Summary of global, G7, and BRIICS case and deaths counts and rates:

Friday, June 26, 2020

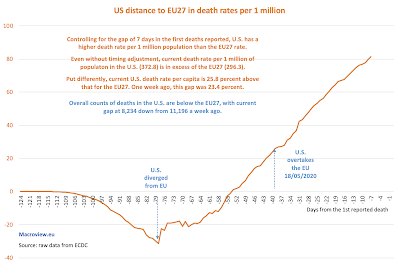

25/6/20: COVID19 Update: EU27 v USA

As explained in the charts: the absolute basket case of the U.S. response to the COVID19 pandemic continues to take its costly toll:

Note: there are some quirks in the data, including due to revisions of cases and deaths, as well as due to differences in reporting timings. I use ECDC data that itself relies on confirmation of global data from the Johns Hopkins University database, as well as CDC and other databases.

In the charts above, I track the dates of the earliest imposition of lockdowns in the EU (case of Italy) and the U.S. (starting with California). In terms of both deaths and cases, the U.S. is currently running (daily and 7-day moving averages) at much higher rates of the pandemic than the rates that triggered the lockdowns.

25/6/20: COVID19 Update: World Cases and Deaths

As explained in the charts: although geography of cases and deaths continues to shift to Latina America and Africa, Western nations are starting see pockets of increased cases. This is happening during the summer season in the Northern Hemisphere, making current increases more worrying.

The pandemic has not gone away. And any 'normalization' in these circumstances must be taken with extreme caution. Which is, currently, being abandoned more than adhered to.

Thursday, June 25, 2020

24/6/20: COVID19 Social Impact: June 2020 Ireland

Interesting insights from the CSO on some impacts of COVID19 pandemic on general population: https://www.cso.ie/en/releasesandpublications/ep/p-sic19eep/socialimpactofcovid-19surveyjune2020asnapshotofexperiencesandexpectationsinapandemic/.

The following are of significant medium and long-term concern:

- Health impact 1: 40.9% of all respondents to the survey report increased body weight since the start of the COVID19 restrictions, against 13.7% who report weight loss.

- Health impact 2: "49.0 of newly labour inactive respondents (those in employment before the onset of the COVID19 crisis and currently not working) reported an Increase in weight. This compares with 37.6% of respondents that are currently working."

- Health impact 3: The above health effects are most likely primarily driven by stress. For example: "Analysis of weight change by household composition found that a higher percentage of adults living in households with children reported having gained weight (47.5%) when compared with adults living alone (35.2%)." Given that households with children faced the pressure of not only own lockdown-related factors, but also the burden of caring for children and the pressures of home-schooling, changes in the health status are likely to be signifcantly driven by stress.

- Precautionary savings: "Of respondents that reported reduced expenditure and/or an increase in income, just over half (51.1%) said that they have/will put additional money into Savings."

- Workplace: Of the respondents who reported as working from home, 19.6% stated they do not have adequate work space and/or equipment. "Almost one in five (18.5%) respondents reported being Very or Extremely concerned about their employer’s ability to provide a safe work environment in the context of COVID-19."

What does this mean for business? Some thoughts:

- We are likely to see stronger focus on health and well-being when it comes to consumers voting with their Euros in months and years to come. Smaller, natural and sustainability-focused brands are likely to have an opportunity space as long as they can maintain value proposition.

- The above also supports increased demand for personalisation of goods and services being supplied to consumers, a trend that will accelerate should COVID19 restrictions persist or even re-accelerate.

- Financial implications of COVID19 will reinforce workplace and brand effects: as consumers return to work, they will increasingly demand greater safety and more direct engagement with their employers and brands.

- Production processes will shift toward ensuring tighter control and quality delivery by the brands, which means that co-manufacturing and outsourcing will be less favoured by consumers than in-house production.

- Direct-to-Consumer channels of sales will become more important, as they provide greater assurances to consumers of quality, provenance and ESG-impacts attributes of their suppliers.

- On investment side: organic cash flow-funded investment will become more important in years to come. This will be driven by greater preference amongst retail investors for liquidity and by the re-discovery of the need for cash-based safety buffers amongst the companies. Low cost of funding in the bonds markets and in the banking channel will also disfavour households shifting out of their precautionary savings accumulated during the pandemic.

I am sure there will be other disruptive factors at play as well.

Wednesday, June 24, 2020

24/6/20: German Business Sentiment for June: Mixed Signs of the Ongoing Recovery

Germany's ifo Institute published June survey results for business confidence, reflecting the latest changes arising from the graduate, but fast, 'normalization' of economic activities. There are some improvements in forward expectations, set against virtually no improvement in current conditions:

The gap between pre-COVID19 and current conditions sentiment remains massive, with trough to current reading improvement of just 2.4 points, compared to the pre-crisis to trough fall of 20.2 points. Expectations (6 months forward) gains 11.9 points on the trough, with pre-crisis to trough decline of 21.5 points. This implies that forward expectations are now just over half-way into recovering pre-COVID19 levels, but current conditions assessment still shows dire state of the economy.

