The

never-before mighty Ruble started the last day of 2015 trading on a shaky ground:

And it ended the year on a shaky ground:

And for all the pain, there is little gain. As oil tanks, Ruble will keep sinking. Per

recent report from Bloomberg (emphasis mine):

"The currency would need to tumble more than 20 percent to at least 90 against the dollar to tip the

country into a full-blown crisis, according to 17 of 20 respondents in a Bloomberg survey. Should such a threat emerge, the Bank of Russia has an array of tools at its disposal, including verbal and market interventions, an emergency interest rate increase and capital controls, they said. “

It would take more than 90 rubles per dollar to provoke significant repercussions,” said Sergey Narkevich, an analyst at Promsvyazbank PJSC in Moscow. “In 2015, Russian monetary authorities managed to mostly avoid spillovers from the foreign currency market and keep the financial system afloat and broadly functional.”

Except, here's a problem, per BAML:

Source: Bloomberg

Now, connect the dots... At above 90, we will have 'significant repercussions' and oil is already at around 37. What is more, all of the above references Brent prices. But Urals-Brent spread has been pretty awfully 'unfair' to Russian energy suppliers, and with the glut of eager and ready substitutes producers in the markets, the spread is unlikely to improve. Which means that 'above 90' can be 91 or it can be 95 or it can be 88... go figure.

Then again, may be, by some miracle, the New Year will be a happy one for the Ruble.

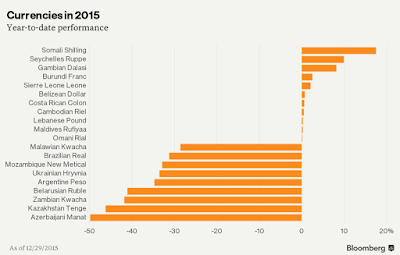

Update: Russia is hardly unique in linking currency valuations to budgetary / exchequer balances, as

argued in this post - all commodities-dependent economies do that. And there is, of course, that added dimension of recessionary pressures, as shown in the chart below (taken from Bloomberg article covering

Chinese growth woes):