My recent comment on the Biden Administration early successes for the Euromoney: https://www.euromoneycountryrisk.com/article/b1rqlvl15wr2mw/special-country-risk-survey-us-investor-confidence-is-returning-under-biden?LS=Adestra2055255%E2%80%A6

Tuesday, June 8, 2021

Monday, October 26, 2020

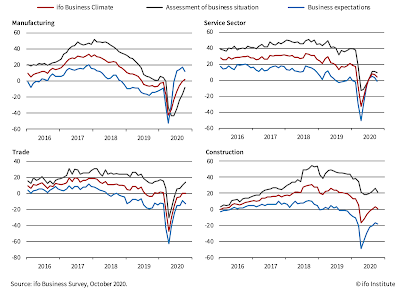

26/10/20: ifo Institute: German Economic Conditions Deteriorated in October

ifo Institute's latest Business Climate survey data for Germany is pointing to continued weakness in the recovery momentum:

Notably, all four sectors covered remain under water:

Current conditions are deteriorating month-on-month in two sectors, expectations have deteriorated in all four sectors.

Tuesday, August 25, 2020

25/8/20: Germany's Economic Recovery: ifo Survey

ifo Institute's latest economic barometer for Germany is showing continued signs of recovery in the German economy, with remaining pressures in terms of current assessment of business conditions and more positive outlook forward (expectations):

Business expectations are now ahead of the same for December 2019 - February 2020 pre-pandemic period, which really says little about the levels of activity expected and more about the speed of adjustments to the expected activity. What matters more is the current climate perception. This is still some 11 points below the three months prior to the pandemic.

Given that German economy has largely moved past the stage of restricted activity, this is worrying, as it suggests the lack of domestic demand recovery in the medium term.

Tuesday, August 11, 2020

11/8/20: McKinsey on Changes in Economic Outlook

McKinsey have a neat summary of changes in economic outlook across major global regions:

A more granular perspective is from consensus forecasts, as summarized by the Focus Economics and by other sources:

The above are from my presentation deck from earlier today for a Dublin-based conference.

The key to all of the above is that we are still in a very complex, highly uncertain forecasting environment, and behavioural differences between professional forecasters, economic analysts and business practitioners are vast, reflecting on overall forecasts and outlook sentiments reported.

Wednesday, May 6, 2020

6/5/20: The Glut of Oil: Strategic Reserves

The Giant Glut of Oil continues (see my analysis of oil markets fundamentals here: https://trueeconomics.blogspot.com/2020/04/23420-what-oil-price-dynamics-signal.html)

China strategic oil reserves have also surged. U.S. oil reserves are now nearing total capacity of 630 million barrels, and China's reserves are estimated to be about 90% of the total capacity of 550 million barrels. Japan's reserves similar (capacity of ca 500 million barrels). Australia is using leased U.S. strategic reserves capacity to pump its own stockpiles, with its domestic storage capacity already full.

Tuesday, May 5, 2020

5/5/20: A V-Shaped Recovery? Ireland post-Covid

My article for The Currency on the post-Covid19 recovery and labour markets lessons from the pst recessions: https://www.thecurrency.news/articles/16215/the-fiction-of-a-v-shaped-recovery-hides-the-weaknesses-in-irelands-labour-market.

Key takeaways:

"Trends in employment recovery post-major recessions are worrying and point to long-term damage to the life-cycle income of those currently entering the workforce, those experiencing cyclical (as opposed to pandemic-related) unemployment risks, as well as those who are entering the peak of their earnings growth. This means a range of three generations of younger workers are being adversely and permanently impacted.

"All of the millennials, the older sub-cohorts of the GenZ, and the lower-to-middle classes of the GenX are all in trouble. Older millennials and the entire GenX are also likely to face permanently lower pensions savings, especially since both cohorts have now been hit with two systemic crises, the 2008-2014 Great Recession and the 2020 Covid-19 pandemic.

"These generations are the core of modern Ireland’s population pyramid, and their fates represent the likely direction of our society’s and economy’s evolution in decades to come."

Thursday, April 23, 2020

23/4/20: What Oil Price Dynamics Signal About Future Growth

My column at The Currency this week covers the fundamentals of oil prices and what these tell us about the markets expectations for economic recovery: https://www.thecurrency.news/articles/15674/supply-demand-and-the-dilemma-of-trade-what-the-collapse-in-oil-prices-tells-you-about-post-covid-10-economy.

