My latest blog post on European Union innovations in financial regulation, continuing coverage of the European Banking Union is now available here: http://blog.learnsignal.com/?p=181

Friday, May 15, 2015

15/5/15: New Financial Regulation: Part 8: An Overconfidence Bias Awaits

My latest blog post on European Union innovations in financial regulation, continuing coverage of the European Banking Union is now available here: http://blog.learnsignal.com/?p=181

Thursday, May 14, 2015

14/5/15: Expert Insight: Q1 results: Estonia

My contribution (and others') to economic outlook analysis for Estonia, via Euromoney Country Risk http://www.euromoneycountryrisk.com/Analysis/Expert-insight-%E2%80%93-Q1-results-Estonia

Here are the jpgs of the article:

14/5/15: The Happiest Deflationary Consumers of Ireland... April 2015 Data.

Good thing Consumer Confidence is booming in Ireland, cause otherwise we might get a wind that domestic demand for goods and services is going nowhere:

Now, how would we get such an idea. you might ask? Well, simples.com : take a look at consumer prices:

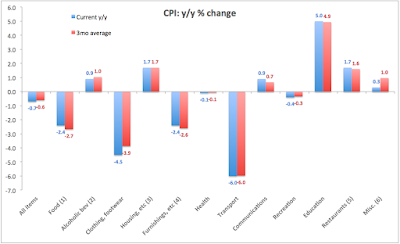

Spot the trend? That's right: CPI was down 0.7% y/y in April and down 0.6% on average over the last 3 months.

And in case you want to see what 'sustains' at least some semblance of non-totally-collapsing prices? Why here it is:

And so just as with retail sales, deflation is now consistent with rising consumer confidence. Happiness attained, at last. Just never ask what happens to demand when prices (imported from the rest of the Euro area) start creeping up across all sectors... that is something polite Irish economy forecasters don't want to talk about...

Wednesday, May 13, 2015

13/5/15: Dublin Commercial Property Market 1Q: No Fireworks, yet...

CBRE's commercial property report for 1Q 2015 is worth reading. If only for the surprising sub-trends that go largely unnoticed in the overall frothy markets.

Let's start with the summary: "Office take-up in Dublin during Q1 2015 reached 38,359m2 in 64 individual lettings." And, "the highest number of lettings in a quarter since Q1 2008".

So we have a handy chart:

Do tell me this is somehow a sign of 'strong' performance - 1Q 2015 lettings are lower than 1Q 2013 and 1Q 2014.

"15 of the 64 transactions signed in Q1 were to US companies with a further 39 lettings to Irish companies"

Which is good, because up until recently, main new signees were MNCs and Irish public sector. But… "There were no large lettings of over 4,645m2 (50,000 sq. ft.) completed in Q1." Wait, there were no large lettings completed in 4Q 2015 either, as I recall. Which means no large lettings in at least 6 months.

"62% of office take-up in Q1 occurred in Dublin City Centre" which is lower than in 1Q 2014, but higher than in 1Q 2013. Which suggests no clear trend in terms of pick up outside Dublin City Centre. Actually, ex-Dublin City Centre, lettings completed are the lowest for 1Q period compared to 2013 and 2014.

"The overall rate of vacancy fell to 11.27% down from 11.84% at the end of 2014. The Grade A vacancy rate in Dublin 2/4 at the end of Q1 2015 was 1.78%." And "prime office yields now 4.75%". Which suggests that while the prime market is clearly over-heating, secondary market is not.

"2 of the ten largest lettings completed in Dublin during Q1 were expansions, while 5 were relocations and 3 were lettings to new entrants." Which is an improvement on 4Q 2014 when there were no new entrants at all.

So I dare say there is not that much of a 'revival' going on, compared to where we are relative to the pre-crisis activity. It is probably more accurate to describe 1Q 2015 as steady, gradual and potentially risky recovery. Cautious, except when it comes to pricing Grade A prime location properties - the trophy treasure of MNCs and Public Sector and Semi-States.

Tuesday, May 12, 2015

12/5/15: Behold the Digital (Paper) worth EUR415 billion

Yes, EU has a new proposal for a new White Elephant, named Digital Strategy and costed at EUR415 billion: https://euobserver.com/digital/128602...