So far, current conditions dynamics do not suggest a V-shaped recovery, but there is some hope in terms of expectations. Manufacturing and construction sectors dominate negative outlook. Services sectors current assessment is matched by forward expectations, while trade sectors are showing more robust recovery across the board.

Monday, June 22, 2020

21/6/20: Does Populism in Politics Matter in COVID19 Pandemic Outcomes?

I spent some time over the last day and a half crunching through some interesting data on COVID19 cases and deaths in Europe, using two data sets:

- The usual ECDC data set on daily cases and deaths, allowing me to compute - through 20/06/2020 both deaths per 1 million population and cases per 1 million population for EU27, UK and Switzerland, Iceland and Norway, plus Serbia.

- The Timbro Institute's index data for measuring extent of populist parties and politicians influence in Europe (same countries).

In theory - often discussed these days on social media - populist leaders and parties tend to place lower emphasis on scientific research and expertise in shaping their policies. This should naturally imply that more populist-leaning governments and governing systems potentially should be associated with higher numbers of cases of COVID19 and higher death rates per capita. Also, in theory, when voters express persistent and rising - over the number of years - support for populists, such voter preferences should also influence core policies positions occupied by the mainstream parties, pulling these parties somewhat closer toward adopting at least some features of the 'winning' populists.

So, I tested if European states' outcomes in terms of the extent of contagion (cases per million, variable Y1) and the degree of mortality from the COVID19 pandemic (deaths per million, variable Y2) were related to

- Variable X1: 2018-2020 average share of populist vote in each country

- Variable X1A: 2020 share of populist vote in each country

- Variable X2: 2018-2020 average share of right wing populist vote in each country

- Variable X2A: 2020 share of right wing populist vote in each country

The data is not pretty, so I run a barrage of regressions with different specifications: inverse, linear, polynomial up to d(3), log-log, log-linear, power, compound, sigmoid, logistic and exponential. Of all specifications, using a range of tests, I have selected the best-fit specification which turns out to be exponential.

The results are shocking.

1) There was not a single case where there was a significant (statistically AND econometrically) relationship between the popularity of populist votes and worsening of the outcomes of the pandemic either in terms of how many people got infected (officially) and how many people died (also, officially). In other words, we can firmly not accept the proposition that higher degree of populism in the electoral politics of the countries AND higher degree of right-wing populism relate to worse outcomes in the COVID19 pandemic.

2) X1 variable: 2018-2020 average share of populist vote in each country has a very weak (but statistically significant at 10% confidence) and negative relationship with the number of cases of COVID19. In other words, with a lot of caution, we can reject the hypothesis that higher share of populist votes is associated with worse outcomes in terms of the number of COVID19 cases reported. Or, put differently: higher share of populist votes over 2018-2020 time horizon appears to be associated with lower number of reported infections.

2)For X1A variable (2020 share of populist votes) things are statistically indifferent from zero: share of populist vote appears to have no statistical relationship to COVID 19 deaths and cases

3) X2 variable: 2018-2020 average share of right wing populist vote in each country yields exactly the same conclusions as X1 variable. with one slight modification: the negative relationship between the COVID19 cases reported and the average share of right-wing populist votes is slightly stronger than for X1 variable.

4) X2A variable: 2020 share of right wing populist vote in each country yields the same results, qualitatively, as X2 variable.

Here is the example of X1 variable effects:

Now, there are many ways in which we can derive intuitive analysis to accompany the above results, including, but not limited to:

- Data on COVID19 pandemic is shoddy. We are relying on reported cases which are a function of testing. Data on deaths relies on reported deaths which reflect different methodologies of designating deaths from COVID19 and different time lags, etc. One might be tempted to say that the above results reflect the possibility that countries with more right-wing or any populism in their voting have under-reported data on cases and deaths. It is, of course, a possibility. But, the countries selected above are all European countries, with precedence of populist voting stronger in a number of advanced EU & EEA member states. These countries tend to report more accurate data to begin with. In addition, as far as I am aware, ECDC did not issue any clarifications or caution notes on any EEA member states in terms of their reporting of COVID19 data. So low quality of COVID19 pandemic data is either present relatively uniformly across the present set of countries, or is not systematic in nature. Which, in turn, means that quality of data should not be a significant source of distortions to the analysis.

- Even from the chart above, you can see that the negative results are driven by a cluster of 3 outliers on the X1 axis and 1 outlier on the Y1 and Y2 axes. I formally tested for these outliers and removing all of them does not change the fact that the data shows NO statistically valid relationship between worsening of COVID19 outcomes and the greater presence of populism in voter preferences. So, again, this is an unlikely culprit for the overall results.

- Omitted variables and model specification biases. These can, of course, play a role. The thing is that I did perform a non-parametric ANOVA and rank correlations and rank regressions analysis on the data, and, once again, I found absolutely NO effects in COVID19 data reactions to populist preferences of the voters, neither in quartiles analysis, nor in rank analysis.

Final thought: the paradoxical lack of the effect of populism on the COVID19 pandemic outcomes so far might be down to something else. European states, especially EEA states, are predominantly mature democracies with well-developed institutions. 3-10 years of rising populism may impact their political systems and policy formation mechanisms, but the time span might be too low for the quality of institutions (health systems, public health systems, bureaucratic systems, etc) to change dramatically. I will be looking into these factors later, so stay tuned.