Key takeaways:

- "...current futures market pricing is suggesting that traders and investors expect much slower recovery from the Covid-19 pandemic than the V-shaped one forecast by the analysts’ consensus and the like of the IMF and the World Bank.

- "As a second order effect, oil markets appear to be pricing post-Covid-19 economic environment more in line with below historical trends global growth, similar to that evident in the economic slowdown of 2018-2019, rather than a substantial expansion on foot of the sharp Covid- shock."

Tuesday, April 14, 2020

14/4/20: Re-Opening America: A Long Road Ahead

In our Financial Systems class, yesterday, we were discussing the potential trajectories for 'exit' from COVID19 restriction and easing of economic constraints. Handily, yesterday, Morgan Stanley published this analytical timeline of the pandemic evolution:

Their analysis is based on the following assumed timings:

- They expect U.S. coastal regions to peak in the next 3-5 days (so March 15-17),

- The rest of the U.S. will lag these by "around 3 weeks", leading to a "second peak" that promises to be not as severe as the first peak.

- The MS are expecting the second peak to result in the US cases peaking at x4 China and x2 Italy.

- MS therefore describe the U.S. trajectory as having "a very long tail".

- Based on comparisons to Korea testing, the MS research suggests the earliest 'reopening' date for the U.S. as mid-to-late May.

Sunday, July 15, 2018

14/7/18: Elephants. China Shop, Enters a Mouse: Global Debt Bubble

Bank for International Settlements Annual Report for 2018 has a very interesting set of charts covering the growing global debt bubble, one of the key risks to the global economy highlighted in the report.

First, levels:

- Global debt rose from 179% of GDP at the end of 2007 to 217% at the end of 2017 - adding 38 percentage points to the overall leverage carried by the global economy.

- The rise has been more dramatic for the Emerging Economies, with debt levels rising from 113% of GDP to 176% between the end of 2007 and the end of 2017, a net addition of 63 percentage points.

- Advanced economies faired somewhat better, posting an increase from 233% of GDP to 269%, a net rise of 36 percentage points.

- As it stood at the end of 2017, Global Debt was well in excess of x3 the Global GDP - a degree of leverage not seen in the modern history.

As noted by BIS: “...financial markets are overstretched, as noted above, and we have seen a continuous rise in the global stock of debt, private plus public, in relation to GDP. This has extended a trend that goes back to well before the crisis and that has coincided with a long-term decline in interest rates".

Next, impacts of monetary policy normalization:

As the Central Banks embark on gradual, well-flagged in advance and 'orderly' overall rates and asset purchases 'normalization', the global economy is likely to bifurcate, based on individual countries debt exposures. As the chart above shows, impact from a modest, 100bps hike in rates, will be relatively significant for all economies, with greater impact on highly indebted countries.

Per BIS: "Since the mid-1980s, unsustainable economic expansions appear to have manifested themselves mainly in the shape of unsustainable increases in debt and asset prices. Thus, even in the absence of any near-term market disruptions, keeping interest rates too low for too long could raise financial and macroeconomic risks further down the road. In particular, there are reasons to believe that the downward trend in real rates and the upward trend in debt over the past two decades are related and even mutually reinforcing. True, lower equilibrium interest rates may have increased the sustainable level of debt. But, by reducing the cost of credit, they also actively encourage debt accumulation. In turn, high debt levels make it harder to raise interest rates, as asset markets and the economy become more interest rate-sensitive – a kind of “debt trap”."

Thus, the impetus for rates and monetary policies normalisation is the threat of continued debt bubble inflation, but the cost of such normalisation is the deflation of the debt bubble already present. In other words, there's an elephant and here's the china shop.

"A further complication in calibrating normalisation relates to the need to build policy buffers for the next downturn. Indeed, the room for policy manoeuvre is much narrower than it was before the crisis: policy rates are substantially lower and balance sheets much larger". And here's the mouse: cyclically, we are nearing the turning point in the current expansion. And despite all the PR releases about the 'robust recovery' current up-cycle in the global economy has been associated with lower growth rates, lower productivity growth, lower real investment (as opposed to financial flows), and more debt than equity (see http://trueeconomics.blogspot.com/2018/07/14718-second-longest-recovery.html).

In other words, things are risky, but also fragile. Elephants in a china shop. Enters a mouse...