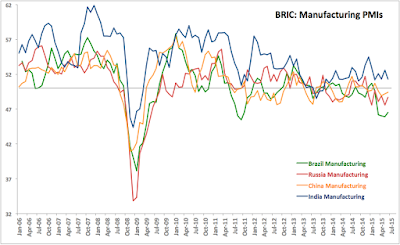

BRIC Services PMIs and Composite PMIs are in for September. I covered Manufacturing PMIs for BRTIC economies earlier here.

Unlike Manufacturing sector, BRIC Services sector did much better, posting overall a shallow, but positive growth.

- Russia Services PMI was covered in detail in this post. Overall, in the end Russia Services PMI reading for September ended up being tied for the highest position in the entire group alongside India’s

- India’s Service PMI came in at 51.3, down from 51.8 in August and marking third consecutive month of above 50 readings. The rate of growth singled by the Indian PMI is, however, relatively weak.

- China Services PMI came in at 50.5, the second weakest reading for a BRIC economy and down on 51.5 in August. Statistically-speaking, just as with Russian and Indian Services indicator, Chinese Services PMI was not distinguishable from zero growth 50.0 marker. For the economy that never posted below 50 reading in its Services PMIs, however, current reading for China is probably consistent with a sector growth plummeting sharply. This is the lowest rate of activity since July 2014. September reading was also second lowest on record.

- Brazil Services PMI was the only reading below 50 in the BRIC group and at 41.7 it is a very poor reading and is below August 44.8. Brazil has now posted the weakest of Services PMIs reading for all BRIC economies every month since March 2015.

As Chart above clearly indicates, Brazil weakness is sharp and sustained over some time now. In contrast, Russia has managed some stabilisation in the Services sector with very strong upward correction starting from February 2015 low. Overall, you can also see the extremely compressed and subdued growth activity in the Sector across the BRIC economies starting with 3Q 2013 on.

Summary table below highlights recent changes in Manufacturing and Services PMIs for the BRIC economies:

Now, let’s consider Composite PMIs.

- Again, Russia Composite PMI was covered in the separate earlier post here. In comparative terms, Russian Composite PMI was the second highest in the BRIC group after India.

- India Composite PMI came in at 51.5 in September compared to 52.6 in August, marking a deterioration in the rate of growth in the economy. 51.5 reading is border-line significant in statistical terms, suggesting possibly sharper downturn in the economic activity than simple decline of 1.1 points suggests. Still, India posted the best performing Composite PMI of all BRIC.

- China Composite PMI came in at disappointing 48.0 in September, down from an already weak 48.8 in August. Last two months readings suggest negative growth in the Chinese economy, although it is hard to call what exactly is happening in the actual economy. Nonetheless, China was a negative drag on the BRIC growth for the second month in a row.

- Brazil Composite PMI literally is tanking. It hit 42.7 reading in September, down from 44.8 in August. This marks a seventh consecutive month of composite PMI for the country signalling an outright contraction in output.

|

Charts above plot BRIC Composite PMIs. Several things worth noting here are:

- There is continued divergence in Russian PMIs (to the upside) and BRIC ex-Russia PMIs (to the downside) driven by sharp deterioration in Brazil economic environment over the last 7 months. Local peaking of BRIC ex-Russia PMIs in February 2015 is now fully exhausted and in September, BRIC ex-Russia index took a sharp nosedive. Trendiness reflect this divergence and show that it is currently well-established. In other words, although Russian economy is performing poorly, ex-Russia BRIC economies are performing even worse, even if we include into this sub-grouping a relatively well performing India.

- Overall, BRIC Composite PMI is on a sustained downward trend since June 2014 and in July-September 2015 this downward trend accelerated sharply. BRIC Composite PMI now signals recessionary conditions across the whole group of four largest Middle-Income and Emerging Markets economies. On a longer time line, weak performance in the BRIC economies has been now a feature of the global growth environment since the end of 1Q 2013.

I will be covering quarterly PMI signals in the subsequent post, so stay tuned.