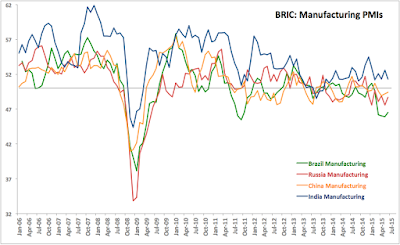

Now, as promised, the summary of 3Q 2015 BRIC PMIs and the insights these give us into global growth trends. Note: series history refers here to data from 1Q 2006, since some countries in the group only started collecting PMI data from that period.

Brazil:

- Brazil’s Manufacturing PMI averaged poorly 46.7 in 3Q 2015, which is… drum roll… an improvement on disastrous 46.1 recorded in 2Q 2015. All in, Brazil manufacturing sector contraction is now 6 consecutive quarters-long. Over the last two consecutive quarters, Brazil posted the worst Manufacturing sector performance of all BRIC economies.

- Meanwhile, Brazil Services PMI tanked to 41.9 on 3Q 2015 average basis from already abysmal 42.3 reading in 2Q 2015. This means that Brazil Services sectors are in a deep contraction over the last 6 months and the rate of contraction accelerated in 3Q 2015. This is the worst quarterly reading in all BRIC economies for Services sector for the second consecutive quarter running and the fourth consecutive quarter of recession in Brazil’s Services.

- While Manufacturing PMI in 3Q 2015 was the fifth lowest in history of the series, Services PMI hit its lowest level in history. In brief, Brazil is in deep trouble and is currently the worst performer across both manufacturing and services sectors of all BRIC economies. Brazil recorded now four consecutive quarters of sub-40 readings in both indices - the only economy in the BRIC group to have done so (in Russia case, such coincident sub-50 readings have occurred for the duration of only two quarters) in post-Crisis period.

Russia:

- Russian Manufacturing PMI averaged 48.4 in 3Q 2015 unchanged on 48.4 reading in 2Q 2015. This is the lowest (tied with 2Q) reading since 1Q 2014 and marks the third consecutive quarter of sub-50 readings in the sector. The level of contraction singled by 48.4 reading is, however, not particularly remarkable, marking the 6th sharpest rate of activity decline in series history.

- Russian Services PMI posted a reading of 50.7 in 3Q 2015, consistent with weak growth, following 51.0 reading in 2Q 2015 and marking two consecutive quarters of above 50 readings. Growth is still weak in the sector, with 3Q 2015 reading being 9th lowest in series history.

- Overall, Russian economy is still in a recessionary scenario, judging by PMIs although some improvement is visible in the Services side of the economy. In my view, it is too early to call the bottom of the recession, yet, but there are some potentially encouraging signs emerging.

- Russia remained the second weakest economy in the BRIC group, only marginally (by about 0.1 points) underperforming China when comparative is taken across both sectors of the economy.

China:

- Chinese Manufacturing PMI fell off the cliff in 3Q 2015, declining to 47.4 compared to 49.2 in 2Q 2015. This marks second consecutive quarter of sub-50 readings for the index. 3Q 2015 index was 3rd lowest in the history of the series, highlighting just how sharp the deterioration was. Over the last 4 quarters, Chinese manufacturing failed to post a reading above 50.0 in all quarters, meanwhile, over the last 16 quarters, Chinese Manufacturing posted a statistically significant growth reading in only one quarter.

- China Services PMI fell from 52.7 in 2Q 2015 to 51.9 in 3Q 2015. This is the 5th lowest reading in the history of the series and, although nominally above 50.0, statistically is not consistent with a signal of even moderate growth.

- In simple terms, China is getting dangerously close to statistically zero growth across the economy, which, in my view - given the low quality of Chinese official data - can be anywhere around 3-4 percent official GDP expansion for 2015. Potentially - lower.

India:

- Indian Manufacturing PMI continued to lead the BRIC economies indices, rising to 52.1 in 3Q 2015 from 51.7 in 2Q 2015. Still, the case of growth is 9th slowest in data series history.

- Indian Services PMI posted a strong rebound from 49.9 reading in 2Q 2015 to 51.3 in 3Q 2015. Even with this rebound, latest indicator is signalling 10th slowest rate of growth in the Services side of the economy.

- Overall, India returned to the scenario of broadly based (across both Services and Manufacturing) growth in 3Q 2015. However, considering past performance, growth across both sectors in India was anaemic in 3Q and it has been weak since the start of 2013.

Charts below illustrate key trends:

Overall, BRIC group activity has been pretty disastrous in recent quarters, as shown in the Chart below

As the above illustrates, combined BRIC Manufacturing index is currently running at 48.5 down from 49.4 in 2Q 2015 and marking second consecutive quarter of sub-50 readings. This the third worst performance level for the indicator. Across Services sectors within the BRIC economies, activity also fell in 3Q 2015 (to 50.7) from already weak 50.9 in 2Q 2015. 3Q 2015 Services reading is 5th worst in history.

Table below summarises recent changes in quarterly PMIs:

Key conclusions:

- BRIC economies are in a sharp, structural slowdown across both manufacturing and services, with Brazil and Russia lingering in sustained recessions, China effectively falling off the growth cliff and India slowing down, but still generating positive growth. The rot is global - it is driving global trade and currencies imbalances and is also driven by global trade, demand and currencies imbalances. With the world’s largest EMs in deep trouble, one has to wonder how low can global GDP growth revisions go in months ahead.

- The structural or longer-term nature of this rot is best highlighted in the last chart above, showing clearly the dramatic trend decline in Manufacturing activity starting with 2Q 2011, followed with the onset of decline in Services side of the economy in 2Q 2013.

Note: Monthly PMIs for September were covered in previous posts:

- For Services and Composite PMIs: here.

- For Manufacturing PMIs: here.