On rare occasions does one come across an essay so brilliantly argued and provocative in its depth. A must-read: Nucleating the False Vacuum of the European Union

Monday, March 25, 2013

25/3/2013: The False Vacuum of the EU: a must-read essay

On rare occasions does one come across an essay so brilliantly argued and provocative in its depth. A must-read: Nucleating the False Vacuum of the European Union

25/3/2013: Bankrupted Cyprus, aka 'The Rescue'

While European 'leaders' celebrate the breakthrough 'bailout' agreement with Cyprus, let's get back to Planet Reality, folks. The 'deal' is based on a EUR10bn loan to the Cypriot Government for which the taxpayers will be on the hook.

EUR10bn = 56.2% of the country 2013 forecast GDP.

And now, let's begin counting the proverbial chickens:

- IMF forecast for GDP - used above - is based on nominal GDP growth over the fiscal year 2013 of 0.33%. Even by IMF 'rosy' standards this is way off the mark, as other (EU Commission and Cypriot own) forecasts envisioned GDP contracting between 0.5% and 1.3% in 2013.

- IMF forecast is based on pre-bailout assumptions with the banking sector returns to the economy being at the levels consistent with full functioning of the Cypriot financial services sector.

- Even outside the above points, IMF forecast through 2017 saw Government debt/GDP ratio in Cyprus rising to 106.11%, prior to the current 'deal' on foot of forecast GDP growth of 2.87% per annum on average between 2013 and 2017.

Now, with the deal:

- Shrinkage of the financial services sector will be immediate and deep;

- Deficit financing of any capital investment by the Cypriot Government will cease;

- New debt is going to be loaded onto the country;

- Reduced savings and exits by larger depositors will mean reduced revenues for the economy, etc

Much of this was outlined in my previous post on debt sustainability in Cyprus (http://trueeconomics.blogspot.ie/2013/03/2432013-are-cypriot-debt-dynamics-worse.html)

Now, let's do simple exercise. Add EUR10bn to Cypriot debt pile and get scenario of Cyprus (post-crisis with no growth effects).

Then, adjust GDP growth from 2013 through 2017 to yield average rate of economic growth of -0.18% annually (note, this is much more benign than Greek forecasts for the first 5 years of the crisis which are equal to -2.94% annually on average). This yields scenario of Cyprus (post-crisis with growth effects).

The above two scenarios are compared in the chart below against Greek forecasts by the IMF and the pre-'bailout' forecast by the IMF for Cyprus:

This is what the EU leadership is currently celebrating - a wholesale, outright bankrupting of the entire country. Well done, lads!

Sunday, March 24, 2013

24/3/2013: Few Cypriot Myths & Few Billions in Losses

Ever wondered why would the IMF (and reportedly the EU Commission) reject the proposed (Plan B) Cypriot Government raid on state pensions funds? Oh... ok... IMF review from November 2011:

Naughty, naughty little Cyprus...

And the very same IMF note also sheds some light on those 'oligarchs' deposits that are so vast, the entire EU is apparently chocking on chicken breasts at Herman von Frompuy's dinners:

"First, non-resident deposits (NRD) in Cypriot banks (excluding deposits raised abroad by foreign affiliates) are €23 billion (125 percent of GDP), most of which are short-term at low interest rates [note: ECB official data does not exclude foreign affiliates deposits, which are normally out of touch in levy imposition. Also note: much of bulls**t about Russian oligarchs deposits was about high interest rates allegedly collected by them on Cyprus deposits. Guess that wasn't really the case as chart below confirms: deposit rates decline sharply by nationality grouping for both corporates and individuals... so who was exactly earning 'high returns' on Cypriot deposits? oh, well... Cypriots...].

"This risk is partly mitigated by the 70 percent liquid asset requirement against the €12 billion in NRD in foreign currency), and the 20 percent requirement for the €11 billion in euro-denominated NRD). [Wow, so apparently 'oligarchs' deposits carry massive safety cushions, whilst 'ordinary' depositors are not...]

"Second, €17 billion in deposits collected in the Greek branches of the three largest Cypriot-owned banks could be subject to outflows in response to difficult conditions in Greece. Outflows in the first half of 2011 were close to €3 billion (nearly 15 percent of the total), although a portion of these returned to the Cypriot parents as NRD. [Now, there was more of Greek money than 'oligarchs'?]

Now, couple more revealing charts:

Clearly, structuring PSI the EU authorities & IMF knew the above factoid, right? Just as they knew the following (which clearly highlights the fact that any substantial hit on Cypriot banks would have immediately spelled insolvency of the entire economy):

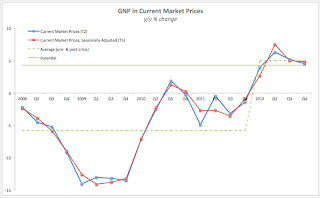

24/3/2013: Irish GDP & GNP Growth 2007-2012

Five charts summarising Irish GDP and GNP dynamics in 2007-2012 period. The first set is of 4 charts plotting various measures of GDP and GNP in constant and current prices in terms of year-on-year changes:

In all of the above, I show two 'trend' figures: the 2% annual real growth trend as a long-term sustainability level of growth and the within-crisis (period of contracting GDP or GNP) and out-of-crisis (period of sustained positive growth) averages. These two sets of lines provide a marker for assessing as to whether or not the economy is currently running at the growth rates above or below trend.

