Starting the new year of data analysis for Covid19 pandemic, I have re-configured the charts and my database to reflect changes in ECDC reporting from daily to weekly aggregates, as reported through Thursday each week. The result is smoother data series, allowing for clearer analysis of the key trends. The downside, of course, is the lags in data reporting.

Please, note for the future: weekly data is subject to revisions by the ECDC.

First post, Worldwide figures and trends.

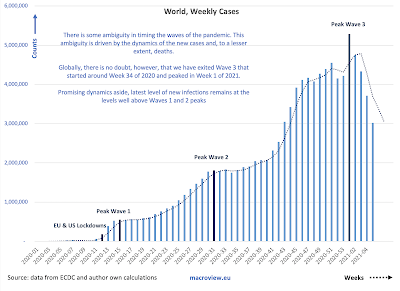

As of the last week of 2020, worldwide cases of positive tests have reached 80,177,400, with seventh consecutive week of above 4 million new cases reported on a weekly basis. The last week of the year data is subject to future revisions and reflects low accuracy of reporting due to holidays. Nonetheless, the pandemic shows no signs of de-acceleration globally in both cases and deaths.

As pointed out in the chart above, it is too early to call the peak of the Wave 3 of the pandemic, yet. Excluding the last week of the year, prior three weeks saw re-acceleration of the trend in new cases. Week 51 of 2020 saw the highest number of new cases on record at 4,534,601.

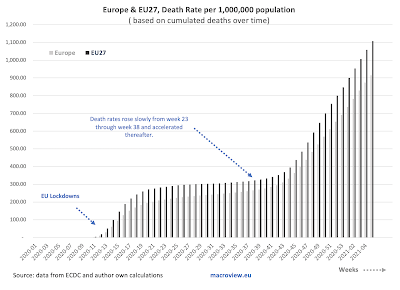

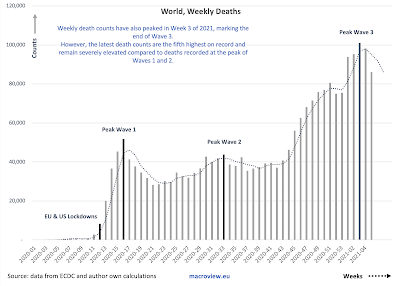

Cumulated number of Covid19 related deaths reached 1,767,037 at the end of 2020, with week 52 marking the fifth consecutive week of > 70,000 new deaths per week. Week 51 marked the highest number of weekly deaths recorded to-date at 79,708. Again, given the nature of the data reporting during the last week of the year, it is too early to call the peak of the Wave 3 of the pandemic.

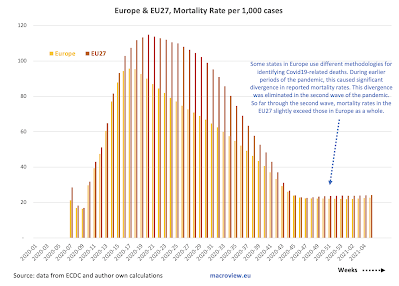

The mortality rate, measured as reported deaths per 1,000 cases continues to decline, but remains well above 20 deaths per 1,000 cases. The data is not, yet, reflective of the new (UK-originated) strand of the virus.

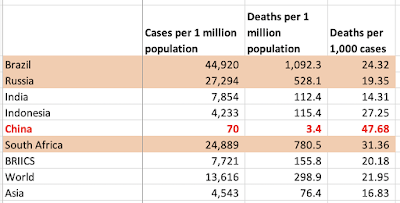

A summary table of the recent trends:

Based on monthly trends (4 weeks averages), the pandemic is showing no signs of abating in Africa, America (driven by the USA) and BRIICS, with signs of moderation off-the-peak in other parts of the world. In deaths, only Asia and Oceania are showing encouraging signs of the pandemic abating.

Once again, even the tentative and weak signs of improvement in the pandemic dynamics mentioned above are subject to a lot of uncertainty, as the data covers the last week of 2020 and the Christmas period, both most likely contributing to underestimation of the pandemic severity.

Stay tuned for more analysis of the data.