Quite an interesting chart from OECD on Ireland and its peers in terms of the spread / reach of the ICT economy. Now, keeping in mind that Ireland is, allegedly, a 'knowledge-based economy' with prime talent in ICT services, attracting huge share of global ICT services firms, etc... why is, then

Or put in words, why is Ireland is one of only 3 countries with shrinking, not growing proportion of workforce engaged in ICT sector?

Per OECD report (link here), Ireland had 3 firms represented in top 250 ICT firms globally, same as, for example South Africa (which is not calling itself a 'global ICT hub' last time I checked). Nonetheless, Ireland's count is large for our relative size. Alas, in 2000 total revenue of ICT firms in Ireland was estimated at USD29.04bn and that rose to USD42.8bn in 2011 - a rise of 47.4% or a growth rate of 3.6% annually. Not spectacular, considering worldwide sector revenue grew 108% over the same period of time expanding at an average annual rate of 6.9% per annum. In other words, Ireland's ICT 'global hub' managed to grow at slightly above 1/2 the global rate of growth.

Just when you thought things couldn't get much worse. Net revenues of the ICT sector in Ireland amounted to USD3.871 billion in 2000. You would expect this to rise dramatically by 2011, especially since globally net revenues grew 127% over 2000-2011 period. But no: Irish ICT sector net revenues have actually fallen USD3.444 billion in 2011.

Now, wait: gross revenues of ICT sector in Ireland underperformed global growth rates by a factor of almost two, while net revenues have shrunk. This hardly constitutes some huge success in attracting ICT FDI and creating a global ICT services hub.

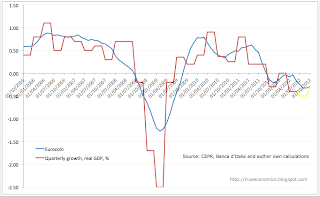

Now, chart below shows just how much of a 'leading' light our FDI magnet in ICT sector really is:

Good news is that "On average, 20% of total BERD investment is focused on the ICT sector. But the data show very large differences across countries. In 2010, ICT BERD accounted for more than a half of total business R&D expenditure in Chinese Taipei, Greece, Finland and Korea. It accounted for more than 30% in Estonia (30%), Ireland (32%), Singapore (36%) and the United States (33%)." The problem, however, is that Ireland has one of the lowest BERD investment overall in the OECD economies, so 32% of a small number can be less than 16% of a larger one...

So here's the outcome:

I will continue blogging on the OECD report tonight, so stay tuned.