And to summarise the state of play today:

Thus, after almost two years of 'turned corners' and 'recoveries'

- Ireland's GDP and GNP are still massively below the pre-crisis levels of 2007.

- Ireland's GDP growth in constant and current prices is running below trend levels in Q3 and Q4 2012

- Ireland's GDP growth shorter-term trend (post-crisis) is below the long-term trend levels, which is simply not consistent with normal U-shaped recovery

- Ireland's GNP growth is running at above trend levels for 3 quarters now in constant prices terms, and close to the trend levels for current prices terms

- By all measures (across current and constant prices) both GDP and GNP are posting markedly slower rates of growth in Q4 2012 compared to previous quarters.

24/3/2013: Are Cypriot Debt Dynamics Worse than Greek?

A nice chart via Pictet (link) on the size of the banking sector in Cyprus and its dynamics since 2006:

Now, do notice, reducing the above to 300-330% of GDP as required by the Troika in Plan A (and so far not disputed by the Cypriot Government) will imply lowering liabilities by EUR66.6 billion. Overall, banking margins in Cyprus are running at around 1.2% net of funding costs, we can roughly raise that to double to include wages and other costs spillovers, which implies that EUR66.6bn deleveraging of liabilities should take out of the Cypriot GDP somewhere around EUR1.5bn annually or 9% of GDP. Auxilliary services, e.g. legal, accounting and associated expatriate community benefits that arise in relation to international banking services being offered from Cyprus will also have to be scaled back. Assuming that these account for 50% of the margin returns to the economy, overall hit on Cypriot economy from deleveraging can be closer to EUR2.2bn annually or 12.7% of GDP.

Now, consider the loans package of EUR10 billion that Cyprus is set to receive if it manages to close the EUR5.8 billion gap. Absent banking sector deleveraging, this will push Cypriot Government debt/GDP ratio to over 140% of GDP. However, with reduction in GDP, the debt/GDP ratio (assuming to avoid timing considerations assumptions a one-off hit to GDP) will rise to 161%.

Now, recall that IMF and Troika 'sustainability' bound for debt/GDP ratio used to be 120%. We are now clearly beyond that absolutely abstract number even without the banking sector deleveraging. And let's take the path of debt/GDP ratio forecast by the IMF which would have seen - absent the 'rescue' package - debt/GDP ratio in Cyprus rising 106.1% of GDP by 2017. With the 'rescue' package and banking sector deleveraging, this can now be expected to rise to 174% of GDP in 2017 against Greek debt of 153% of GDP.

In short, the EU 'rescue' is going to simply wipe Cyprus off the map in economic terms. All debt 'sustainability' consideration are now out of the window.

Here's the chart:

Of course, the above analysis is crude as it ignores:

- Potential positive effects of replacement activity and the fabled 'gas revenues' etc - which presumably were already reflected in GDP growth figures in the IMF forecasts

- Potential negative effects of tourism, real estate sales and other services declines due to the reduced activity in the banking sector, which can raise the above adverse impact of the banking sector deleveraging to 15% of GDP. Corporation tax increases can yield further losses.

- Timing issues for the deleveraging which is not expected to happen overnight.

Nonetheless, all in, there have to be some severe doubts as to viability of the Cypriot debt path under the Troika Plan A, let alone under the Cypriot Plan B.

Saturday, March 23, 2013

23/3/2013: And the Strong Are Yet to Become Strong: German Debt Sustainability

A very interesting paper by Burret, Heiko T, Feld, Lars P. and Koehler, Ekkehard A., titled "Sustainability of German Fiscal Policy and Public Debt: Historical and Time Series Evidence for the Period 1850-2010" (February 28, 2013). CESifo Working Paper Series No. 4135. Available at SSRN: http://ssrn.com/abstract=2228623

Here's from the abstract:

"In the last decades, the majority of OECD countries has experienced a continuous increase in public debt. The European debt crisis has prompted a fundamental re‐evaluation of public debt sustainability and the looming threat of sovereign debt default. Due to a multitude of large scale events in its past, Germany is far from being an exception: In fact, Germany’s peacetime debt‐to‐GDP (Gross Domestic Product) ratio has never been higher."

And a chart:

[Click on the chart to enlarge]

On methodology: "In this paper, we analyse the sustainability of Germany’s public finances against the standard theoretical back‐ground using a unique database, retrieved from multiple sources covering the period from 1850 to 2010. Multiple currency crises and external events offer anecdotal evidence, contradicting the historical perception of Germany as the poster child of European public finance. Given these corresponding breaks in time series, the empirical analysis is conducted for the sub‐periods 1872‐1913 and 1950‐2010. In addition to an anecdotal historical analysis, we conduct formal tests on fiscal sustainability, including tests on stationarity and cointegration and the estimation of Vector Autoregression (VAR) and Vector Error Correction Models (VECM)."