And yes, unveiling it, the forward-looking modernist commissioner for everything Digital had to carry into the hearing a pile of... papers...

You can't make this up... but you can (if you are an EU Commissioner) make up a EUR415 billion new 'Lisbon Agenda'... this time for a Digital Union... to out digitalise every other Digital Economy in the world... using pencils and binders...

12/5/15: European Bonds are Set to Continue their Decline

Things are getting ugly in the bond markets. Bund 10 year is already up ca 7bps, while Italy is up 9bps.

Here's yesterday close for the 'peripherals':

Source: @tradeweb

And Italy, Spain, Portugal on a longer view:

Source: @Schuldensuehner

Meanwhile, Germany...

Source: @Schuldensuehner

Meanwhile, the theme of investment flows (ETFs) rotation is may be starting, although European ETFs are seeing record inflows, breaking USD500 billion mark in April:

Monday, May 11, 2015

11/5/15: Frightening: Only 10.3% of Board Seats in Ireland are Held by Women

Just came across a startling or [better descriptor] - frightening - statistic:

Source: http://www.catalyst.org/knowledge/2014-catalyst-census-women-board-directors

Yes, the issue of causes for each country performance in this metric is complex.

But there is no excuse for Ireland's corporate culture in this: it goes without saying that women residing in Ireland (be they of Irish or foreign nationalities) are educated, trained and have comparable experience, aptitude to work, career aspirations and human capital to be exactly on par with men, even after we adjust for maternity leave and family formation.

10.3% women share on Irish boards is simply out of any tangible relation to the modern, competitive enterprise culture we want to continue building here.

Saturday, May 9, 2015

9/5/15: Politico and 'Spice Me Up, Scotty' Headlines for Grexit

Europe's latest media arrival, Politco.eu is an outfit made to thrill... or to add thrill to the banal, boring, grey, stodgy (you name it) world of Brussels. And it is off with a flying start: http://www.politico.eu/article/a-crazy-european-storm/ The headline reads "A Carzy European Storm" and promises the risks of Grexit, Greefault, with some pepper garnish of Brexit too. It is as if someone at a gas station in Washington DC picked an old newspaper and gave it a 'Look wha's up in old crazy Europe!' yelp.

The premise is that Greece is about to face EUR774 mln payment to the IMF. No, we did not know this until the Politico.eu told us.

The thesis is that Greece might not repay it. No, we did not know that this was a possibility and we had no idea that the Greek Government officially said they will repay it.

The theorem is that if it is not repaid, there can be forced (by other member states) exit of Greece from the Euro.

Quote: "On May 12, after several weeks of barrel-scraping, Greece will pay back a €774 million loan to the IMF. Or maybe not. Which would then trigger the dreaded debt-default spiral that could push Greece out of the monetary union."

Proof [Politico.eu styled]: "“In 30 years here I’ve never seen such a crazy climate,” says a former merger-and-acquisition banker and hedge fund manager now running a corporate-finance advisory boutique." Which begs a question, was this lad asleep in 2008, 2009, 2010, 2011, 2012, 2013, 2014... to have missed an even 'crazier' 'climate'. Or were his measures of 'crazy' somewhat at odds with normal financial markets and public opinion polling indicators?

Never mind that Politico's only data-focused source, the Grant Thornton survey says that... err... no, there is not quite panic yet about Grexit, though concerns are rather high.

Of course, no one would dispute the risk of Grexit is serious. But Politico.eu might want to actually consult direct sources on whether it is feasible and whether it can be linked (over 'next 2 months' as one source alleges) to a reasonable likelihood of Greece leaving the Euro. And, finally, they might want to rethink as to whether it is possible at all to 'push Greece out of the monetary union'.

Here are two links worth considering:

- ECB position on potential mechanics for member state exit from the Euro: see second link in this post: http://trueeconomics.blogspot.ie/2015/01/412015-greek-crisis-40-politics-1.html. For the impatient media spicers: summary is that per ECB view, "a Member State’s exit from EMU, without a parallel withdrawal from the EU, would be legally inconceivable; and that, while perhaps feasible through indirect means, a Member State’s expulsion from the EU or EMU, would be legally next to impossible."

