In previous posts, I covered updates for Covid19 pandemic figures for:

- Worldwide data: https://trueeconomics.blogspot.com/2021/03/12321-covid19-update-worldwide-data.html, and

- Europe and the EU27 countries: https://trueeconomics.blogspot.com/2021/03/13221-covid19-update-europe-and-eu27.html.

Now, world's worst hit countries and regions.

World's 5 worst impacted countries by the number of cases per capita (the first table above), with ranks 1 = worst:

- Andora

- Montenegro

- Gibraltar

- Czechia

- San Marino

The U.S. ranks 9th worst in the world - the only country with more than 100 million population. There are three countries with population over 10 million but below 100 million on the list: Belgium (15th) and Portugal (11th), plus Czechia.

World's 5 worst impacted countries by the number of deaths per capita (the second table above), with ranks 1 = worst:

- Gibraltar

- San Marino

- Czechia

- Slovenia

- Belgium

The U.S. ranks 12th in the world - the only country with more than 100 million population in the list of worst-impacted in terms of deaths per capita. Notably, there are two countries with population between 50 million and 99 million on the list of the worst impacted countries by deaths per capita: Italy (ranked 8th worst in the world), and the UK (ranked 6th worst in the world). There are further 4 countries on the list with population over 10 million, but less than 50 million: Belgium and Czechia already referenced above, plus Portugal (ranked 11th), and Span (ranked 14th).

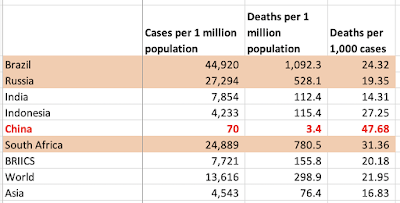

Two tables above summarize key statistics for the countries with more than 250,000 cases of Covid19 recorded. The table also provides overall rankings for these countries in terms of their performance across three metrics: cases per capita, deaths per capita and deaths per case.

Notably, ten worst countries based on these combined metrics are (once again, rank = 1 implies the worst overall performance):

- Belgium

- UK

- Italy

- Hungary (tied with Italy)

- Portugal

- Czechia

- Spain

- U.S.

- Bulgaria (tied with U.S.)

- Peru

Across major regions:

Note: in the above table, regions are ranked as countries, though countries' rankings do not include regions. Thus, if the EU27 was treated as a country, it would rank 19th worst in the list of countries. If we remove EU27 member states from the list, the EU27 itself would rank 9th worst in the list, just below the U.S. which continues to perform worse than the EU27, but only marginally.

Finally, countries' and groups' shares of deaths relative to their share of world population:

The U.S. is the second worst performing major country with its ratio of its share of world deaths to its share of world's population standing at 4.7. The UK is the worst, with a ratio of 5.6 and the EU27 third worst with a ratio of 3.8.