And the punchline: "While we cannot reject the hypothesis that fiscal policy was sustainable in the period before the First World War, the tests allow for a rejection of the hypothesis of fiscal sustainability for the period from 1950 to 2010. This evidence leads to the conclusion that Germany’s public debt is in dire need of consolidation. Albeit a much needed reform, the incompleteness of the German debt brake will have to be addressed in the coming years, in order to ensure that fiscal consolidation actually takes place"

[Skip below to see the more extensive summary of conclusions]

And the recent experience? Here are the economic fundamentals pertaining to the cost of capital and growth:

A descriptive table of stats summarising the overall performance:

And public expenditure levels (alongside revenue and balances)

So the results after skipping through loads of rigorous tests are:

"After the experience of the two World Wars, the German population is quickly alarmed when debt levels appear to be rising to unsustainable levels. This holds particularly for recent years, as Germany’s debt‐to‐GDP ratio has never been higher in peacetime than today...

In this paper, we analyse sustainability of German public finances from 1872 to 2010. Given the breaks in the data series, in particular those induced by the two World Wars, the main analysis is conducted for the sub‐periods 1872‐1913 and 1950‐2010. …While we cannot reject the hypothesis that fiscal policy was sustainable in the period before the First World War, this only holds if we do not allow for trends in the cointegration relation. The hypothesis of fiscal sustainability for the years 1950 to 2010, on the other hand, must be rejected. After the Second World War, German public finances have become unsustainable.

This evidence leads to the conclusion that public finances in Germany are in dire need of consolidation. In fact, the introduction of the debt brake in the year 2009 is a much needed reaction to this development. Although such fiscal rules always have their loopholes and are necessarily incomplete, they usually have some success in restricting public deficits and debt (Feld and Kirchgässner 2008, Feld and Baskaran 2010). The incompleteness of the German debt brake will have to be addressed in the coming years in order to ensure that fiscal consolidation actually takes place. One shortcoming of the new debt rule requires wider ranging reform, however: The Länder (including their local jurisdic‐tions) not only have huge consolidation requirements, they also do not have the tax autonomy to balance the spending demands on their budgets. The next major reform of the German fiscal constitution should thus allow for more tax autonomy at the sub‐federal level."

23/3/2013: IMF 9th Review of Ireland's Programme

IMF Completed 9th Review with Ireland:

"Ireland’s strong policy implementation has continued and positive signs are emerging. Real GDP growth was 0.9 percent in 2012, and employment rose slightly over the year, although unemployment remains high at 14.2 percent. Further deepening its market access, Ireland issued €5 billion of 10 year bonds at 4.15 percent in March."

"The 2012 fiscal deficit of 7¾ percent of GDP was well within the 8.6 percent target. In 2013, the fiscal deficit is projected at 6¾ percent of GDP, moving toward the target of below 3 percent by 2015. Public debt is expected to peak at 122½ percent of GDP this year and decline in later years provided growth picks up from the 1 percent rate projected in 2013."

"Financial sector reforms have continued to advance, but banks remain weighed down by nonperforming loans at about 25 percent of total loans." Per Mr. David Lipton, First Deputy Managing Director and Acting Chair:

"…problem loans remain high and accelerating their resolution is a key to economic recovery. The recent establishment of mortgage loan restructuring targets for banks is therefore welcome, and it will be supported by reforms announced by authorities that facilitate constructive engagement between banks and borrowers, promote the efficiency of repossession procedures as a last resort, provide banks with the right incentives through provisioning rules, and by sound implementation of the personal insolvency reform. Progress with resolution efforts for SME loans is also a priority.

“Building on the strong budget outturn for 2012, sound budget execution remains critical in 2013, including continued vigilance on health spending and a successful introduction of the property tax...

“Prospects for Ireland’s exit from official support have improved, yet continued strong policy implementation remains paramount given risks to medium-term growth and debt sustainability. Timely and forceful delivery on European pledges to improve program sustainability, especially by breaking the vicious circle between the banks and the Irish sovereign, would go a long way toward Ireland’s durable exit from drawing on official support.”

Friday, March 22, 2013

22/3/2013: National Accounts 2012: Ireland - Part 4

The first post of the series covering 2012 National Accounts looked at the headline numbers for real GDP growth. The second post covered sectoral weights in GNP and our GDP/GNP gap. In the third post I explored the opportunity cost of the crisis and the effect the realignment of economic activities in Ireland is having on fiscal position.

Quarterly GDP/GNP gap posted second consecutive easing, moving away from mean reversion, suggesting the MNCs are building up capex reserves - once these are to be deployed, prepare for the gap to shift down to 20-22% territory and GNP shrinking by up to EUR2.6bn in any given quarter of reversion relative to Q4 2012. Were mean reversion to bite in Q4 2012, we would have had GNP down y/y and q/q and ditto for H2 down y/y.

Now, let's focus on the quarterly series.

The headline for quarterly national accounts should be reading: Ireland is back in a recession for the fourth dip…

- Q/Q Irish GDP fell, in real terms, 1.5% in Q4 2012, which followed a 1.9% q/q contraction in Q3 2012, marking two consecutive q/q contractions.

- Y/Y Irish GDP was flat - exactly flat - on Q4 2011 but in Q3 2012 it was up 0.9%.