- And here is the IMF official procedures for dealing with arrears: http://trueeconomics.blogspot.ie/2015/04/1415-greek-crisis-gaining-rhetorical.html. Again, for trigger happy journos a summary: first 3 months after arrears arising will be taken up by 'strongly worded' letters. It takes up to 15 months before a declaration on non-cooperation can be issued. Which is (1) hell of a lot longer than 2 months and (2) gives plenty of time to 'sort something out'.

Yep. An already crazy European storm that has been blowing over Greece and the euro area since mid-2008, uninterrupted, is pretty... well... crazy. But do we need another 'Spice Me Up, Scotty' media headline about it out on the web? Neah... not really...

Friday, May 8, 2015

8/5/15: BIS on Build Up of Financial Imbalances

There is a scary, fully frightening presentation out there. Titled "The international monetary and financial system: Its Achilles heel and what to do about it" and authored by Claudio Borio of the Bank for International Settlements, it was delivered at the Institute for New Economic Thinking (INET) “2015 Annual Conference: Liberté, Égalité, Fragilité” Paris, on 8-11 April 2015.

Per Borio, the Achilles heel of the global economy is the fact that international monetary and financial system (IMFS) "amplifies weakness of domestic monetary and financial regimes" via:

- "Excess (financial) elasticity”: inability to prevent the build-up of financial imbalances (FIs)

- FIs= unsustainable credit and asset price booms that overstretch balance sheets leading to serious financial crises and macroeconomic dislocations

- Failure to tame the procyclicality of the financial system

- Failure to tame the financial cycle (FC)

The manifestations of this are:

- Simultaneous build-up of FIs across countries, often financed across borders... watch out below - this is still happening... and

- Overly accommodative aggregate monetary conditions for global economy. Easing bias: expansionary in short term, contractionary longer-term. Now, what can possibly suggest that this might be the case today... other than all the massive QE programmes and unconventional 'lending' supports deployed everywhere with abandon...

So Borio's view (and I agree with him 100%) is that policymakers' "focus should be more on FIs than current account imbalances". Problem is, European policymakers and analysts have a strong penchant for ignoring the former and focusing exclusively on the latter.

Wonder why Borio is right? Because real imbalances (actual recessions) are much shallower than financial crises. And the latter are getting worse. Here's the US evidence:

Now, some think this is the proverbial Scary Chart because it shows how things got worse. But surely, the Real Scary Chart must reference the problem today and posit it into tomorrow, right? Well, hold on, for the imbalances responsible for the last blue line swing up in the chart above are not going away. In fact, the financial imbalance are getting stronger. Take a look at the following chart:

Note: Bank loans include cross-border and locally extended loans to non-banks outside the United States.

Get the point? Take 2008 crisis peak when USD swap lines were feeding all foreign banks operations in the U.S. and USD credit was around USD6 trillion. Since 'repairs' were completed across the European and other Western banking and financial systems, the pile of debt denominated in the USD has… increased. By mid-2014 it reached above USD9 trillion. That is 50% growth in under 6 years.

However, the above is USD stuff... the Really Really Scary Chart should up the ante on the one above and show the same happening broader, outside just the USD loans.

So behold the real Dracula popping his head from the darkness of the Monetary Stability graveyards:

Yep. Now we have it: debt (already in an overhang) is rising, systemically, unhindered, as cost of debt falls. Like a drug addict faced with a flood of cheap crack on the market, the global economy continues to go back to the needle. Over and over and over again.

Anyone up for a reversal of the yields? Jump straight to the first chart… and hold onto your seats, for the next upswing in the blue line is already well underway. And this time it will be again different... to the upside...

Labels:

BIS,

Current Account deficits,

debt,

Debt crisis,

debt overhang,

Euro area debt crisis,

Finance,

Financial Imbalances,

financial stability,

investment markets,

lending,

loans,

USD

8/5/15: Euro Area Growth Indicator for April: Weak, but Improving

The €-coin index of growth indicators for Euro area published by Banca d'Italia and CEPR posted another rise in April, marking the fifth consecutive month of increases. Eurocoin printed 0.33 in April, up from 0.26 in March. Per Banca d'Italia, "the indicator was mainly buoyed by the increase in industrial production and rising share prices." In other words, welcome to the marvels of QE.

Forecast 3mo on 3mo growth rate is now at 0.3-0.35%, the highest since April 2014. However, April 2015 reading of 0.33 is still below April 2014 reading of 0.39.

