"Banking Competition, Housing Prices and Macroeconomic Stability" by Oscar Arce and Javier Andres (The Economic Journal, Vol. 122, Issue 565, pp. 1346-1372, 2012 | http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2174836):

The paper develops a macroeconomic model "with an imperfectly competitive bank‐loans market and collateral constraints that tie investors’ credit capacity to the value of their real estate holdings".

The model shows that "lending margins are optimally set by banks and have a significant effect on aggregate variables." [Something that can be potentially magnified by the market structure, such as, for example duopolization of the market, as in the case of Ireland today].

"Fostering banking competition increases total consumption and output by triggering a reallocation of available collateral towards investors." In other words, that 'creative destruction' works - flows of collateral are made more efficient by a competitive banking system.

"Also, stronger banking competition implies higher (lower) persistency of credit and output after a monetary (credit crunch) shock."

"In the short‐run, output, credit and housing prices are more responsive on impact to shocks in an environment of highly competitive banks." "…Key to this last result is the reaction of housing prices and their effect on borrowers' net worth. The response of housing prices is more pronounced when competition among banks is stronger, thus making borrowers' net worth

more vulnerable to adverse shocks and, specially, to monetary contractions."

"Thus, regarding changes in the degree of banking competition, the model generates a trade-off between the long run level of economic activity and its stability at the business cycle frequency."

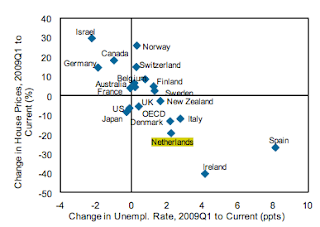

Of course, the problem for Ireland in the current crisis is that

1) we have an ongoing monetary crisis (with interest rates and FX rates policies out of synch with the economy needs);

2) a solvency crisis (debt overhang); and

3) a liquidity crisis

We are also experiencing a dramatic collapse of competitive forces in the banking sector just when we would hope for the competition in banking to start generating those efficiencies in funding allocations and thus sustaining recovery.

In other words, we have - per paper above - the worst of both worlds, we neither had a cushion of the rigid downward shocks responses in the economy going into the crisis, nor do we have the salvation option of using a competitive banking system to drive up recovery. All that, plus no controls over monetary policy.

And we are still hearing the drivel about a 'Lost Decade' for Ireland? Try decades...