Meanwhile,

- GNP was up 0.67% q/q in Q4 2012 after posting a contraction of 1.75% in Q3 2012 in q/q terms.

- Y/Y GNP was up 3.04% in Q4 2012 after posting a y/y gain of 3.9% in Q3 2012

- In H2 2012, GDP rose 0.4 y/y and shrunk 1.4% on H1 2012, while GNP rose 3.5% y/y and was up 1.89% on H1 2012.

Volatility is the name of the game for our national accounts, folks.

You can see components of GDP dynamics here.

Quarterly GDP/GNP gap posted second consecutive easing, moving away from mean reversion, suggesting the MNCs are building up capex reserves - once these are to be deployed, prepare for the gap to shift down to 20-22% territory and GNP shrinking by up to EUR2.6bn in any given quarter of reversion relative to Q4 2012. Were mean reversion to bite in Q4 2012, we would have had GNP down y/y and q/q and ditto for H2 down y/y.

22/3/2013: Sunday Times, 17/03/2013

This is an unedited version of my Sunday Times article from March 17.

Economics is an art of contention. In so far as economics body of knowledge is concerned, the world is largely composed of an infinite number of things that are either uncertain, or open to interpretation. One of the very few near-certainties that economists do hold across the ideological and philosophical divisions is that an economy undergoing deleveraging of household debt is likely to experience a lengthy period of below-trend growth. The greater the debt pile to be deleveraged, the faster was the period of debt accumulation, the longer such a recession or stagnation will last.

Another near-certainty is that in a debt crisis, economy is unlikely to recover on foot of either monetary or fiscal stimuli. Monetary easing can help the deleveraging process if and only if low policy rates translate into cheaper mortgages on the ground. This requires a functioning banking system, in addition to monetary policy independence. Fiscal stimulus can only help to the extent to which it can temporarily stimulate growth, and even then the impact on more indebted households is unlikely to be any stronger than on less-indebted ones. Longer-term effects of a significant debt-financed fiscal stimulus in an economy already struggling with government and household debt, are more likely to be detrimental to the overall process of deleveraging. Higher debt today necessary to fund economic stimulus translates into higher burden of that debt in the future.

Meanwhile, deleveraging of the households in and by itself, even absent banking and other crises, is a process associated with dramatically reduced economic activity and growth.

Households struggling with a debt overhang are effectively removed from being active participants in the economy. Indebted households do not save, thus depleting their future pensions provisions and reducing overall levels of investment in the economy. Indebted households tend to cut back their consumption, both in terms of large-ticket durable goods and in terms of everyday items. They also reduce consumption of higher-quality higher-cost goods, adversely impacting domestic producers in higher-cost economies, like Ireland, favoring more competitively priced imports.

With banks beating on their doors, indebted households abstain from entrepreneurship and engage less actively in seeking improved employment opportunities. The latter means that indebted households, fearing even a short-term spell in unemployment, do not seek to better align their skills and talents, as well as future prospects for promotion with jobs offers. This, in turn, implies loss of productivity for the economy at large. The former means slower rate and more risk-averse entrepreneurship resulting in further reduction in future growth potential for the economy.

Last, but not least, household debt overhang results in increased rates of psychological and even psychiatric disorders, incidences of self-harm, suicide, stress and social dislocations. These effects have a direct and adverse impact on public services, the economy and the society at large.

In Irish context, the effects of household debt overhang (most acutely expressed in mortgages arrears) are likely to be significantly larger than in normal debt crises episodes and last longer.

Consider the sheer magnitude of the problem. In an average debt crisis, household debt arrears peak at around 7-10% of the total debt outstanding. Per latest data from the Central of Bank of Ireland, at the end of 2012, 143,851 private residential mortgages accounts and 37,995 buy-to-let accounts were in arrears. Total number of mortgages in arrears represented 19% of all mortgages outstanding. Total balance of mortgages in arrears amounted to EUR35.4 billion, or 25% of the entire mortgages-related debt. Mortgages at risk of default or defaulted (defined as all currently in arrears, relating to properties with repossession orders and mortgages restructured during the crisis, but currently not in arrears) amounted to 238,663 accounts and EUR45.3 billion of the outstanding debt, or 25.3% and 31.9% of the respective totals.

Given expected losses from the above mortgages in the case of repossessions and/or insolvency, and inclusive of the interest costs due on this unproductive debt, over the next 3 years Irish economy is likely to face direct losses from this mortgages crisis to the tune of EUR20 billion. This will reduce our current level of gross fixed capital formation in the economy by 40 percent in every year through 2015.

In indirect costs, the crisis currently is impacting some 650,000-700,000 individuals living in the households with mortgages at risk, as well as countless others either in the negative equity or arrears on unsecured debt (credit cards, credit unions’ loans, utility bills etc). Using basic cost of health insurance coverage, the relationship between health insurance spend in Ireland and cost of public healthcare, and assuming that annual cost of higher stress associated with debt overhang amount to just 10% of the total annual insurance costs, direct health costs alone from the debt crisis can add up to EUR400-500 million per annum. Factoring productivity losses due to stress, the total social, psychological and psychiatric costs of the mortgages arrears can run over a billion.

