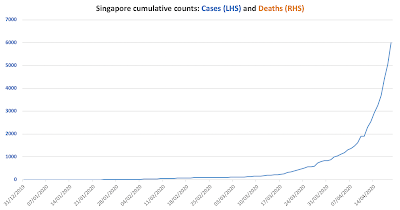

New cases are spiking in the 'safe haven' of #COVID19 pandemic: Singapore

And, worse, South Korea is now witnessing re-infection of those who have previously tested positive for coronavirus: 160 people who have been previously confirmed as having recovered from coronavirus have now tested positive again.

In Japan, that 'successfully' flattened the curve in the past, the healthcare system is now running out of ICU beds. So, many "Japanese emergency rooms are even turning away patients suffering from strokes, heart attacks or external injuries" per Axios: https://www.axios.com/japan-singapore-coronavirus-infections-a617efde-3e04-4baf-9a65-377f10454acf.html. Japan has also hit a second peak this week:

While the second peak is lower than the first one, 5 day total new cases around the previous peak was 3,349 against the current peak of 2,706: the difference not as big as would be required not to strain the resources of the healthcare system already carrying previous peak patients.