Updating latest data for COVID19 pandemic - comments in charts

New cases and deaths: daily counts

Key trends in thee above:

- Global number of daily new cases was on an upward trend through July 2020. Since the start of August, however, new daily cases additions have been flat at the levels close to the prior peak trend (< 260,000 per day).

- In the last 30 days, average number of new cases stood at 258,816, with the current 7-days average at 252,383.

- Week-to-date, daily case numbers ranked within top 10 in 1 day, and in 11-25th place in 4 days.

- Overall, there are some indications in the more recent data that the trend in new cases will likely moderate toward 220-225,000 per day in the next 7-10 days. Such a moderation will not, in itself, be sufficient to mark the end of the first wave of the pandemic.

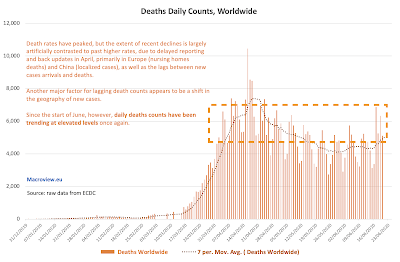

- Death rates have peaked in mid-April, but the extent of subsequent declines is largely artificially contrasted to past higher rates, due to:

- Delayed reporting, especially in April, primarily in Europe (nursing homes deaths);

- Lags between new cases arrivals and deaths;

- Shift in new cases to younger demographics;

- Improved detection/testing;

- Shift in the pandemic intensity toward countries with different reporting methodologies.

- In July, average growth in death cases was +5.79%. August-to-date, the average is -2.66%. Last 7 days average is -4.42%.

- However, deaths are still running at high rates. 30-days average is 5,882 deaths per day and 7-days average is 5,663 deaths.

- New daily cases growth rates are moderating. July average daily growth rate in new cases was 10.35%. This fell to 0.65% in August (to-date).

- In July, average growth in death cases was +5.79%. August-to-date, the average is -2.66%. Last 7 days average is -4.42%.

Two summary tables of stats: G7+ and BRIICS:

Recent divergence in deaths counts dynamics from the new case counts dynamics can be indicative of:

1. Improving rates of detection (earlier detection) of cases

2. Learning from treating COVID19 patients

3. The pandemic working through a decreasing density of older population impacted by the disease (due to increasing numbers of detections amongst younger patients)

4. Younger demographics of the new geographical concentrations of COVID19, and

5. Differences in cases and deaths recordings from the early stage of the pandemic (countries with deaths recorded on a primary cause basis, as opposed to COVID19 attribution in the presence of virus).