Costs of foregone entrepreneurship are even harder to quantify, but can be gauged from the overall decline in investment. In 2012 the shortfall in aggregate domestic investment activity compared to 1999-2003 annual average (taking the period before the rapid acceleration in property bubble) was running at ca EUR6.9-7.0 billion. This shortfall is roughly comparable to the above estimated annualized cost of servicing defaulting and at risk mortgages. Gross investment in Ireland is now running at a rate not seen since 1997. Meanwhile, net expenditure by the local and central Government on current goods and services is running above 2005 levels, same as personal consumption of goods and services. This suggests that our current rates of domestic investment and associated entrepreneurship are down more significantly than personal and Government spending.

In some sectors, things are even worse. Construction sector is clearly seeing no turnaround with new residential construction permits down 88% in 2012 on the peak, heading for historical low of estimated full-year 14,022 permits based on data through Q3 2012. Extending mortgage arrears crisis or deepening the households’ already significant debt overhang through the means of forcing them into repaying the unsustainable loans will only exacerbate the crisis in Irish construction sector and in all sectors of domestic economy.

In years to come, the mortgages crisis today is likely to cost Irish economy around 10% of our GNP.

And it is unlikely to ease significantly any time soon, since the above costs exclude the effects of likely acceleration in mortgages defaults in months and years to come due to the adverse policy and economic headwinds.

Firstly, ongoing fiscal consolidation is shifting more burden of paying for our State onto the shoulders of Irish households, including those subsumed by the debt crisis. This process is not going to end with Budget 2014.

Secondly, reform of the personal insolvency regime will add fuel to the fire by giving banks disproportional powers over the households in structuring long-term solutions to the mortgages distress. Changes to the Central Bank code of conduct for the banks in dealing with borrowers, along with the accelerated targets for restructuring non-performing mortgages announced this week are likely to push the banks to more aggressively deal with the borrowers. These factors will amplify the rate of mortgages arrears build up, driving more households into temporary relief measures. These measures will structured by the banks in absence of transparent and efficient consumer protection to suit banks’ objectives of extracting all resources out of households for as long as possible before forcing the households into bankruptcy in the end.

Finally, mortgages arrears will continue to rise on foot of weak economic growth and continued re-orientation of the Irish economy away from domestic activity toward MNCs. This headwind closes the loop from the household debt overhang to depressed domestic investment to higher unemployment and lower domestic growth to an even greater debt overhang.

In order to deal with the mortgages crisis, we need a prescriptive approach to long-term solutions based on principles of borrower protection, standardization and transparency.

All lenders operating in Ireland should be required to publish a full list of solutions offered to the distressed borrowers which complies with the minimum standards set out by the Central Bank and a borrowers’ protection watchdog, such as reformed and independent Mabs. The financial criteria and conditions that qualify borrowers for such solutions should be disclosed. The process of finalizing the details of solutions should involve borrowers supported by an adviser, fully resourced to deal with the lender and independent from the lender and the state.

Only by matching borrower and lender powers and resources in a transparent and strictly supervised manner can we achieve a resolution to this crisis. Until then, this economy will continue operating well below its potential rate of growth, condemning generations of Irish people to debt slavery. The status quo of the state granting ever increasing powers to the banks in dealing with mortgages arrears is not sustainable and is likely to lead to both economic misery, continued emigration, and in the long run to political and social discontent. Sixth year into the mortgages crisis of extremely acute nature, we can not afford another round of half-measures and fake solutions.

Box-out:

This week auction of Irish bonds put to some test the theory of yields divergence with the euro area periphery. Compared to Italian Government bonds auction carried out on the same day, Irish 10 year bonds were greeted by the markets with a cheer. While supportive of the analysts’ consensus view that Ireland is decoupling from the peripheral states, such as Italy, Portugal and Spain, the results of the auction were at least in part driven by factors outside the Irish Government control. This was the first 10 year bond issuance for Ireland in 3 years and the issue came without much of the adverse newsflow surrounding the economy. Complete absence of 10 year bonds in the secondary market prior to the auction assured some of the demand. For Italy, this was the first auction following Fitch downgrade of the sovereign to Baa1 rating – fresh in the memory of the markets. Italian newsflow has also been disappointing recently with elections outcome unnerving the markets and with GDP figures (Italy has reported its 2012 full year growth almost a month ahead of Ireland, which is still to post results for Q4 2012).

Just how much of this week’s result for Ireland can be accounted for by the factors unrelated to the Government policies or real economic performance is impossible to determine. Nonetheless, Minister Noonan’s cheerful references to the auction as ‘extraordinary’ in nature sounds more like a political PR opportunism than of financial realism.

23/3/2013: Sunday Times 10/03/2013

This is an unedited version of my Sunday Times article from March 10.

Some two years ago in these very pages, I have described the prospects for the Irish economy as following a flatline trend with occasional volatility. In other words, back in the beginning of 2010, the economy’s prospects for the near-term future were consistent with an L-shaped recovery: stabilization followed by near-zero growth.

