Previously, having posted on disconnection between S&P500 market valuations and basic corporate finance (earnings and distributions) - see that post here:

http://trueeconomics.blogspot.com/2016/04/15416-corporate-finance-s-and-bubble.html - it is time to remind us all what a popping bubble looks like.

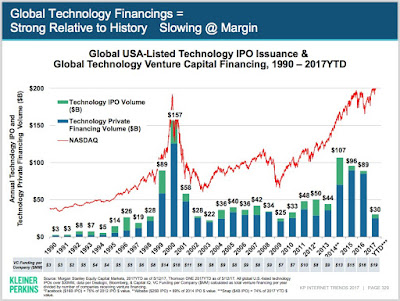

Earlier this month, I was in San Francisco, the epicentre of the corporate finance-free world of tech. Not surprisingly, few smoke breaks and few chats over a glass of wine with some tech folks revealed a very interesting insight: every single one tech CEO/CFO/COO (but

not CTO) I spoke to was concerned with evaporating funding in the markets for non-public equity financing around the Silicon Valley.

Need confirmation? Here is a chart through 1Q 2016 on Tech IPOs trends:

Source: https://www.theatlas.com/charts/Nkk4jHLCe

And a note from the WSJ:

http://www.wsj.com/articles/startup-investors-hit-the-brakes-1460676478 on same with a handy graph:

And the numbers of deals? Why, off the cliff too:

Source: https://www.theatlas.com/charts/Vk8_bYUAl

There is not panic, yet, but there is panic already in works: techies are retrenching on new hiring and there are rumours of some layoffs in younger companies. Meanwhile, states-sponsored agencies seeking to lock start ups and existent players into relocating to their countries or landing in the countries with regional HQs are still shopping around, as if money will always be there to rent plush offices and the case-styled furniture for those whiz kids who make up apps with little cash flow behind them...

It all might be temporary. Or it might be the beginning of the real thing. But one thing is certain: on a long enough timeline, one can defy gravity of basic corporate finance only as long as the interest rates defy gravity of risk pricing.