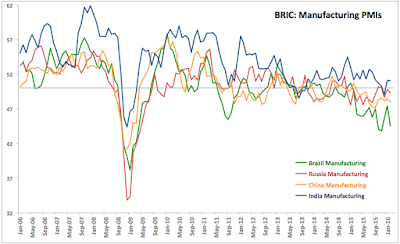

China Services PMI fell to 51.2 in February, from January’s six-month high of 52.4, pointing to a much slower rate of growth than the historical series average of 55.0. This comes on foot of Manufacturing PMI registering an outright contraction in February, with the rate of reduction quickening to the steepest since September 2015 (details here: http://trueeconomics.blogspot.com/2016/03/2316-bric-manufacturing-pmi-february.html).

Services PMI 3mo average through February was 51.3, which is basically flat on 51.2 recored in 3mo period through November 2015 and lower than 3mo average through February 2015 (52.4).

Per Markit: “New business growth also slowed across the service sector in February after a solid rise at the start of the year. Furthermore, the latest increase in new orders was weaker than the long-run trend and only modest, with some panellists commenting on relatively subdued client demand. New orders continued to decline at manufacturing companies, and at a slightly quicker rate than at the start of 2016.”

After posting a weak stabilisation in January (at 50.1), the Composite PMI fell to a recessionary level of 49.4 in February, indicating “a renewed fall in total Chinese business activity in February… to signal a marginal rate of contraction.”

On a 3mo basis, 3mo average through February 2016 was at 49.7, up on 3mo average through November 2015 (49.5) and down on 3mo average through February 2015 (51.2). Again, last six months we saw averages well below historical average (52.9).

Per Markit, “slower increases in both activity and new orders contributed to a weaker expansion of service sector staff numbers in February. Companies that reported higher staff numbers generally mentioned hiring new employees in line with new order growth. Job shedding meanwhile intensified across the manufacturing sector in February, with the latest decline in workforce numbers the sharpest since January 2009. As a result, composite employment fell at a rate that, though modest, was the quickest in six months.”

This clearly signals that troubles are not over for Chinese economy and also suggests that currently projected rates of growth for the world’s second largest economy are way off the mark. Composite PMIs have now posted sub-zero growth signals in five out of the last seven months, with one other month reading being basically consistent with zero growth. On a Composite indicator basis, China is now the second weakest economy in the BRIC group after Brazil, with Russia overtaking itm having posted a composite index reading of 50.6 in February. Over the last 12 months, the same situation prevailed in July-September 2015, and in November 2015 the two countries were tied for the second worst performance reading.

Services PMI 3mo average through February was 51.3, which is basically flat on 51.2 recored in 3mo period through November 2015 and lower than 3mo average through February 2015 (52.4).

Per Markit: “New business growth also slowed across the service sector in February after a solid rise at the start of the year. Furthermore, the latest increase in new orders was weaker than the long-run trend and only modest, with some panellists commenting on relatively subdued client demand. New orders continued to decline at manufacturing companies, and at a slightly quicker rate than at the start of 2016.”

After posting a weak stabilisation in January (at 50.1), the Composite PMI fell to a recessionary level of 49.4 in February, indicating “a renewed fall in total Chinese business activity in February… to signal a marginal rate of contraction.”

On a 3mo basis, 3mo average through February 2016 was at 49.7, up on 3mo average through November 2015 (49.5) and down on 3mo average through February 2015 (51.2). Again, last six months we saw averages well below historical average (52.9).

Per Markit, “slower increases in both activity and new orders contributed to a weaker expansion of service sector staff numbers in February. Companies that reported higher staff numbers generally mentioned hiring new employees in line with new order growth. Job shedding meanwhile intensified across the manufacturing sector in February, with the latest decline in workforce numbers the sharpest since January 2009. As a result, composite employment fell at a rate that, though modest, was the quickest in six months.”

This clearly signals that troubles are not over for Chinese economy and also suggests that currently projected rates of growth for the world’s second largest economy are way off the mark. Composite PMIs have now posted sub-zero growth signals in five out of the last seven months, with one other month reading being basically consistent with zero growth. On a Composite indicator basis, China is now the second weakest economy in the BRIC group after Brazil, with Russia overtaking itm having posted a composite index reading of 50.6 in February. Over the last 12 months, the same situation prevailed in July-September 2015, and in November 2015 the two countries were tied for the second worst performance reading.