that most of inflation, including double-digit rampant inflation, is concentrated in state-controlled or state-set prices (marked in red).

You can see that even when it comes to energy, state-controlled prices (e.g. electricity and natural gas) are ahead of inflation driven by virtually identical underlying oil and gas prices (other hydrocarbons-linked fuels).

The above, of course is consistent with the State policies that have prioritized extraction of rents from the private economy in order to close fiscal gap. The State is doing this even though Irish Government is aware that we face a deleveraging crisis among our households and companies. In other words, prioritization of the policy is clear - skin consumers to save the Exchequer and to hell with households barely capable of making ends meet.

Don't think that this is not a prescription for an economic disaster. Killing off private economy to sustain public sector's lack of real reforms as well as to sustain exceptionally costly measures to underwrite Irish financial sector meltdown is not a good thing to do. But, hey, 'international investors' seem to approve.

4 comments:

Depressingly true Constantin! Well done for exposing the vampire states that exists only to suck its citizens dry rather than take the hard road of real reform in its spending policies. Jim

This is indeed a prescription for disaster and it is the reason why this country is already three quarters down the road to an economic disaster of immense proportions. A journey begun in 2009, accelerated in 2010 with the criminal Croke Park agreement which logically culminated in having to take Bailout No. 1 with another bailout or bailout extension to come, if the Euro holds together long enough. I believe their is now a silent run on banks throughout the EZ as the wholesale funders of these institutions try to get their capital to the least worst effected safe haven.

The game being played by government and unions is positively tawdry and incomprehensible in terms of a nation state seeking it's long term survival. In the end they will implode the economy in on itself.

But what's the alternative? I voted Labour all my life, until the last election when I voted Fine Gael 1 and 2. I work in the private sector, the sharp end in IT Sales and my immediate peer group mostly work in the public sector in the state labs, the civil service, education, etc.

People simply would not believe what I know goes on from talking to my friends. All this at a time when I'm studying technical exams at night, just to make myself more marketable in case things go really pear shaped and at a time when we're being asked to deliver more and more for literally 20/30% less in our incomes.

But if all the major parties are committed to an easy life and Croke Park, then we're do we go?

I'm similar to the above poster. I always voted Joe Higgin's/ Greens but in the last electection I would've most likely voted FG if my submission to the electoral register had been processed in time.

We seem to have the worst possible coalition, FG won't raise taxes and Labour won't reduce wages.

Sean

Post a Comment