Taking the first three quarters of 2012, in headline terms, the above prediction has translated into 2009 to 2012 GDP growth of just 0.22% per annum, GNP decline of 0.16% per annum and domestic demand drop of 4.81% per annum. Again, let’s take a look at the above numbers from a different angle. Compared to the pre-crisis levels, the latest GDP data shows that over 2011-2012, Irish economy was able to close just 22% of the gap between GDP peak and the Great Recession trough, implying that it will take Ireland through the end of 2014 before we get our GDP back to the half-point of the Great Recession. At the same time, Domestic demand continued to hit crisis period lows in 2012 and all international projections show that 2013 will be another post-2007 low for these data series.

With these rather depressing statistics in mind, one is warranted to take with a grain of salt ever-more frequent and boisterous pronouncements from the Government that Irish economy has ‘turned the corner’. Ditto for the ever-more saccharine messages from the EU policymakers to the ‘best pupil’ in their austerity policies ‘class’.

And the most recent data – through Q4 2012 and January-February 2013 – is offering no signs of any statistically significant improvements in the economy compared to the rather abysmal 2012.

Mortgages arrears were once again up in the last quarter of 2012. While the rate of increases was markedly slower than in previous quarters, number of accounts currently in arrears 21.4% year on year. As of the end of 2012, some 186,785 private residencies-related mortgages are either in arrears, in temporary restructuring or in the process of repossessions – almost 25% of all accounts outstanding if we were to use as the base total accounts numbers comparable across the 2009-2012 horizon. All in, some 650,000-700,000 Irish residents are currently under water when it comes to paying on their original mortgages. Some turnaround in the economy to witness.

Data for January-February 2013 on new cars registrations shows that not only the motor trade is continuing to suffer from on-going collapse in sales, but that there is no indication of any substantial improvement in either the Irish households or the Irish SMEs outlook for the future. New private cars registrations are down 20% year-on-year over the first two months of 2013, while new goods vehicles registrations are down 21.4%. This shows clearly that Irish consumers are not engaged in purchasing large-ticket items and, supported by the declines in durable goods consumption evident in the retail sales data, signals that consumers have little real credence in the ‘green shoots’ theory espoused by our Government officials and business leaders. Lack of demand uplift in goods vehicles, on the other hand, shows that when it comes to capital investment, Irish businesses are also refusing to buy the hype of economic turnaround. In any cyclical recovery, capital expenditure, especially on rapidly depreciating items such as vehicles used in transporting goods for wholesale and retail trade, logistics and transportation services, is one of the leading indicators of improving economic conditions. Data for the first two months of this year shows no such uplift.

Core retail sales, once stripping out motor sales, are showing a slightly more upbeat activity. While all retail business activity has declined on average over 3 months through January 2013 compared to year ago, some encouraging signs of uplift were present in the Department Stores sales, and sales of electrical goods when it comes to volume and value of sales. Nonetheless, two factors continue to characterize Irish domestic consumption: extremely low activity from which any increases might take place, and exceptionally anemic trend in any rises we do record.

On the investment front, gross domestic capital investment remained basically unchanged in the first 3 quarters of 2012 compared to 2011,ann there are currently no signs that this situation has changed since the end of Q3 2012. We are now into the fourth consecutive year of gross investment failing to cover amortisation and depreciation of the capital stock accumulated over the years of the Celtic Tiger. Recalling that our growth success over 1992-1998 was predicated on a rapid catching up in capital stock and quality relative to our, at the time more prosperous European partners, this means that the ongoing crisis is effectively erasing any capital gains achieved post 1999.

In short, domestic side of the economy shows no green shoots of any harvestable variety. And the potential headwinds we are likely to face in the near-term future are still severe.

In property markets and when it comes to mortgages arrears, we face a long list of risks that are yet to play out. Impacts of property taxes introduced in the Budget 2013, the upcoming lifting of the banking guarantees, and the saga of the Personal Insolvency regime reforms all represent distinct threats to the fragile stabilisations achieved in these areas of the economy.

On business investment front risks are also mounting, rather than abating. Continued lack of bank credit and strong indications that in the near term Irish banks are likely to follow their other Euro area counterparts in dramatically hiking the retail interest rates for both existent and new loans.

When it comes to consumers’ appetite for spending, latest consumer confidence data shows significant deterioration in confidence in February, compared to January 2013 and to 2012 average. If anything, when it comes to consumers’ reported outlook for 2013, things are getting worse relative to 2012, rather than better.

Which leaves us with the Government’s old favorite signal of the recovery: Irish exports. The hype about Irish external trade prowess is such, that even a usually somber IMF has recently waded in with a lengthy paper outlining how Ireland is likely to turn back to Celtic Tiger era prosperity on foot of booming exports. In summary, the IMF missive, titled Boosting Competitiveness to Grow Out of Debt – Can Ireland Find a Way Back to Its Future concluded that “Ireland is poised to return to its path of strong growth and low imbalances” on foot of “enhanced competitiveness”.

The idea that ‘exports-led recovery’ is Ireland’s only salvation from the systemic and structural crises we face is not new. Previous Government put as much credence into this proposition as the current one. Alas, this idea – as I have pointed out repeatedly – is simply not reflected in the reality of the Irish economy for a number of reasons.

