So for a poor start of the week, Monday data on manufacturing across the euro area continues to push the stagflationary growth scenario.

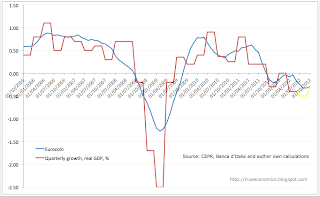

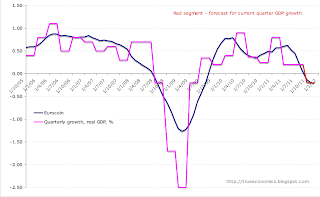

First, the eurocoin leading economic indicator came in at another contraction in September - see details

here.

Second, gloomy PMIs readings across the entire euro area are, not surprisingly, confirming slowdown and contrasting the UK (although not too-cheerful 51.1 reading, on a foot of a 49.4 revision in August, with UK new export orders sub-index falling to 45.0 from 46.9, reaching the lowest level since May 2009):

- Euro area overall PMI at 48.5 in September against 49.0 in August, marking the worst monthly reading since August 2009. Output sub-index at 49.6 against 48.9 in August and new orders sub-index at 45.2 in September, down from 46.0 in August, lowest reading since June 2009. Rate of output contraction slows but new orders drop at fastest rate for over two years. PMIs fall in all countries except Italy. Steepest declines seen in Greece and Spain.

- German September PMI for manufacturing is at (barely expansionary) 50.3 from 50.9 in August and at the lowest level since September 2009.

- French September PMI-M fell to 48.2 from 49.1 in August. Now, recall that France posted zero growth in Q2 2011 when PMIs were above expansion line.

- Italian PMI-M up at 48.3 from 47.0 in August, implying that manufacturing is shrinking at a slower pace than before, but shrinking nonetheless.

- Spanish September PMI for manufacturing is at 43.7 down from 45.3 in August - both depressing readings signaling accelerating and deep contraction.

- Greece: 43.2 in September, down from 43.3 in August

So manufacturing activity overall is followed now by new exports fall off as well:

All of this has been building up for some months now. The latest Eurostat data (through July 2011) shows already nascent trends of weaknesses on manufacturing and broader industry sides:

Manufacturing:

New orders (lagging series in terms of signaling slowdown):

Capital goods (leading indicators):

And finally, overall industrial production:

Things are now looking structurally weak, rather than temporarily correcting.