As the annus horribilis concludes for the terminally

ill, but refused (by the ECB & EU & the respective Governments) death,

Euro area banks, the key note of that Mahlerian (the 5th

symphony-styled) Trauermarsch is the LTRO allocation of cheap 3 year €489

billion worth of ECB credit (at 1%) to the European banks. And, thus, the theme

for 2012, the second movement in the opus magnum of the Euro destruction, is

the looming recapitalization deadline for the said zombies – the end of June.

Alas, the hope that seems to sweep the markets to

boost, albeit moderately, Euro area banks valuations – the hope that having the

mother of all carry trades can help these banks recover their margins just in

time to use ‘organic’ recapitalization path through mid 2012 – is seemingly out

of reach.

Firstly, I put ‘organic’ in the inverted commas, since

the margins rebuilding on the back of ECB-created artificial liquidity boost is

about as organic as performing a puppet show with a corpse is ‘live-like’.

Secondly, the carry trade I am talking about - for

those readers of this blog who are unfamiliar with finance – is the artificial

exercise of taking cheap loans in one country/currency and carrying funds into

purchase of assets in another country/currency. Of course, with nothing but

loss making (or near-loss making) assets in the markets of the Euro zone, any

banks who borrowed funds in the LTRO will be either buying Government paper

(yielding on average, say, 3.0 percent margin on borrowings gives Euro area

banks pre-tax uplift of just €7.3 billion in 6 months time (and no, there are

no capital gains realizable, since buying today and selling into mid-2012 will

leave this paper, at best, capital gains neutral). Thus, to make even a dent in

the capital demand, the banks will be needing assets yielding more than double

the junkier Euro area sovereign yields, which means carry trade, and all

associated currency and asset risks.

Of course, Euro area banks can try to magnify their

returns via ECB-offered leveraged carry trades. But unless ECB offers more LTRO-styled longer term operations, doing so at 3mo or even 11mo liquidity supply windows would be simply mad.

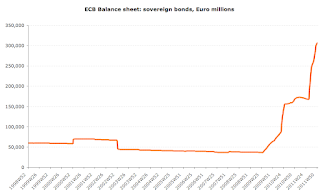

So, having borrowed through LTRO, Euro area banks will purchase Government

bonds which then can be used as a collateral for further ECB borrowing. So let

us assume that the banks will be buying liquid debt, e.g. Spanish or Italian.

The margin earned by banks is ca 2.6-3.5% per annum after they cover the cost

of LTRO borrowing. Note, this carry trade will turn loss-making for the bank if

the sovereign bonds yields fall below 1% cost of ECB LTRO funds. In my view,

this is highly unlikely.

So the whole operation can provide some €14.6 billion

annually to the banks in terms of profits earned. And this is pretty much the

unleveraged maximum. Nice one, but through June 2012 hardly enough to support

banks recaps. Even if EBA deadline is shifted to December 2012, profits from

LTRO are nowhere near the required funds to cover recapitalizations. Recall

that under 9% Core Tier 1 scenario, euro area banks require something to the

tune of €119 billion in fresh capital.

The downside

from this conclusion is that the Euro area banks will require, post LTRO either

a warrant to die (the preferred option, assuming the death warrant involves

orderly shutdown of the insolvent banks) or a public bailout of immense

proportion. Given the EU hit some serious trouble coming up with €200 billion

for loans to IMF, good luck with that latter option.