Saturday, June 20, 2020

20/06/20: COVID19 Update: Sweden v Other Nordics

Sweden is a now a verifiable basket case amongst the Nordic countries when it comes to the country management of the COVID19 pandemic:

The two charts above show that Sweden performance in both daily cases and deaths has been truly shockingly poor, compared to all other Nordic countries combined. The same is true in country-by-country comparatives.

In fact, based on ECDC data, were Sweden to perform as all other Nordics (including Estonia), its total number of cases of COVID19 registered would currently stand at 22,890, against its actual count of 54,443, and its death toll would have been 2,113 against its actual death toll of 4,877.

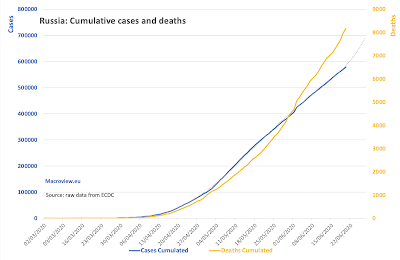

20/6/20: Russia COVID19 Update: Too Early For Going Back To Normal

Russia is taking a page from the U.S. book on 'How Not to Do Pandemics' entering a major restrictions relaxation stage too early:

In simple terms, Russia is not ready to go to a more relaxed restrictions regime, yet.

20/6/20: EU vs USA Covid19 Update

Currently, compared to the pre-lockdown dynamics, daily cases and deaths in the U.S. warrant continued, if not accelerated severity of lockdowns, as opposed to relaxation of restrictions:

In Europe, in contrast, new cases are relatively benign and currently running (on a sustained medium term basis) below the levels at which the wide-spread lockdowns have been introduced.

In summary, the U.S. is currently the worst global basket case in managing the COVID19 pandemic. My take on the underlying causes: https://twitter.com/GTCost/status/1273999784089497606?s=20

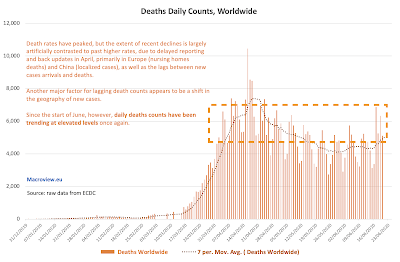

20/6/20: World COVID Data Update: The Theory of Back to Normal

Relaxation of the Covid19 pandemic restrictions is gaining momentum worldwide, with clusters of renewed concerns over the 'second peak' or 'second wave' dynamics. The problem is that global pandemic numbers remain extremely worrying:

Total new cases are hitting all-time highs:

The orange box represents, roughly, the range of earlier data that triggered the lockdowns. It is clear that worldwide numbers are sustainably above that range. The 7-day running average is horrific and trending up at an accelerating rate. The slope of the current 7-day moving average is now similar to what we observed in the peak period of contagion in Europe.

Total daily deaths are also on the rise, once again:

Once again, the orange box related current deaths to the European lockdowns initiation deaths. The 7-day moving average is on the rise, once again.

Yes, on per-capita basis, the pandemic has moderated, primarily due to different geographies of concentration of new cases and new deaths. However, European lockdowns periods coincided with more robust testing in Europe and in advanced economies in Asia, while current period of globally spiking cases and rising deaths is coincident with less robust public health systems in less developed countries, implying that current numbers are most likely coming from much larger underestimates of actual cases and deaths.

Friday, June 19, 2020

19/6/20: Fox News, COVID19 Social Distancing and COVIDIOTS?

How influential is the U.S. mainstream media in defining public attitudes toward pandemic risk, decision-making under severe uncertainty and risks to their own health? It turns out - hugely influential.

A new paper from a group of U.S. economists, titled "The Persuasive Effect of Fox News: Non-Compliance with Social Distancing During the Covid-19 Pandemic" (authored by Andrey Simonov, Szymon Sacher, Jean-Pierre Dube, and Shirsho Biswas, May 17, 2020 https://bfi.uchicago.edu/wp-content/uploads/BFI_WP_202067.pdf) finds that:

- "The average partial effect of Fox News viewership in a zipcode implies that 1 percentage point increase in cable viewership reduces the propensity to stay at home by 8.9 percentage points compared to the pre-pandemic average."

- "A persuasion rate of Fox News on noncompliance with stay-at-home behavior during the crisis of about 33.5% − 50% across our various social distancing metrics."

- Simple regression (OLS) analysis o"generate a positive and statistically significant effect of Fox News viewership from early March onwards."

- More robust, IV estimates. "are considerably larger and indicate a take-off in the Fox News effect in early March and a stabilization in mid March, almost immediately after the declaration of a national emergency."

- "Since the supply-side measures, such as business closures, start to happen only two weeks later after the take-off of Fox News effects, the magnitudes of the viewership effects reflect the persuasive effect of Fox News on viewers and not a feedback effect from the equilibrium response of firms, at least early on."

- "Our findings for CNN are inconclusive, with imprecise point estimates centered near zero."

Subscribe to:

Comments (Atom)