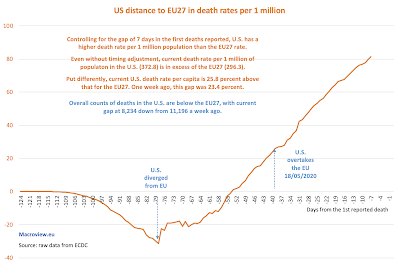

I spent some time over the last day and a half crunching through some interesting data on COVID19 cases and deaths in Europe, using two data sets:

- The usual ECDC data set on daily cases and deaths, allowing me to compute - through 20/06/2020 both deaths per 1 million population and cases per 1 million population for EU27, UK and Switzerland, Iceland and Norway, plus Serbia.

- The Timbro Institute's index data for measuring extent of populist parties and politicians influence in Europe (same countries).

In theory - often discussed these days on social media - populist leaders and parties tend to place lower emphasis on scientific research and expertise in shaping their policies. This should naturally imply that more populist-leaning governments and governing systems potentially should be associated with higher numbers of cases of COVID19 and higher death rates per capita. Also, in theory, when voters express persistent and rising - over the number of years - support for populists, such voter preferences should also influence core policies positions occupied by the mainstream parties, pulling these parties somewhat closer toward adopting at least some features of the 'winning' populists.

So, I tested if European states' outcomes in terms of the extent of contagion (cases per million, variable Y1) and the degree of mortality from the COVID19 pandemic (deaths per million, variable Y2) were related to

- Variable X1: 2018-2020 average share of populist vote in each country

- Variable X1A: 2020 share of populist vote in each country

- Variable X2: 2018-2020 average share of right wing populist vote in each country

- Variable X2A: 2020 share of right wing populist vote in each country

The data is not pretty, so I run a barrage of regressions with different specifications: inverse, linear, polynomial up to d(3), log-log, log-linear, power, compound, sigmoid, logistic and exponential. Of all specifications, using a range of tests, I have selected the best-fit specification which turns out to be exponential.

The results are shocking.

1) There was not a single case where there was a significant (statistically AND econometrically) relationship between the popularity of populist votes and worsening of the outcomes of the pandemic either in terms of how many people got infected (officially) and how many people died (also, officially). In other words, we can firmly not accept the proposition that higher degree of populism in the electoral politics of the countries AND higher degree of right-wing populism relate to worse outcomes in the COVID19 pandemic.

2) X1 variable: 2018-2020 average share of populist vote in each country has a very weak (but statistically significant at 10% confidence) and negative relationship with the number of cases of COVID19. In other words, with a lot of caution, we can reject the hypothesis that higher share of populist votes is associated with worse outcomes in terms of the number of COVID19 cases reported. Or, put differently: higher share of populist votes over 2018-2020 time horizon appears to be associated with lower number of reported infections.

2)For X1A variable (2020 share of populist votes) things are statistically indifferent from zero: share of populist vote appears to have no statistical relationship to COVID 19 deaths and cases

3) X2 variable: 2018-2020 average share of right wing populist vote in each country yields exactly the same conclusions as X1 variable. with one slight modification: the negative relationship between the COVID19 cases reported and the average share of right-wing populist votes is slightly stronger than for X1 variable.

4) X2A variable: 2020 share of right wing populist vote in each country yields the same results, qualitatively, as X2 variable.

Here is the example of X1 variable effects:

Now, there are many ways in which we can derive intuitive analysis to accompany the above results, including, but not limited to:

- Data on COVID19 pandemic is shoddy. We are relying on reported cases which are a function of testing. Data on deaths relies on reported deaths which reflect different methodologies of designating deaths from COVID19 and different time lags, etc. One might be tempted to say that the above results reflect the possibility that countries with more right-wing or any populism in their voting have under-reported data on cases and deaths. It is, of course, a possibility. But, the countries selected above are all European countries, with precedence of populist voting stronger in a number of advanced EU & EEA member states. These countries tend to report more accurate data to begin with. In addition, as far as I am aware, ECDC did not issue any clarifications or caution notes on any EEA member states in terms of their reporting of COVID19 data. So low quality of COVID19 pandemic data is either present relatively uniformly across the present set of countries, or is not systematic in nature. Which, in turn, means that quality of data should not be a significant source of distortions to the analysis.

- Even from the chart above, you can see that the negative results are driven by a cluster of 3 outliers on the X1 axis and 1 outlier on the Y1 and Y2 axes. I formally tested for these outliers and removing all of them does not change the fact that the data shows NO statistically valid relationship between worsening of COVID19 outcomes and the greater presence of populism in voter preferences. So, again, this is an unlikely culprit for the overall results.

- Omitted variables and model specification biases. These can, of course, play a role. The thing is that I did perform a non-parametric ANOVA and rank correlations and rank regressions analysis on the data, and, once again, I found absolutely NO effects in COVID19 data reactions to populist preferences of the voters, neither in quartiles analysis, nor in rank analysis.

Final thought: the paradoxical lack of the effect of populism on the COVID19 pandemic outcomes so far might be down to something else. European states, especially EEA states, are predominantly mature democracies with well-developed institutions. 3-10 years of rising populism may impact their political systems and policy formation mechanisms, but the time span might be too low for the quality of institutions (health systems, public health systems, bureaucratic systems, etc) to change dramatically. I will be looking into these factors later, so stay tuned.