CSO published Q2 national accounts for Ireland today and these are worth detailed analysis, which I will break up into a series of posts next.

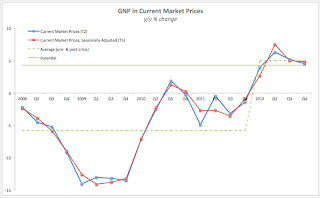

Starting with the headline GDP and GNP figures:

In Q2 2013 Irish real (constant prices) GDP fell 1.17% compared to Q2 2012, compounding the previous fall of 1.04% y/y recorded in Q1 2013. On an annual basis, this marks the fourth consecutive quarter of real GDP contractions, the longest period of continuous contractions since the end of Q2 2010. Currently, real GDP stands 7.83% below the historical peak.

At the same time, Irish real GNP fell 0.1% in Q2 2013 compared to Q2 2012, having only marginally reversed the 6.01% y/y rise recorded in Q1 2013. Despite a surprisingly robust rise in Q1, Q2 2013 real GNP stood 10.40% lower than pre-crisis peak.

The swing in the direction between GDP and GNP was driven in Q2 2013 by a 5.85% drop in the outflows of transfer payments to the rest of the world compared to Q2 2012, which compounded a massive 28.26% decline in the transfer payments recorded in Q1 2013. In other words, GNP improvements appeared to have been sustained by a massive parking of MNCs profits in Ireland. The reasons for this are unknown, but we can speculate that the MNCs are holding back profits from transferring out of Ireland due tot ax considerations and due to subdued global investment activities. It remains to be seen what happens to the GDP and GNP were the MNCs to begin once again actively exporting retained earnings.

Note: shaded periods show episodes of more than 2 quarters consecutive contractions (here on y/y basis, so these are not official recessions)

On quarterly basis, seasonally-adjusted series:

Q2 2013 real GDP rose 0.45% on Q1 2013, partially compensating for the 0.59% contraction in Q1 2013 and ending the third spell of the recession that lasted from Q3.2012 through Q1 2013. The expansion, however was weak and well below the one recorded during the previous recovery periods. For example in Q1 2010, the end of the second recessionary dip, GDP expanded by 0.82%. The end to one-quarter drop of Q2 2010 led to a GDP rise of 1.08% in Q3 2010, the end of one quarter contraction in Q4 2010 was followed by 1.48% expansion in Q1 2011 and 1.38% expansion in Q2 2011, even the end of Q1 2012 quarterly decline was marked by a 0.48% expansion in Q2 2012. In previous episodes, recovery that was associated with growth rates at below 0.7% q/q was swiftly followed by the subsequent quarter contraction in GDP. This suggests underlying weakness in the GDP performance in Q2 2013, although my personal expectation is that Q3 2013 will post stronger performance than Q2 2013 with possible GDP q/q upside of closer to 1%.

On GNP side, seasonally-adjusted real GNP fell 0.37% in Q2 2013 in q/q terms, ending two consecutive quarters of quarterly growth (Q1 2013 growth was robust 2.2% q/q and Q4 2012 growth was weak at 0.32%).

Two charts:

Note: shaded periods show episodes of more than 2 quarters consecutive contractions (here on q/q basis, seasonally adjusted, thus representing official recessions).

On historical comparison basis, table below summarises latest movements in GDP and GNP:

So a summary: we are officially out of the third dip of the Great Recession. This is a good news.

Bad news is that this data is once again being paraded around as a sing of 'stabilisation' of economic activity. Alas, the first time we've heard this 'stabilisation' argument was in Q1 2010, when the main - longest and deepest - second dip ended. Since then, Irish economy has managed to grow by just 2.63% in real GDP terms and only 3.54% in real GNP terms. Since the onset of the recovery, we have posted average quarterly growth of only 0.18% (seasonally-adjusted figures) and this effectively means that the economy is in a stabilisation pattern closer to coma than to a sustained recovery.

Good note to all of this is that, as mentioned above, I do expect stronger activity to be recorded for Q3 2013 and possibly for Q4 2013 as well.