It is true that Irish exports growth has improved significantly during 2009-2012 period, rising from negative 3.75% in 2009 to a positive 6.25% in 2010 and 5% in 2011. In the first three quarters of 2012, exports of goods and services were up 6.8% on the same period of 2011.

Alas, the composition of our exports has shifted dramatically toward more services exports, as opposed to goods exports. In addition to reducing the overall level of real economic activity and employment associated with every euro worth of exports, this shift also has meant a number of changes that further divorce our external trade activity from economy. Firstly, most of employment creation in the exports-oriented services sectors, such as International Finance and ICT services, is oriented toward specialist, highly educated foreign employees, instead of domestic unemployed or underemployed individuals. Secondly, services exports are associated with greater cost (or imports) intensities as they require higher payments for patents and intellectual property, which are neither taxed in Ireland, nor are developed here. This means that while exports of services generate high revenues, much of these revenues is not captured within our economy. Thirdly, exports of services, as opposed to exports of goods, are more concentrated in a handful of giant MNCs. This fact, known as the ‘Google effect’ drives up the cost of hiring skilled workers for Irish SMEs, reduces margins at Irish enterprises, lowers investment into Irish SMEs, and actually undermines our competitiveness, rather than improving it.

In short, booming exports along the current trend can actually cost this economy its ability to sustain indigenous entrepreneurship and investment in the long run. Instead of supporting growth and recovery, the green shoots of some of our exporting activities can turn out to be super-strong weeds of the economy suffering from a classical Dutch disease where resources flow to an increasingly inefficient use in specialist sectors, exposing the society and the economy at large to future adverse shocks.

Lastly, as with other indicators, the latest data, covering only goods exports, shows that our external trade is suffering from a significant slowdown in global demand and the pharmaceutical sector patent cliff. Once again, I warned about both of these factors more than a year ago.

At the same time, on the more positive note, the ongoing US and global economic recovery should provide some support for goods exports from Ireland, especially in the areas relating to capital investment goods and equipment in months ahead.

In short, the miracle of the ‘exports-led recovery’ is simply nowhere to be seen at this point in time, despite the fact that exporting activity continues to expand and despite the fact that this activity represents the only bright spot on our economic horizon.

After five years of the greatest economic crisis in the modern history of this nation, it is time to ask our political leaders a question: at what point in time does one’s rhetoric of economic turnarounds becomes an unbearable burden to one’s political and social reputation? For the previous Government it took just under 3 years to face the music of its own making. For this Government, the clock is ticking on.

Box-out:

Having achieved a relatively underwhelming progress on restructuring the Promissory Notes of the IBRC, the Government has turned its attention in recent weeks on attempting to restructure our debts to the European sides of the Troika. However, the issue of the Promissory Notes is still an open topic. Last week at a conference in Brussels I had a chance to speak to some senior decision makers from the European Parliament and the EU Commission who unanimously voiced their concern over the potential for the ECB to alter the terms and conditions of the Irish Promissory Notes restructuring deal. ECB has two material powers to do so. Firstly, it can simply alter by a majority decision the technical aspects of the deal. Secondly, the ECB has the ultimate power to determine the overall schedule of the sales of the long-term bonds issued to replace the Promissory Notes to the private investors. This latter power is very significant. Under the current arrangement, the Central Bank of Ireland has committed to an annual schedule of minimum disposals of bonds. Based on this schedule, the cumulative long-term benefit of the deal to Ireland can be estimated in the range of Euro 4.5-6.3 billion over the 40 years horizon. Accelerating the rate of disposals by a third on average over the deal horizon can see the net gains to the Exchequer declining by more than a quarter. Hardly a confidence-inspiring outcome for the Government that put so much hype behind the deal.

22/3/2013: National Accounts 2012: Ireland - Part 3

The first post of the series covering 2012 National Accounts looked at the headline numbers for real GDP growth.

The second post covered sectoral weights in GNP and our GDP/GNP gap.

Overall, there are two main themes in rebalancing of the economy that showed up in data so far:

1) Increasing share of MNCs activity in GDP (and temporarily GNP), which means that the official figures for the National Accounts now even more overestimate the real economic activity in the country; and

2) Long-term falling out of Agriculture, Forestry & Fishing and Construction sectors from the economy, with Public Administration & Defence clearly showing signs of contraction, albeit at the rate that is, so far, trailing contraction in overall economy over the period 2003-2012.

In this post, let's take a look at the opportunity cost of the crisis.

Recall that relative to peak, Irish GDP is down 5.97% as of the end of 2012 and GNP is down 8.08% despite 'two years of consecutive growth' the Government is so keen on emphasising.

Also recall that 1980-2011 average growth rates in constant prices terms were 3.58% per annum, whilst IMF forecasts consistent structural or potential growth rate is currently around 2%. Using 2% figure we can, therefore, estimate the opportunity cost of the current crisis as losses to GDP and GNP arising from the growth foregone during the crisis. Chart below illustrates:

The grand total in opportunity cost due to the crisis (note, this is not an exercise in 'blaming the Government' or providing any estimate of real or actual losses, but rather an estimate of the opportunity cost of the crisis) is:

-- EUR104.5bn of cumulated foregone GDP for 2008-2012 or per-capita EUR22,823;

-- EUR58.8bn of cumulated foregone GNP for 2008-2012 or EUR12,828 per capita

With taxes net of subsidies at 9.647% of the GDP in 2012, the above implies roughly EUR10.1bn in foregone net tax receipts or ca EUR2bn in annual receipts. Using 2008-2012 average weight of net taxes in GDP implies EUR2.4bn in foregone annual net tax receipts.

