Host of stats released today point to continued recessionary dynamics in the Irish economy and no turnaround in sight.

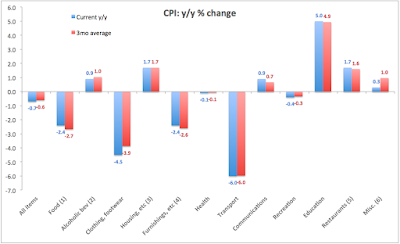

First, on consumer prices side. While the usual cheerleaders' squad of 'in-house' economists are singing the swan song of 'deflation is almost over', take a closer look at the composition of CPI changes and you can see that contrary to their claims, prices in categories that represent leading indicators for an uptick are still falling, month on month.

Per CSO: the most significant monthly price changes were

- increases in Housing, Water, Electricity, Gas & Other Fuels (+2.9%), Transport (+0.8%) and Food & Non-Alcoholic Beverages (+0.4%); and

- decreases in Clothing & Footwear (-1.1%) and Furnishings, Household Equipment&Routine Household Maintenance (-0.2%).

Detailed sub-indices show that:

- Education rose 9.1% in 12 months to the end of May, 2010

- Housing, Water, Electricity, Gas & Other Fuels was up 3.7%

- Transport was up 4.9%

So the return of inflation in Ireland - a turnaround sign for some - is driven by such hugely value-additive activities as:

- Hikes in mortgages rates by the banks rebuilding margins (mortgage interest was up 6.1%);

- Liquid fuels price hikes (+8.5% mom) due to our great Government idea of imposing a new tax on fuel which came in effect in May;

- Higher cost of natural gas, courtesy of our regulated state-owned utility that is now offering competition in electricity markets, while jacking up prices in its core activities;

- Cost of air transport (up 14% amidst collapsing demand)

- Higher cost of petrol and diesel;

- In Recreation and Culture group, there was a 4.1% mom increase in the state-controlled cost of cultural admittance;

- In education, as numbers of students continue to rise, and as unemployed folks are dreaming about retraining, while financially stretched parents are seeking the ways to cut costs of raising children, our wonderfully accommodating state has ratcheted prices up by 9.1% yoy.

Oh yes, that does really suggest that "demand is improving" and "the economy is turning the corner".

All in, Ireland has now enjoyed an unprecedented 17 months of deflation. In statistical terms, we've hit the bottom and are now returning to positive price inflation territory, slowly but surely, But in economic terms, price increases are driven not by demand, but by the state diktat. desperate to claw as much as possible out of the economy into its own coffers, our state is inventing ever more elaborate schemes to get to our pockets. And with it, the banks too are getting bolder by the day. Instead of a turnaround, all of this smacks of a threat of a renewed pressure on household incomes, and, thus, on the economy.

And, of course, there isn't much of sunshine in the industrial production data released today either. Overall, Irish industrial production was don 11.8% mom in April in terms of production index and up 2.6% in terms of turnover index. Of course, Irish industrial production is the most volatile in the OECD so one must not be tempted to read too deeply into these figures. However, what is clear is that with such dramatic rate of decline, there isn't any signs of an uptick on industrial production side either.

Which, of course, means I am not changing my earlier forecast for GDP growth of -0.3-0.7 in 2010 and GNP growth of -1.0-1.2%. No matter what Ibec or anyone else says...