A new paper "Home Equity in Retirement" by Makoto Nakajima and Irina A. Telyukova (September 20, 2012) looks at the effects of homeownership on savings/dissaving by retirees, using the US data for 1996-2006.

Using an estimated structural model of saving and housing decisions, the study finds that "homeowners dissave slowly because they prefer to stay in their house as long as possible, but cannot easily borrow against it. Second, the 1996-2006 housing boom significantly increased homeowners' assets. These channels are quantitatively significant; without considering homeownership, retirees' savings are 24-43% lower."

Some more details:

Figure 1 shows over the period 1996-2006, median net wealth remains high very late into the life cycle. The observation that many people die with significant savings, which is puzzling in the context of a simple life-cycle model, has been termed the \retirement saving puzzle. However, the picture changes dramatically if we consider the saving behavior of retirees who

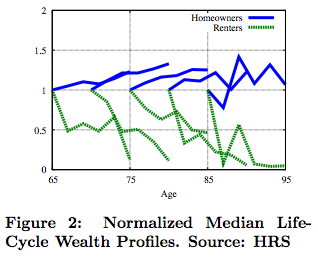

own homes, compared to those who do not. Consider figure 2, which documents the cohort profiles of median net worth over the same period, normalized by the first observation, for homeowners versus renters.

The difference is stark. Homeowners have flat or increasing profiles of net wealth over this period, while renters display a far faster rate of asset decumulation. This suggests that housing may play a major role in determining how retirees save or dissave."

Overall, the paper finds that:

- "…high homeownership rate late into the life-cycle that we observe in the data is crucial to consider for understanding retiree saving behavior."

- "Housing-related channels are significant contributors to the retirement saving puzzle. Retirees stay homeowners late in life, but become increasingly locked into their home equity as they age;

- "...we find that borrowing constraints on retirees tighten considerably. This means, on the one hand, that those who remain homeowners do not decumulate their home equity, thus creating the kind of flat housing profile that we see in the data, while those who face a large expense may come up against their borrowing constraint and be forced to sell the house.

- "We also use the model to understand why people retirees choose to remain homeowners late in life. We find that the leading motivators are utility benefits of owning a house (which capture also financial benefits, such as tax advantages) and bequest motives.

- "In contrast, precautionary motives in the face of medical expense risk do not a effect homeownership significantly, but play a role in the puzzle through financial asset accumulation, although overall this role is quantitatively modest and affects younger retirees more than older ones.

- "Quantitatively, we find that the housing channels {utility benefits of ownership, collateral constraints, and the housing boom} jointly account for between 24 and 43% of the median net worth profile, depending on age.

- "The bequest motive accounts for up to 31% of the median net worth profile, and its importance increases with age.

- "Medical expense risk accounts for maximum 8% of median net worth, and its importance generally falls with age, due to interaction with Medicaid.

- "..we conduct an experiment where we allow households to make a decision on whether or not to maintain their home. We want to evaluate this as an additional, possibly hidden, channel of asset decumulation, consistent with data evidence that homes of elderly owners depreciate more quickly than those of younger owners. We treat this as a hidden channel because we assume that self-reported housing values of owners who remain in their houses do not take into account the depreciation rate unless they have the house appraised for sale, for example. We find this to be a significant channel of asset decumulation. 30% of our model homeowners choose not to maintain their homes in the 75-85 year old cohort; for the younger cohort, that proportion is over 50%, while it is lower for the oldest cohort. We show that this channel affects median housing asset profiles as well."

All of this has huge implications for countries like Spain and Ireland that have undergone a massive property prices bust. Declines in property prices have wealth effects, negative equity has wealth effects. Both, however, have also direct behavioural effects that are also adverse, as outlined above. In my view, we have not even started to count the real costs of the property busts in our fiscal and economic forecasts.

Renters pay rent ad infitinum.

ReplyDeleteHomeowners plan to have paid their mortgage off at least by the time they retire.

Any reduction in income by homeowners on retirement is offset by saving on mortgage/loan repayments; the value of the property is largely irrelevant in terms day-to-day living costs.

Renters on the other hand face a relative increase in outgoings in retirement with a reduced income and static/rising rent.