Updating the tables for countries with more than 100,000 recorded cases of COVID19:

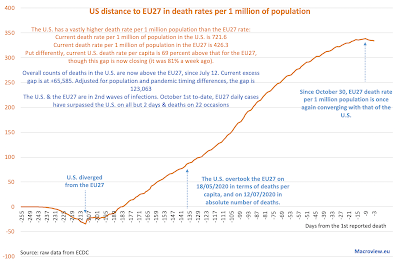

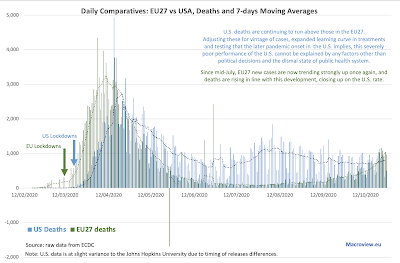

- U.S. continues to lead globally in terms of deaths and new cases counts. On per-capita terms, the U.S. ranks 7th worst in the world in terms of cases per 1 million of population, 12th worst in terms of deaths per 1 million of population and 27th worst in the world in terms of deaths per 1,000 officially detected infections. The country has, by far, the most expensive (as a share of GDP) healthcare system in the world.

- In contrast, were they treated as a single entity, BRIICS+Turkey have better than average performance in terms of number of cases, number of deaths per capita and an average (statistically) rate of deaths per 1,000 cases.

- Worldwide, 20 countries now have more than 500,000 cases and 5 countries of these have more than 50,000 deaths.

- On per capita basis, the worst performing country in the world for cases counts is Qatar, followed by Belgium and Czechia, Armenia and Israel. In terms of deaths per capita, the worst country in the world is Belgium, followed by Peru, Spain, Argentina and Brazil.

- In deaths per 1,000 confirmed cases, the worst performing country is Mexico, followed by Ecuador, Bolivia, Egypt and Iran.