The monetary policy remains firmly lodged in a low-growth, low-inflation corner, while rates are at their zero bound:

Growth conditions signalled by Eurocoin (not actual growth data, yet) signal 12mo growth returning to close to long-term average:

This is hardly impressive, since historical growth records for the Euro area are exceptionally anaemic and current major monetary policy push for growth should be expected to drive rates of growth much higher. This is not happening so far.

Euro area business confidence surveys indicate either weak (EU Commission) or falling (PMIs)

But actual PMIs are a more upbeat:

While Consumers continue to stay away from the shops:

8/5/15: Three Strikes of the New Financial Regulation – Part 7: Fundamentals Matter

My latest blog post on European Union innovations in financial regulation, continuing coverage of the European Banking Union is now available here: http://blog.learnsignal.com/?p=178

8/5/15: Irish Residential Property Prices: Q1 2015

Updating residential property price indices for Ireland for 1Q 2015:

- National property prices index ended 1Q 2015 at 80.7, up 16.79% y/y - the highest rate of growth in series history (since January 2005), but down on 4Q 2014 reading of 81.4. Latest reading we have puts prices at the level of October 2014. Compared to peak, prices were down 38.2% at the end of 1Q 2015. National property prices were up 25.9% on crisis trough in 1Q 2015.

- National house prices ended 1Q 2015 at index reading of 83.8, which is down on 84.6 reading at the end of 4Q 2014, but up 16.55% y/y - the highest rate of growth in the series since September 2006. Relative to peak, national house prices were still down 36.5%.At the end of 1Q 2015, house prices nationally were up 25.5% on crisis period trough.

- National apartments prices index finished 1Q 2015 at 66.4, up on 4Q 2014 reading of 64.2 and 25.5% higher than a year ago. Apartment prices are down 46.4% on their peak and up 45.3% on crisis period trough. Y/y growth rates in apartments prices is now running at the highest level in history of the CSO series (from January 2005).

- Ex-Dublin, national residential property price index ended 1Q 2015 at 75.3, marking a marginal decline on 4Q 2014 reading of 75.5, but up 10.74% y/y - the highest rate of growth since May 2007. Compared to peak, prices are down 41.5% and they are up 13.9% on crisis period trough.

- Ex-Dublin house prices finished 1Q 2015 at the index reading of 77.1, which is virtually unchanged on 77.2 reading at the end of 4Q 2014. Year-on-year prices are up 10.78% which is the fastest rate of expansion since May 2007. Compared to peak prices are still 40.6% lower, although they are 14.2% ahead of the crisis period trough.

- Dublin residential property prices were at 82.5 at the end of 1Q 2015, down on 83.8 index reading at the end of 4Q 2014. Annual rate of growth at the end of 1Q 2015 was 22.77%, the highest since October 2014. Dublin residential property prices are down 38.7% compared to peak and up 44% on crisis period trough. Over the last 24 months, Dublin residential property prices grew cumulatively 40.3%.

- Dublin house prices index ended 1Q 2015 at a reading of 86.9, which is below 88.8 index reading at the end of 4Q 2014, but up 22.05% y/y, the highest rate of growth in 3 months from December 2014. Dublin house prices are down 36.9% on pre-crisis peak and are up 42.93% on crisis period trough. Over the last 24 months, cumulative growth in Dublin house prices stands at 39.5%.

- Dublin apartments price index ended 1Q 2015 at a reading of 73.7, up on 70.2 reading attained at the end of 4Q 2014, and up 29.75% y/y - the fastest rate of growth recorded since September 2014. Compared to peak, prices are still down 42.2% and they are up 59.2% on crisis period trough. Over the last 24 month, Dublin apartments prices rose cumulatively by 51.3%.

Longer dated series available below:

And to update the chart on property valuations relative to inflation trend (bubble marker):

As chart above clearly shows, we are getting closer to the point beyond which property prices will no longer be supported by the underlying fundamentals. However, we are not there, yet. Acceleration in inflation and/or deceleration in property prices growth will delay this point significantly. One way or the other, there is still a sizeable gap between where the prices are today and where they should be in the long run that remains to be closed.

Subscribe to:

Comments (Atom)