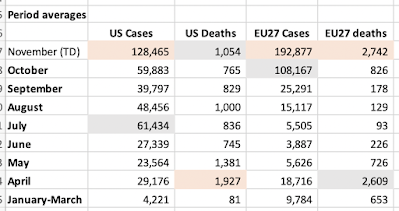

Comparatives for the pandemic development across the EU27 vs U.S.:

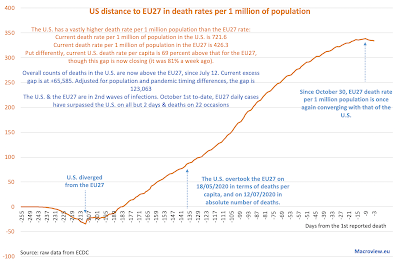

Thanks to an absolutely savage second wave of the pandemic, EU27 is now closing the gap with the U.S. in terms of total deaths, both in absolute terms and in per capita terms:

- Deaths per capita: the U.S. has overtaken the EU27 since May 18, and the trend for the U.S. continued to be worse than that for the EU27 until early October.

- EU27 death rate per capita has effectively flattened-out at around 308 per 1 million prior to August 2, but has been rising once again since then (498.1 currently).

- U.S. deaths per capita continue to increase (760.1 currently).

- The U.S. & EU27 are in 3rd (U.S.) and 2nd (EU27) waves of infections. Since Oct 1st, EU27 cases have surpassed the U.S. on all but 3 days & deaths on all but 16 days

- Overall counts of deaths in the U.S. are now above the EU27, since July 12.

- Current excess gap is at +46,983, which is down on peak excess deaths gap of 68,152 attained a month ago.

- Adjusted for population and pandemic timing differences, the gap is 113,081. Put differently, 113,081 Americans would have been alive today were the U.S. responses to the pandemic similar to those adopted by the EU27.

- November has been thee worst month so far in this entire pandemic in terms of daily cases increases for both the EU27 and the U.S.

- In terms of deaths counts, the U.S. is still lagging behind the EU27, but November to-date is now ranks as the second worst month in daily deaths counts in the U.S. and the worst month in the EU27.

For more EU27 - U.S. comparatives, including comparatives to other countries, see: https://trueeconomics.blogspot.com/2020/11/181120-covid19-update-countries-with.html.