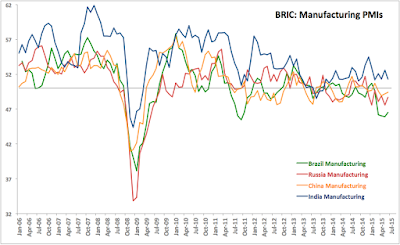

BRIC countries manufacturing PMIs are out via Markit, so here are the main insights:

- Russia: I covered Russian Manufacturing PMI earlier here, with a core conclusion as follows: In November, Russian Manufacturing posted a second monthly reading consistent with weak stabilisation, but virtually no signs of recovery. That said, Russian Manufacturing performance was second strongest in the BRIC group after India’s in November, which is consistent with all readings since July 2015.

- Brazil: In contrast to Russia, Brazil posted another massive deterioration in Manufacturing PMI, with index reading falling to an 80-months low of 43.8 from an already extremely poor reading of 44.1 in October. Overall, we now have 10 consecutive months of sub-50 readings and this dovetails with the latest GDP figures showing Brazil’s economy in a third consecutive quarter of recession at -1.7% in 3Q 2015. Per Markit: “PMI slides further, reaching 80-month low; Production contracts at steep rate amid sharp drop in new projects; Workforce numbers fall at quickest pace since April 2009.” Brazil is now the main laggard in the BRIC group in Manufacturing sector every month since March 2015. Dynamics-wise, things are getting worse: 3mo average through November is at 45.0, which is below 3mo average through August (46.5) and 3mo average through November 2014 (49.0).

- China manufacturing PMI remained below 50.0 mark for the 9th consecutive month in November, posting a reading of 48.6 - marginally better than 48.3 in October. 3mo average through November 2015 is at 48.0, which is marginally worse than 3mo average through August 2015 (48.2) and well below 50.2 3mo average reading through November 2014. Per Markit: “Chinese manufacturing firms signalled that output stabilised in November, thereby ending a six-month sequence of reduction. Meanwhile, total new work continued to decline, and at a similarly modest rate to that seen in October, despite a pick up in new export business growth. Relatively soft overall client demand led firms to scale back their purchasing activity again in November, while inventories also declined. Deflationary pressures intensified over the month, as highlighted by sharper decreases in both input costs and output prices.” China is currently the second weakest BRIC economy in Manufacturing terms every month running, since July 2015.

- India: Continuing to outperform other BRIC, India Manufacturing PMI has, nonetheless, posted a major deterioration in growth conditions in November, falling to 50.3 in November - a 25 months low - from 50.7 in October. 3mo average through November 2015 is at 50.7, below 3mo average through August (52.1) and below 3mo average through November 2014 (52.0).Per Markit: “The health of India’s manufacturing economy improved for the twenty-fifth successive month in November, although to the least extent in this sequence. The latest PMI data showed slower increases in incoming new business and output, while subdued demand growth led firms to keep workforce numbers broadly unchanged. Meanwhile, input cost inflation accelerated to the strongest since May, whereas factory gate prices were raised at a weaker rate that was marginal overall.” Given the historical levels of the series, 50.3 is not statistically distinguishable from 50.0, which implies that statistically, November reading (as well as October) was not consistent with above zero growth.

Core outrun:

Overall, Manufacturing activity contracted in November across BRIC economies, signalling continued pressure on growth in world’s largest emerging markets. Forward indicators are also weak, with new orders pipeline and backlogs of work being depressed across majority of BRIC manufacturing sectors.