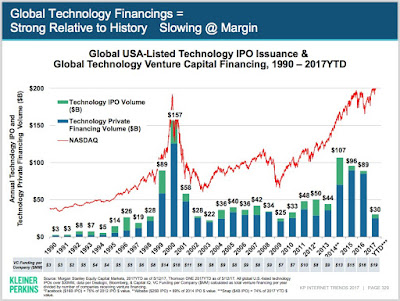

Based on the recent data from Kleiner Perkins, there has been a substantial inflection point in the relationship between NASDAQ index valuations and tech IPOs around 2015 that continued into 2016-2017 period.

Over the period 2009-2014, the positive correlation between NASDAQ and global technology IPOs and PE/VC funding was largely a matter of regularity. Starting with 2015, this relationship turned negative. Which means one pesky thing when it comes to the real economy: the great engine of enterprise innovation (smaller, earlier stage companies gaining sunlight) as opposed to behemoths patenting (larger legacy corporations blocking off the sunlight with marginal R&D) is not exactly in a rude health.

Over the period 2009-2014, the positive correlation between NASDAQ and global technology IPOs and PE/VC funding was largely a matter of regularity. Starting with 2015, this relationship turned negative. Which means one pesky thing when it comes to the real economy: the great engine of enterprise innovation (smaller, earlier stage companies gaining sunlight) as opposed to behemoths patenting (larger legacy corporations blocking off the sunlight with marginal R&D) is not exactly in a rude health.