What does this mean? Aside from the massive opportunity cost of the crisis, we have a rather revealing figure on foregone tax receipts. The figure clearly suggests that even were economic activity running at the 2% growth rate since 2007 without the crisis, re-alignment of economic activity away from domestic sectors toward MNCs-dominated activities and toward MNCs-dominated services activities in particular would still result in unsustainable deficits and would still required some sort of a fiscal adjustment, thanks to our taxation system that is extremely unbalanced when it comes to supporting MNCs-focused activities.

22/3/2013: Cypriot Plan B - any better than Plan A?

So the reports are that Cyprus has a Plan B. And the outlines of the Plan - filtering through yesterday - are quite delusional.

The Plan consists of 3 main bits:

1. Split Laiki bank (see below) into a good and a bad bank. The 'bad' bank will take on deposits of over 100K and deposits under 100K (guaranteed by the State) will be shifted into 'good' bank. Other banks will be recapitalised but there are no specific as to how, when or to what levels of capital. This stage of the Plan aims to reduce the recapitalisation costs by about €2.3bn. The problems with this stage are massive, however. First: smaller depositors are more likely to run on the bank as they are less likely to have termed deposits and as their withdrawals (even under capital controls to be imposed - see below) will be less restricted than for larger depositors. In other words, the Plan B is likely to reduce stability of deposits and funding in the resulting 'good' bank. Second: while Cypriot banking system losses are currently crystallised, reducing uncertainty for any recapitalization, there is no guarantee that depositors flight will not undermine their balance sheets beyond capital injections repair. Thirdly: the new 'good' bank will have a balance sheet (again, see table below) saddled with massive exposure to ELA & ECB funding at ca 40% of the total liabilities. If associated assets move along with larger depositors, it is likely that ECB funding ratio to Assets is going to be close to 50%. How on earth can this be called a 'good' bank beats me.

2. Step two in the delirious process of Plan B repairs of the Cypriot banking system will be the creation of a sovereign wealth fund backed by state, church, central bank and pension funds 'assets'. Even 'future gas revenues' are thrown into the pot. Put simply, the fund will be a direct raid on state pension funds, state properties and enterprises and gold reserves. It will also contain a direct link to the collective psychosis induced by the crisis - the pipe dream of Cypriot 'Saudi Arabia of the Mediterranean' Republic. Honestly, folks, this crisis has taught us one thing: the quantity of hope-for oil & gas reserves in the country is directly proportional to the degree of economic / financial / fiscal insolvency of the nation. So, having set up a bogus and bizarre fund (with hodgepodge of assets and a rich dose of 'dreamin in the night' claims to assets) the state will issue 6-year bonds against these 'assets' to raise some €2.5bn. Now, what idiot is going to voluntarily buy into this fund is quite unclear at this stage, but presumably, with bond yields set at crippling levels, the fund will find some ready buyers.

3. Step 3: the remaining shortfall of €1bn is to be covered through a small deposit levy on deposits above 100K.

Laiki bank latest balance sheet summary is provided (via Global Macro Monitor) here:

It is a whooper… with Assets at EUR30.375bn the bank is over 178% of Cypriot GDP. Deposits are at 105% of GDP.

The question is whether this plan, even if acceptable to the EU and ECB, will prevent or even restrict the deposits flight once the Cypriot banking system opens up. The EU Commission is working with Cypriot Government on developing capital controls to stem outflow of funds. But there are serious questions as to whether such capital controls can be imposed in the country that is part of the common market.

Another pesky problem is whether the bonds issued by the fund in Step 2 above will count toward Government debt. Presumably, EU can allow any sort of fudge to be created (e.g. Nama SPV in Ireland) to avoid such recognition. If not, then whole Plan B is a random flop of a dead whale beached on Cypriot shores…

Third pesky issue is what happens if the Fund goes bust. With pension funds committed to it, will the Cypriot state simply default on all of its pensions obligations? deport its pensioners to Northern Cyprus? whack the remaining (I doubt there will be any) Russian 'oligarchs' once again? or invade Switzerland? The Cypriot Government attempted to dress up the Plan B as the means to avoiding hitting small savers and ordinary people with the bank levy. It so far seems like risky leveraging of ordinary retirees and future retirees to plug the very same hole that would have been created in their budgets by the deposits levy.

Meanwhile, here's the question for those reading this blog in Ireland: According to the ESCB Statures Article 14.3, the Governing Council of ECB can make a determination to shut off liquidity assistance to the national banking system only on foot of a 2/3rd majority vote. The ECB Council did announce such a move for Cyprus comes Monday. This implies that at least one peripheral state National Central Bank governor casted the vote against Cyprus. Would that have been our Patrick Honohan, one wonders, given the frequent propensity of Irish officials to kick other peripheral states in order to gain small favours from the EU/ECB?

Subscribe to:

Comments (Atom)